CTT - Correios De Portugal, S.A.'s (ELI:CTT) Shares Climb 25% But Its Business Is Yet to Catch Up

CTT - Correios De Portugal, S.A. ( ELI:CTT ) shares have continued their recent momentum with a 25% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 81% in the last year.

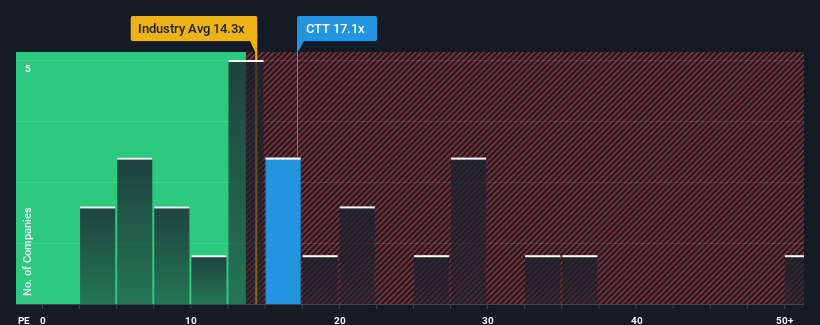

After such a large jump in price, given around half the companies in Portugal have price-to-earnings ratios (or "P/E's") below 11x, you may consider CTT - Correios De Portugal as a stock to potentially avoid with its 17.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times haven't been advantageous for CTT - Correios De Portugal as its earnings have been rising slower than most other companies. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for CTT - Correios De Portugal

Want the full picture on analyst estimates for the company? Then our free report on CTT - Correios De Portugal will help you uncover what's on the horizon.

Does Growth Match The High P/E?

In order to justify its P/E ratio, CTT - Correios De Portugal would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 25% last year. Pleasingly, EPS has also lifted 50% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 6.9% per year over the next three years. With the market predicted to deliver 6.1% growth per annum, the company is positioned for a comparable earnings result. It should be noted that recent positive news may not have flowed through to all analyst estimates, so the growth rate may see an upgrade in the near future.

With this information, we find it interesting that CTT - Correios De Portugal is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. They may be awaiting further upgrades from analysts to confirm their bullish stance.

The Final Word

CTT - Correios De Portugal shares have received a push in the right direction, but its P/E is elevated too. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of CTT - Correios De Portugal's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for CTT - Correios De Portugal with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:CTT

CTT - Correios De Portugal

Provides postal and financial services worldwide.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives