- Portugal

- /

- Oil and Gas

- /

- ENXTLS:GALP

Is Galp (ENXTLS:GALP) Undervalued? Examining Valuation Following Recent Share Price Uptick

Reviewed by Kshitija Bhandaru

Price-to-Earnings of 11.9x: Is it justified?

Galp Energia SGPS is currently valued at a price-to-earnings (P/E) ratio of 11.9, which is notably below the average of both its peer group (15.7x) and the broader European oil and gas industry (12.1x). This suggests that the market may be underrating Galp’s earnings relative to similar companies.

The price-to-earnings multiple is a commonly used metric that compares a company’s share price to its per-share earnings. For energy companies like Galp, the P/E ratio provides a snapshot of how investors are valuing current profitability and anticipated growth compared to competitors in a similar sector.

Given that Galp's multiple is lower than industry averages, this could indicate that the market is underappreciating its potential or pricing in slower expected growth. With strong returns over the long term and high-quality past earnings, this discounted valuation raises questions about whether the company’s future prospects are being overlooked.

Result: Fair Value of €26.07 (UNDERVALUED)

See our latest analysis for Galp Energia SGPS.However, sluggish annual revenue and net income growth may signal operational headwinds. This could limit Galp Energia SGPS’s near-term upside despite its valuation.

Find out about the key risks to this Galp Energia SGPS narrative.Another View: What Does Our DCF Model Say?

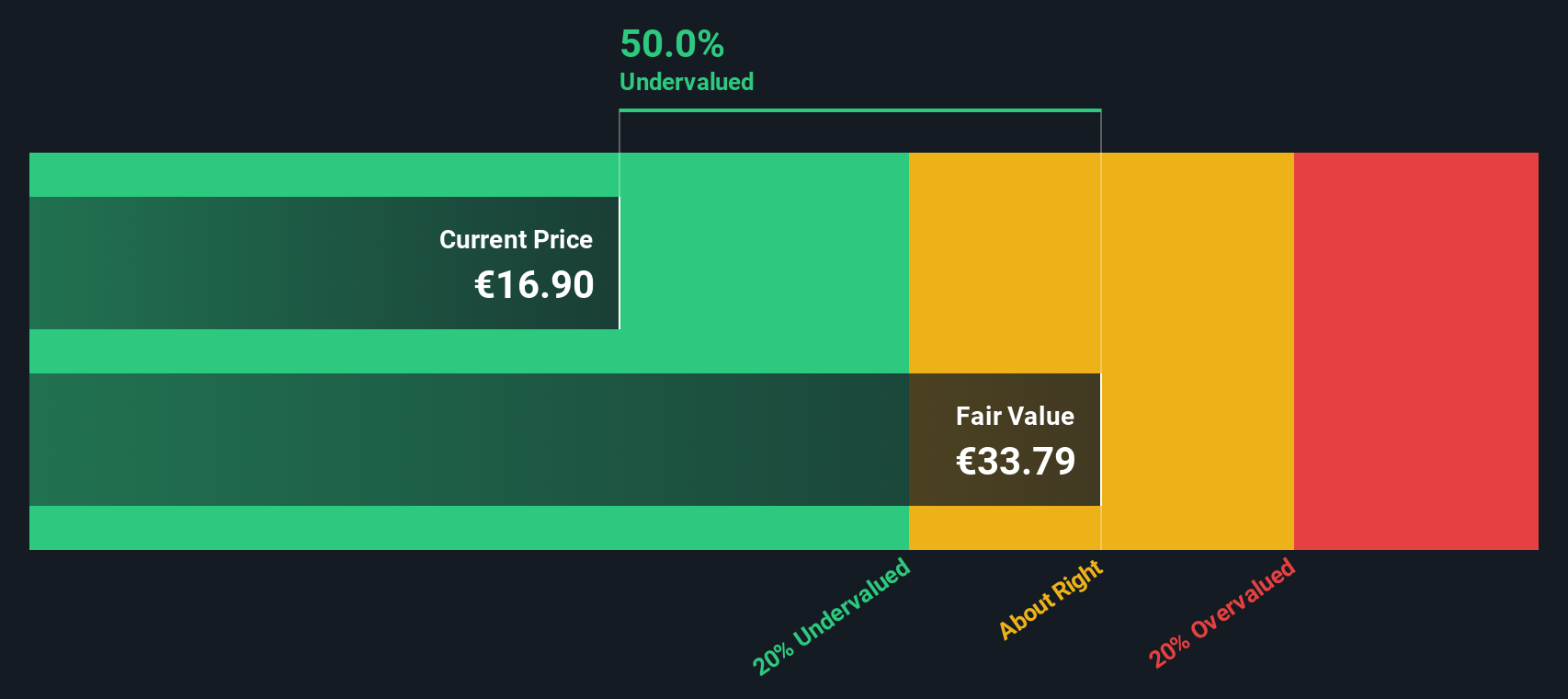

Taking a different approach, the SWS DCF model also finds Galp Energia SGPS to be undervalued at today's prices. This method focuses on future cash flows instead of current profits. Could the market be underestimating what lies ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Galp Energia SGPS Narrative

If you want to weigh in and see things from your own perspective, you can analyze the numbers yourself and shape your own view in just a few minutes. Do it your way

A great starting point for your Galp Energia SGPS research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Compelling Investment Opportunities?

Don’t stop with just one stock. Take charge of your portfolio and uncover standout companies you might have missed by targeting new trends and disruptive industries. The best ideas rarely wait for the crowd to catch up.

- Boost your search for tomorrow’s breakthroughs by scanning pre-vetted picks in quantum computing. Fierce innovation is transforming how the world processes information with quantum computing stocks.

- Unlock the potential of lucrative streaming income by tracking companies offering robust cash payouts and impressive yield histories through dividend stocks with yields > 3%.

- Catalyze your path to value by focusing on businesses currently trading at a discount to their fundamentals with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:GALP

Galp Energia SGPS

Operates as an integrated energy operator in Portugal and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives