- Portugal

- /

- Wireless Telecom

- /

- ENXTLS:SNC

3 Undiscovered European Gems With Strong Potential

Reviewed by Simply Wall St

As European markets navigate the complexities of trade negotiations and shifting economic policies, recent developments such as slowing inflation in key economies and potential interest rate cuts by the European Central Bank have captured investor attention. Amid this backdrop, identifying promising opportunities in small-cap stocks can be a strategic move, as these companies often offer unique growth potential that aligns well with current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sonaecom SGPS (ENXTLS:SNC)

Simply Wall St Value Rating: ★★★★★★

Overview: Sonaecom, S.G.P.S., S.A. is a company engaged in the technology, media, and telecommunications sectors globally with a market capitalization of approximately €746.08 million.

Operations: Sonaecom's revenue primarily stems from its media segment, contributing €16.38 million, followed by the technology segment at €3.02 million. The company's net profit margin is an important metric to consider when evaluating its financial performance over time.

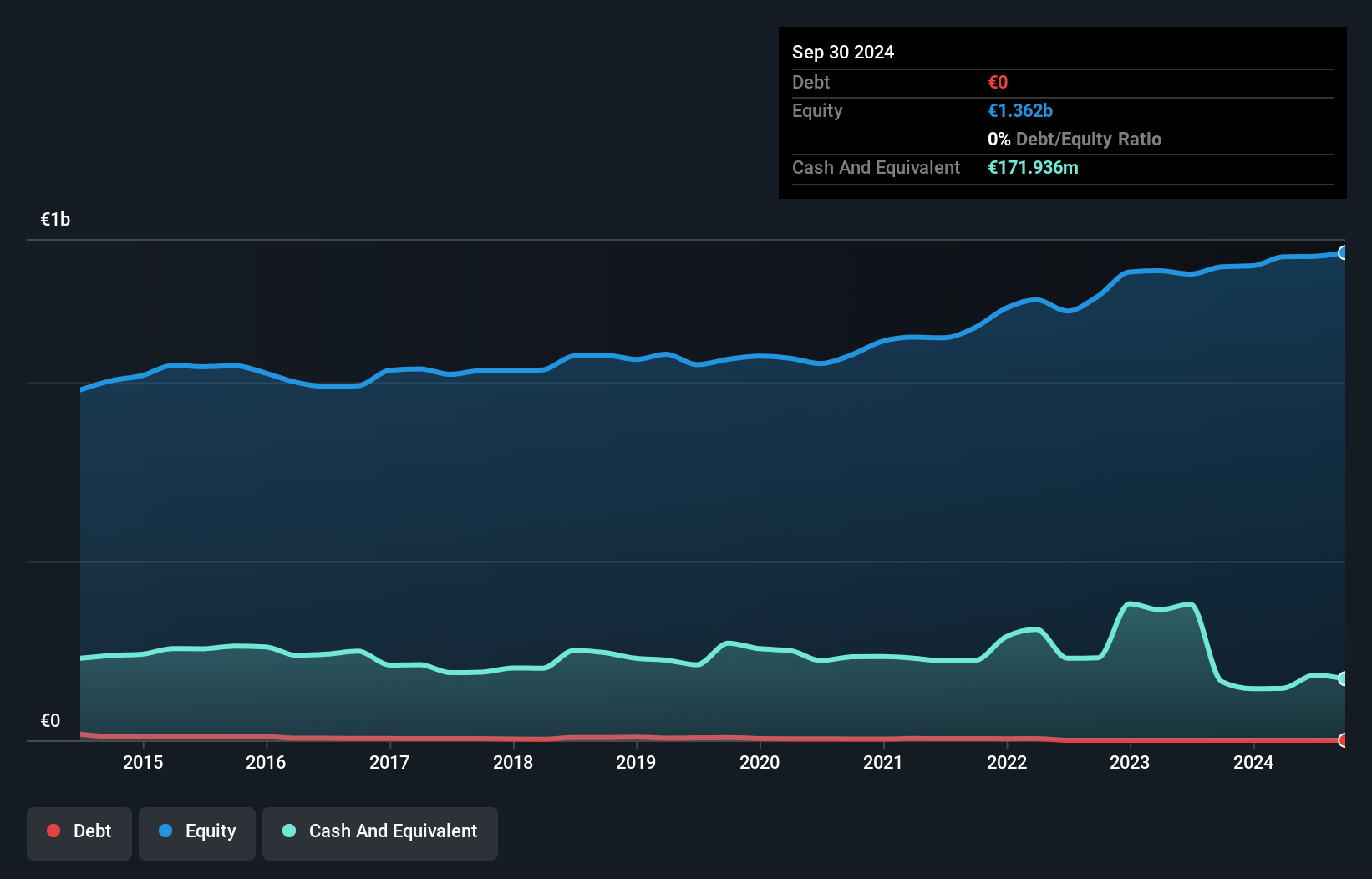

Sonaecom SGPS, a nimble player in the European telecom sector, has shown impressive earnings growth of 150% over the past year, outpacing the industry average of 16.8%. Despite a significant one-off loss of €19.3M impacting recent results, its price-to-earnings ratio stands attractively at 10.4x compared to the Portuguese market's 11.6x. The company is debt-free now, contrasting with a debt-to-equity ratio of 0.7 five years ago, which could enhance its financial flexibility moving forward. However, it's not generating positive free cash flow currently and recently announced a reduced annual dividend of €0.028 per share.

- Navigate through the intricacies of Sonaecom SGPS with our comprehensive health report here.

Evaluate Sonaecom SGPS' historical performance by accessing our past performance report.

Idun Industrier (OM:IDUN B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Idun Industrier AB (publ) is an investment holding company that focuses on the manufacture and sale of glass fiber reinforced fat- and oil separators in Sweden, with a market capitalization of approximately SEK4.13 billion.

Operations: Idun generates revenue primarily through its Manufacturing segment, contributing SEK1.35 billion, and its Service & Maintenance segment, adding SEK863.34 million.

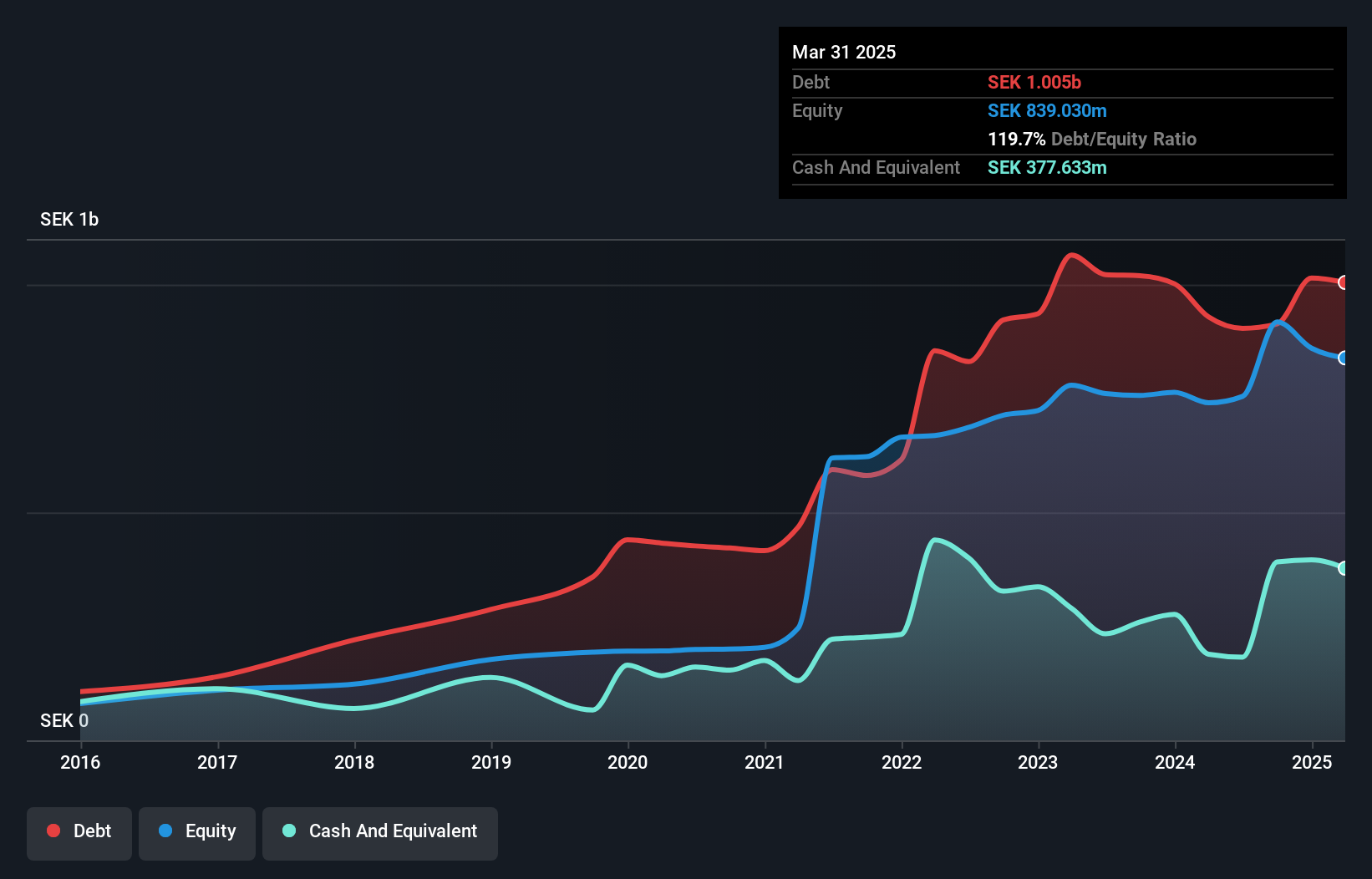

Idun Industrier, a smaller player in the Industrials sector, has shown impressive earnings growth of 25.6% over the past year, outpacing the industry’s -0.4%. Its debt to equity ratio has improved significantly from 220.7% to 119.7% in five years, though its net debt to equity remains high at 74.7%. Trading at about 8% below estimated fair value suggests potential undervaluation. Recent financials highlight a solid performance with Q1 revenue reaching SEK 572 million and net income jumping from SEK 3.47 million to SEK 10.65 million compared to last year, reflecting strong operational efficiency and profitability improvements.

- Click here and access our complete health analysis report to understand the dynamics of Idun Industrier.

Understand Idun Industrier's track record by examining our Past report.

Meko (OM:MEKO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Meko AB (publ) operates in the automotive aftermarket across several Nordic and Baltic countries, with a market capitalization of approximately SEK6.61 billion.

Operations: Meko AB generates revenue primarily from its operations in Sweden/Norway (SEK6.99 billion), Poland/The Baltics (SEK4.87 billion), and Denmark (SEK4.37 billion). The company's financial performance is influenced by its diverse geographic presence, with significant contributions also coming from Finland and Sørensen Og Balchen in Norway.

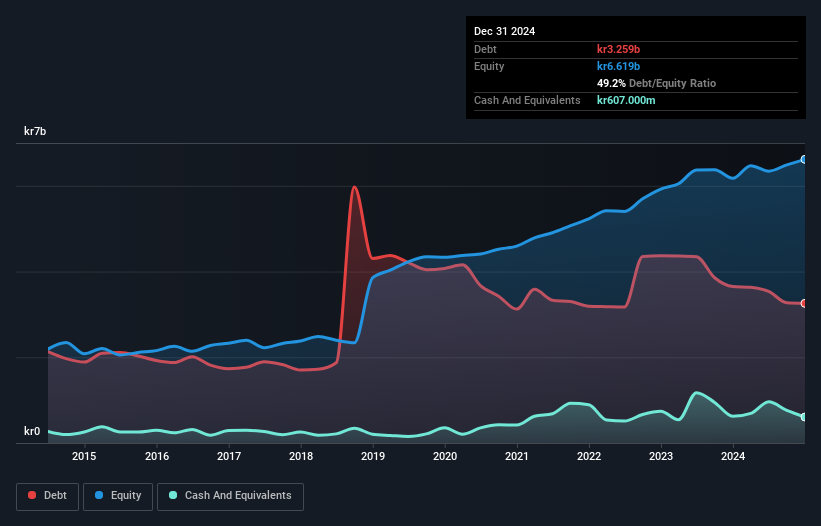

Meko, a nimble player in the European market, shows potential with its strategic moves like warehouse automation in Scandinavia and integration of Elit Polska. Their debt to equity ratio has impressively dropped from 95% to 52.9% over five years, though it remains high at 48.3%. Despite this leverage, Meko's interest payments are comfortably covered by EBIT at 4.1 times. The company trades significantly below its estimated fair value and boasts a solid earnings growth of 9.7%, outpacing the industry average of -1.7%. Recent bond issuance aims to refinance existing debt while supporting corporate goals and enhancing financial flexibility.

Make It Happen

- Discover the full array of 328 European Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:SNC

Sonaecom SGPS

Sonaecom, S.G.P.S., S.A., together with its subsidiaries, operates in technology, media, and telecommunications areas worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives