What CTT - Correios De Portugal (ENXTLS:CTT)'s Strong Q3 Results Reveal About Its Operational Resilience

Reviewed by Sasha Jovanovic

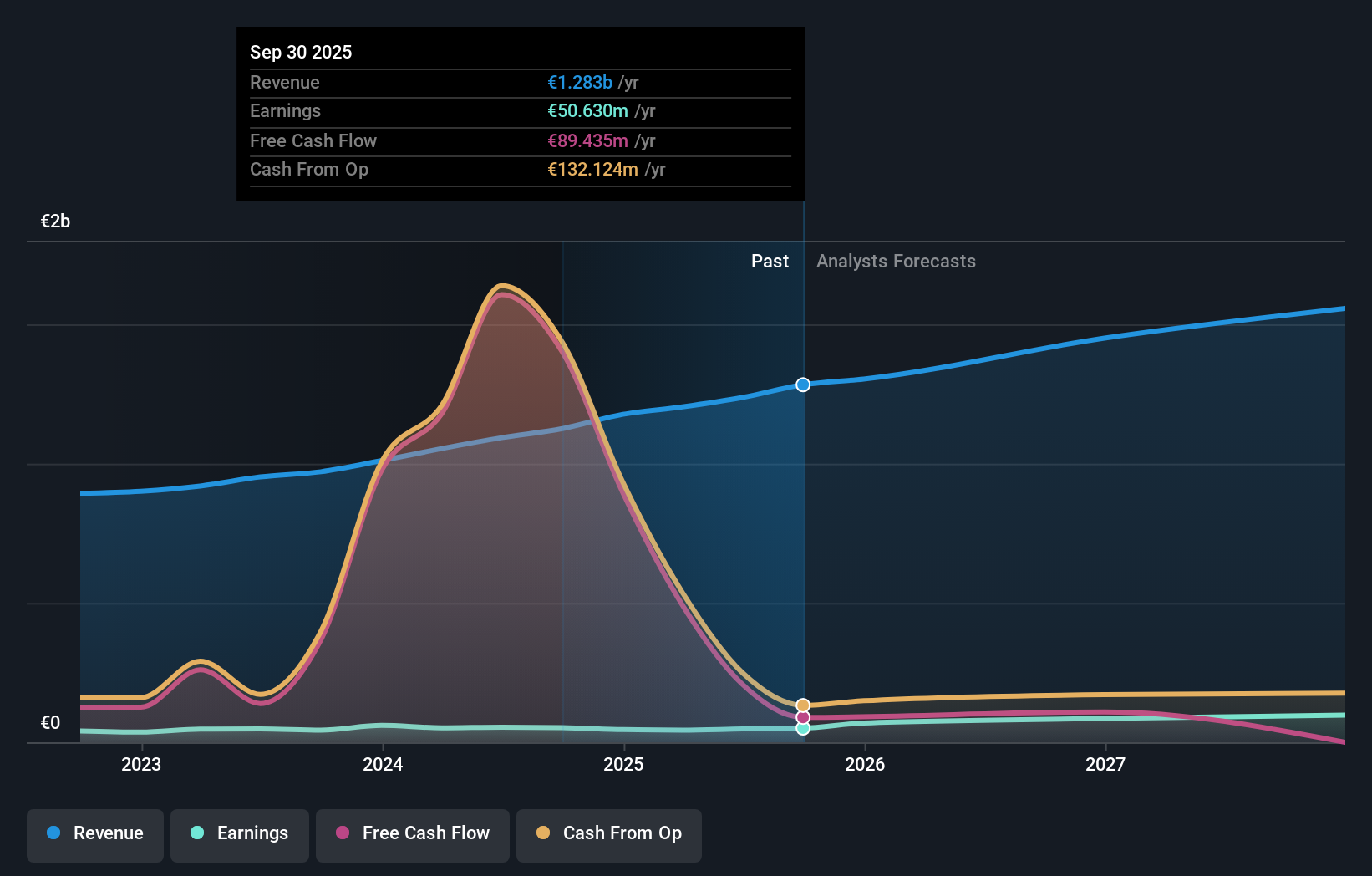

- CTT - Correios De Portugal recently announced financial results for the third quarter and nine months ended September 30, 2025, reporting higher sales, revenue, and net income compared to the same periods last year.

- The company’s sales for the third quarter reached €276.95 million and nine-month net income grew to €32.84 million, reflecting continued operational momentum.

- We'll explore how this ongoing revenue and income growth supports CTT’s investment narrative and highlights its operational resilience.

Find companies with promising cash flow potential yet trading below their fair value.

What Is CTT - Correios De Portugal's Investment Narrative?

To be a shareholder in CTT - Correios De Portugal, the essential conviction revolves around the company’s resilience and earnings growth as it adapts to shifts in postal and logistics demand. With the latest quarterly results showing ongoing increases in sales, revenue, and net income, there’s a clear argument that CTT’s operational initiatives are supporting top- and bottom-line improvement, even as the backdrop remains competitive. Before this recent release, the main short-term catalyst was anticipated earnings acceleration, but with another positive quarter now confirmed, investor focus may shift to whether this operational momentum can outpace potential headwinds like rising costs, pressure on profit margins, or valuation concerns. Risks around earnings quality and the company's relatively high Price-To-Earnings ratio compared to peers remain present, but the effect of this earnings update suggests improvement rather than immediate new risks, potentially increasing market confidence, though perhaps only incrementally, depending on market interpretation and subsequent price moves.

In contrast, CTT’s current price-to-earnings ratio remains above peers, important context for ongoing analysis.

Exploring Other Perspectives

Explore 5 other fair value estimates on CTT - Correios De Portugal - why the stock might be worth less than half the current price!

Build Your Own CTT - Correios De Portugal Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CTT - Correios De Portugal research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free CTT - Correios De Portugal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CTT - Correios De Portugal's overall financial health at a glance.

No Opportunity In CTT - Correios De Portugal?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:CTT

CTT - Correios De Portugal

Provides postal and financial services worldwide.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives