- Portugal

- /

- Entertainment

- /

- ENXTLS:SCP

Sporting Clube de Portugal - Futebol SAD (ELI:SCP) delivers shareholders favorable 8.7% CAGR over 5 years, surging 16% in the last week alone

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. To wit, the Sporting Clube de Portugal - Futebol SAD share price has climbed 52% in five years, easily topping the market return of 24% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 4.8% in the last year.

Since it's been a strong week for Sporting Clube de Portugal - Futebol SAD shareholders, let's have a look at trend of the longer term fundamentals.

Sporting Clube de Portugal - Futebol SAD isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

For the last half decade, Sporting Clube de Portugal - Futebol SAD can boast revenue growth at a rate of 14% per year. That's a pretty good long term growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 9% full reflects the underlying business growth. The key question is whether revenue growth will slow down, and if so, how quickly. There's no doubt that it can be difficult to value pre-profit companies.

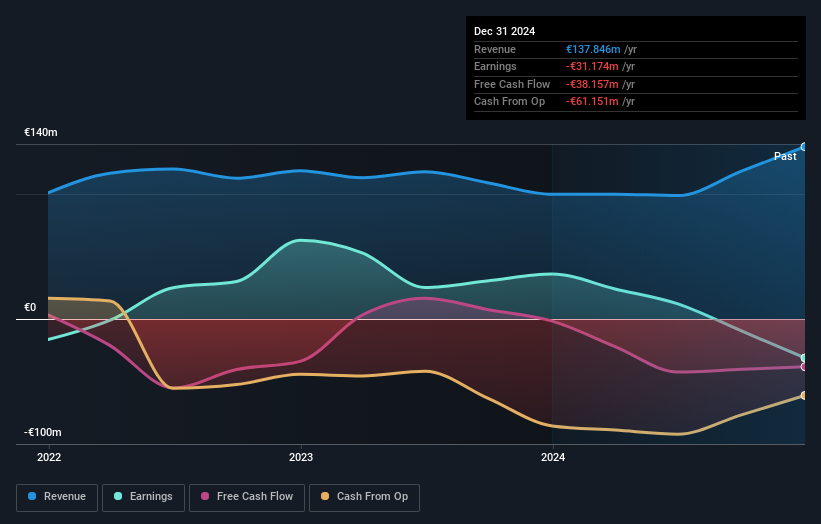

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Sporting Clube de Portugal - Futebol SAD shareholders have received a total shareholder return of 4.8% over the last year. However, that falls short of the 9% TSR per annum it has made for shareholders, each year, over five years. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Sporting Clube de Portugal - Futebol SAD .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Portuguese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:SCP

Sporting Clube de Portugal - Futebol SAD

Operates sports clubs in Portugal.

Very low and overvalued.

Market Insights

Community Narratives