- Portugal

- /

- Paper and Forestry Products

- /

- ENXTLS:ALTR

Will Valmet's €75 Million Evaporation Line Supply Shift Altri SGPS' (ENXTLS:ALTR) Textile Ambitions?

Reviewed by Sasha Jovanovic

- Valmet announced in October 2025 that it will supply a new 7-effect evaporation line to the Altri Biotek mill in Portugal as part of a €75 million project to convert the site for dissolving pulp production targeting the textile industry, with startup planned in the third quarter of 2027.

- This investment is expected to improve the mill's energy and water efficiency, supporting Altri’s goal of expanding into renewable textile fiber markets with higher value-added products.

- We’ll explore how Altri’s planned technology upgrade and expansion into dissolving pulp could reshape its long-term investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Altri SGPS Investment Narrative Recap

For shareholders to have conviction in Altri SGPS, they need to believe in the company’s shift toward higher-value renewable textile fibers and its ability to weather near-term earnings headwinds tied to pulp price volatility and heavy investment needs. The recent €75 million Biotek mill conversion is an important step as it aims to reduce operating costs and support a pivot to specialty products, but it does not directly offset today’s biggest short-term catalyst: the speed and scale of margin recovery, nor does it fully mitigate the main risk of weak commodity pulp markets and capital-driven cash flow strain.

Among recent company announcements, July’s half-year report stands out: revenue fell to €373 million and net income dropped sharply to €14 million, reflecting margin pressure amid global pulp weakness. This context makes Altri’s ongoing capital projects especially relevant, as execution risks and debt levels could become more material if profitability remains subdued or demand fails to recover in key end-markets.

But while this expansion brings clear opportunity, investors should also be mindful that if pulp prices do not recover as anticipated, the impact on debt and cash flow could...

Read the full narrative on Altri SGPS (it's free!)

Altri SGPS' narrative projects €847.3 million revenue and €109.7 million earnings by 2028. This requires 4.2% yearly revenue growth and a €50.5 million earnings increase from €59.2 million.

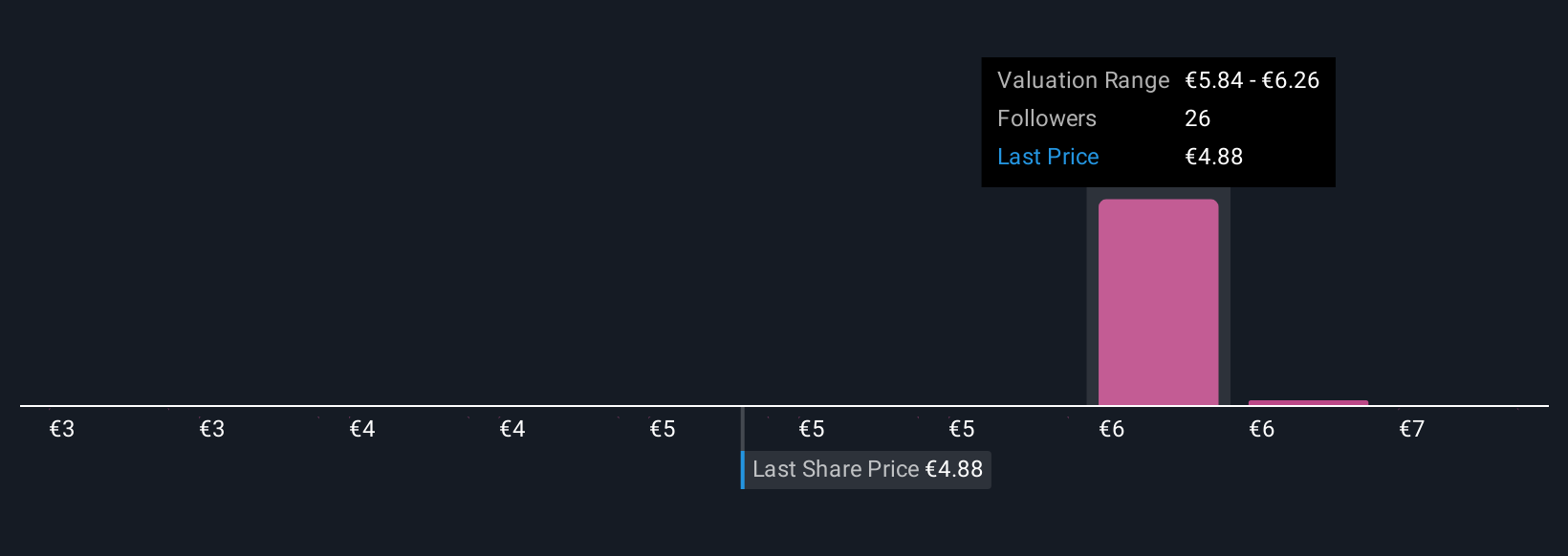

Uncover how Altri SGPS' forecasts yield a €6.17 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer seven fair value estimates for Altri, ranging from €2.89 to €7.10 per share. With earnings growth a key catalyst and views this dispersed, you are invited to weigh several contrasting perspectives on Altri’s potential.

Explore 7 other fair value estimates on Altri SGPS - why the stock might be worth as much as 44% more than the current price!

Build Your Own Altri SGPS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Altri SGPS research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Altri SGPS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Altri SGPS' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:ALTR

Altri SGPS

Produces and sells cellulosic fibers in Portugal and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives