- Portugal

- /

- Renewable Energy

- /

- ENXTLS:EDPR

Does the EDP Renováveis Share Price Rally Signal a Shift After Recent Sector Headwinds?

Reviewed by Simply Wall St

If you are weighing up what to do next with your EDP Renováveis stock, you are not alone. The company has had a bumpy ride in recent years, drawing plenty of debate about where the share price could go from here. On the one hand, the stock has shown flashes of positivity, rising 3.0% over the past week and eking out a modest 1.5% gain year-to-date. However, zoom out for a broader view, and things look less rosy: EDP Renováveis is down 32.8% over the last year, and since that high three years ago, the stock has dropped a staggering 51.0%.

This wide gap between recent gains and long-term losses tells a story of shifting market sentiment. Part of this is linked to broader changes in the renewables sector, with investors recalibrating their expectations after a wave of enthusiasm for green energy stocks in previous years. Recent market analysis suggests that while renewable power is still essential to the global energy transition, there is growing competition and pressure on profit margins, making investors more sensitive to any signs of heightened risk.

Given this mix of short-term optimism and longer-term caution, a closer look at valuation is crucial. EDP Renováveis currently scores a 1 on our value checklist out of a possible 6, indicating it appears undervalued in just one area. That may not sound impressive, but as we will see, different valuation methods can tell their own story about what the market might be missing. Before we reveal an even more effective way to judge value at the end of the article, let us break down each approach and see how EDP Renováveis really fares.

EDP Renováveis scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: EDP Renováveis Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a company’s fair value by analyzing the cash flow generated by its dividends over time, adjusted for growth and discounted back to today’s value. For EDP Renováveis, this model helps investors gauge the sustainability and long-term growth potential of its dividends.

EDP Renováveis currently pays a dividend per share (DPS) of €0.16, with a moderate payout ratio of 17.1%. The company’s return on equity (ROE) stands at 4.6%, indicating measured profitability from shareholder investment. The DDM assumes a long-term dividend growth rate of 2.1%, which analysts have set after revising down from their earlier forecast of 3.85%.

Despite the seemingly steady dividend, the DDM calculation results in an intrinsic value estimate of just €2.17 per share. This figure is significantly below the current trading price, suggesting that EDP Renováveis is 368.5% overvalued based on its forecasted dividend stream. Such a substantial disconnect indicates that investor optimism is far ahead of the company’s actual dividend-generating capacity.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for EDP Renováveis.

Approach 2: EDP Renováveis Price vs Sales

The price-to-sales (P/S) ratio is a widely used valuation metric for companies like EDP Renováveis where profits may be limited by reinvestment or industry cycles, but revenue growth remains robust. This measure is especially useful when comparing businesses with unpredictable or negative earnings, as it focuses on sales, which is a key driver for future profitability.

What investors view as a “normal” or “fair” P/S ratio depends on growth expectations, industry conditions and perceived risks. Higher ratios are typically justified when a company is expected to grow faster or deliver better margins, while increased uncertainty or weaker outlooks warrant a lower multiple.

Right now, EDP Renováveis is trading at a P/S ratio of 5.0x. That is more than double the renewable energy industry average of 2.4x, though it is well below the peer group average of 10.1x. At Simply Wall St, the “Fair Ratio” is also considered, which is a customized benchmark that incorporates earnings growth, profit margins, risk profile, size, and industry trends. In this case, EDP Renováveis’ Fair Ratio stands at 4.6x, only a little lower than the current market multiple. Unlike broad comparisons, the Fair Ratio reflects the company’s specific strengths and challenges in context, giving a more accurate picture of whether it deserves a premium or discount.

With the current P/S just a fraction above the Fair Ratio, EDP Renováveis appears to be priced about right on this metric.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your EDP Renováveis Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a personalized story or perspective that connects your expectations and insights about a company with the numbers, including your own estimates for future revenue, earnings, margins, and fair value.

Narratives help you take what you know or believe about EDP Renováveis, tie it to a forecast based on real data, and see how that translates into a fair value for the company. This approach is more dynamic than typical ratios because it lets you factor in catalysts, risks, and industry shifts. You can then compare the Fair Value you calculate with today's share price to decide whether EDP Renováveis is a buy, hold, or sell for you.

You can easily create and update your Narratives on Simply Wall St’s Community page, a tool trusted by millions of investors, and the platform automatically adapts your view when fresh news, earnings, or analyst updates are released.

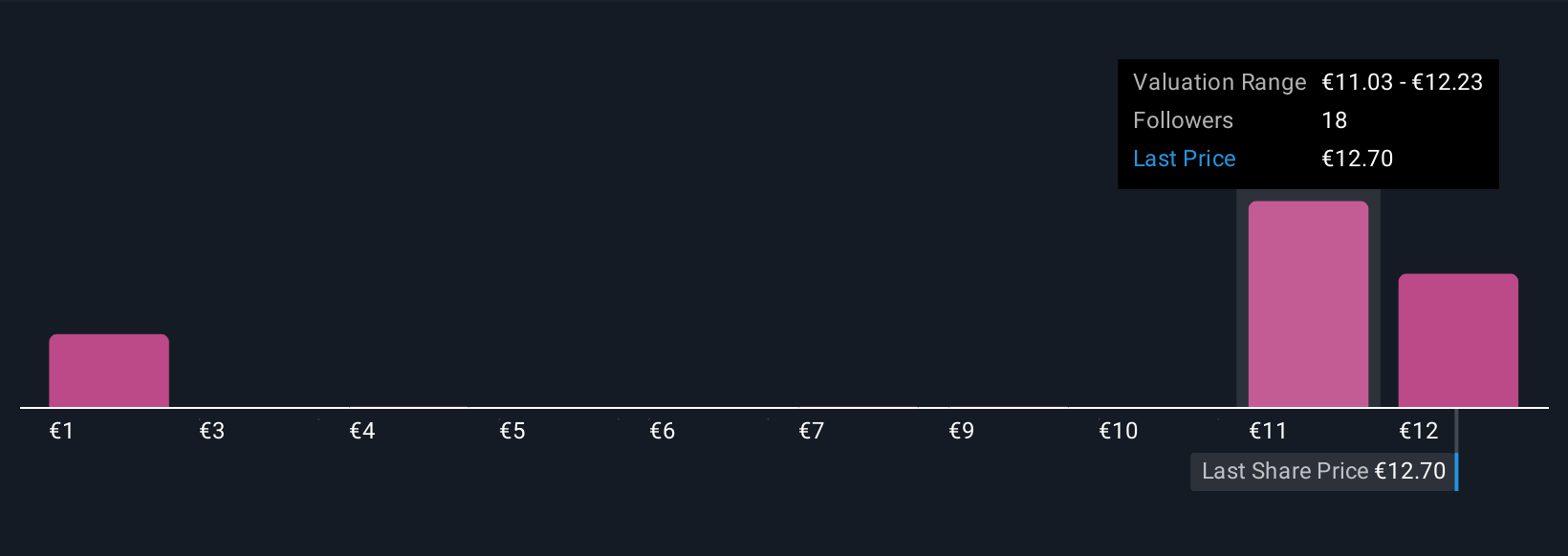

For example, using Narratives on EDP Renováveis, some investors believe recent US solar projects and major tech PPAs will drive revenue and set a Fair Value as high as €19.0. Others are more cautious, putting Fair Value closer to €8.5 based on risks around falling electricity prices and policy uncertainty.

Do you think there's more to the story for EDP Renováveis? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EDP Renováveis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:EDPR

EDP Renováveis

A renewable energy company, plans, constructs, operates, and maintains electricity generating power stations using renewable energy sources in the Europe, North America, South America, and Asia Pacific.

Reasonable growth potential with minimal risk.

Similar Companies

Market Insights

Community Narratives