- Portugal

- /

- Real Estate

- /

- ENXTLS:RAM

How Much Did Ramada Investimentos e Industria's (ELI:RAM) Shareholders Earn On Their Investment Over The Last Three Years?

It is a pleasure to report that the Ramada Investimentos e Industria, S.A. (ELI:RAM) is up 50% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 55% in the last three years, falling well short of the market return.

See our latest analysis for Ramada Investimentos e Industria

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

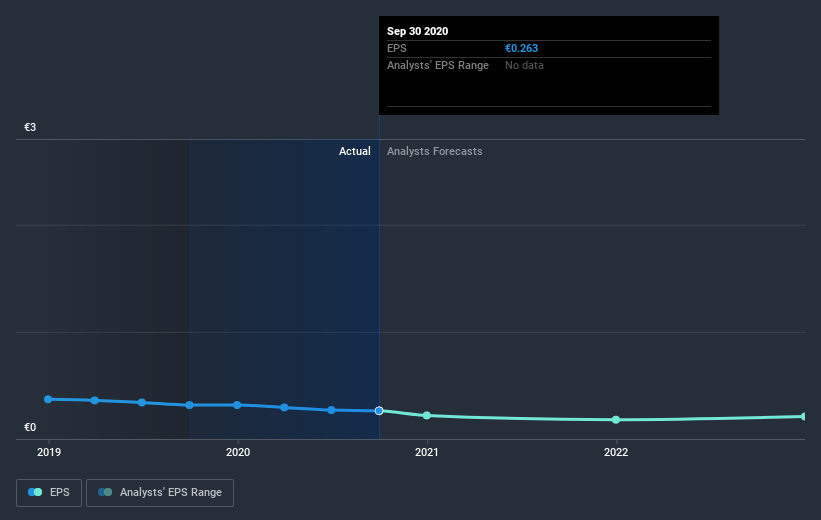

During the three years that the share price fell, Ramada Investimentos e Industria's earnings per share (EPS) dropped by 51% each year. In comparison the 23% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Ramada Investimentos e Industria's key metrics by checking this interactive graph of Ramada Investimentos e Industria's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Ramada Investimentos e Industria, it has a TSR of -31% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 1.8% in the twelve months, Ramada Investimentos e Industria shareholders did even worse, losing 13% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 10%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Ramada Investimentos e Industria better, we need to consider many other factors. Even so, be aware that Ramada Investimentos e Industria is showing 4 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Of course Ramada Investimentos e Industria may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PT exchanges.

When trading Ramada Investimentos e Industria or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTLS:RAM

Ramada Investimentos e Industria

Primarily engages in the real estate business in Portugal.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives