- Portugal

- /

- Oil and Gas

- /

- ENXTLS:GALP

European Dividend Stocks To Consider

Reviewed by Simply Wall St

As European markets show resilience with the pan-European STOXX Europe 600 Index climbing 1.68% and major stock indexes across the region posting gains, investors are increasingly looking towards dividend stocks as a way to achieve stable income amidst fluctuating economic conditions. In this context, selecting dividend stocks that offer consistent payouts and align with current market trends can be an effective strategy for maintaining portfolio stability in times of economic uncertainty.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.36% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.20% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.76% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.32% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.88% | ★★★★★★ |

| Evolution (OM:EVO) | 4.70% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.17% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.67% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.33% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 4.60% | ★★★★★★ |

Click here to see the full list of 225 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

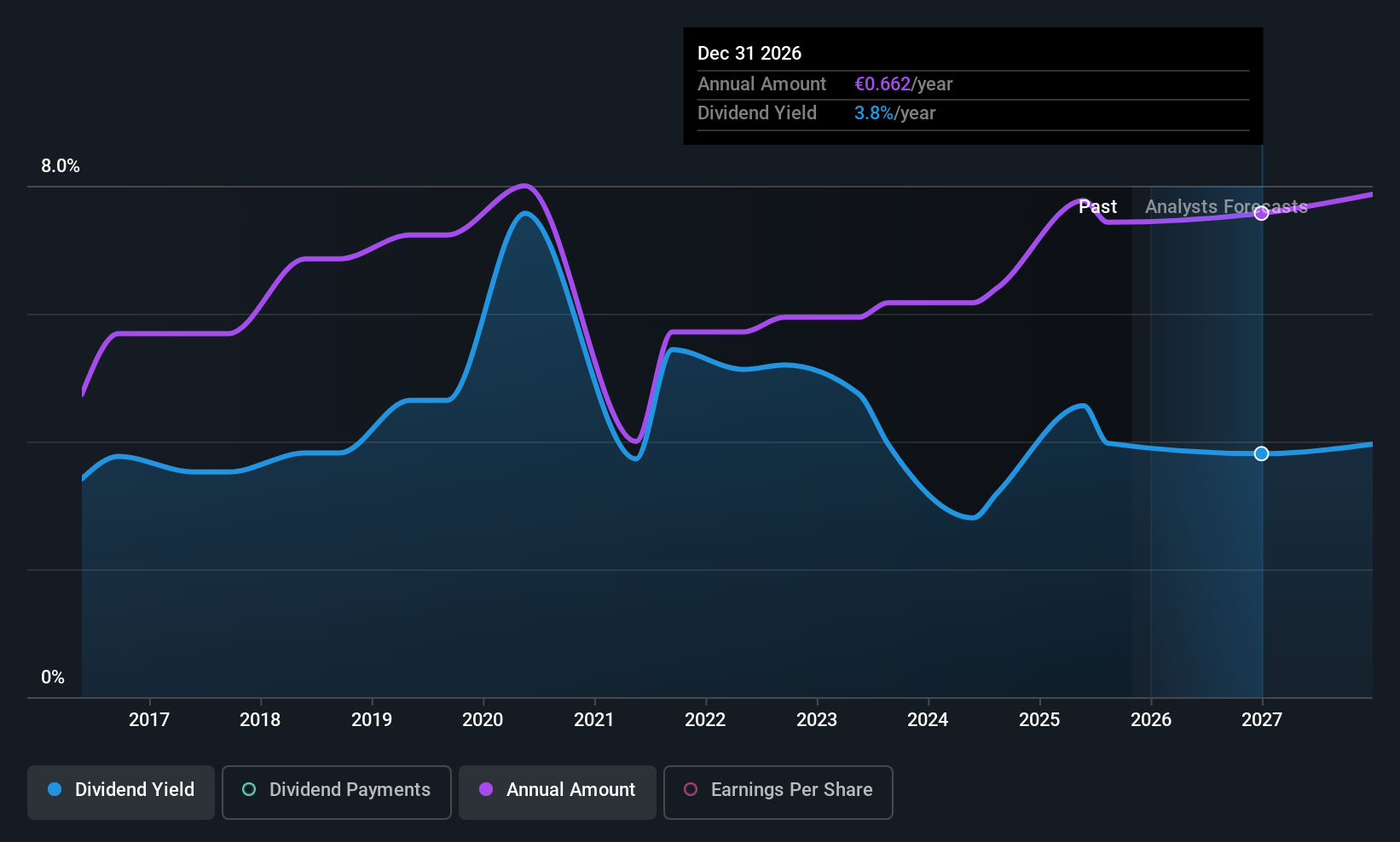

Galp Energia SGPS (ENXTLS:GALP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Galp Energia SGPS is an integrated energy operator based in Portugal, with operations both domestically and internationally, and has a market cap of €12.02 billion.

Operations: Galp Energia SGPS generates its revenue from various segments as an integrated energy operator, with operations spanning both Portugal and international markets.

Dividend Yield: 3.9%

Galp Energia's dividend payments, while covered by earnings with a payout ratio of 25.9% and cash flows at 62.6%, have been historically volatile. Despite the increase in dividends over the past decade, they remain unstable and below top-tier yields in Portugal at 3.93%. Recent earnings showed a decline, with Q3 net income at €264 million compared to €269 million last year, reflecting potential challenges for future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Galp Energia SGPS.

- Our valuation report here indicates Galp Energia SGPS may be undervalued.

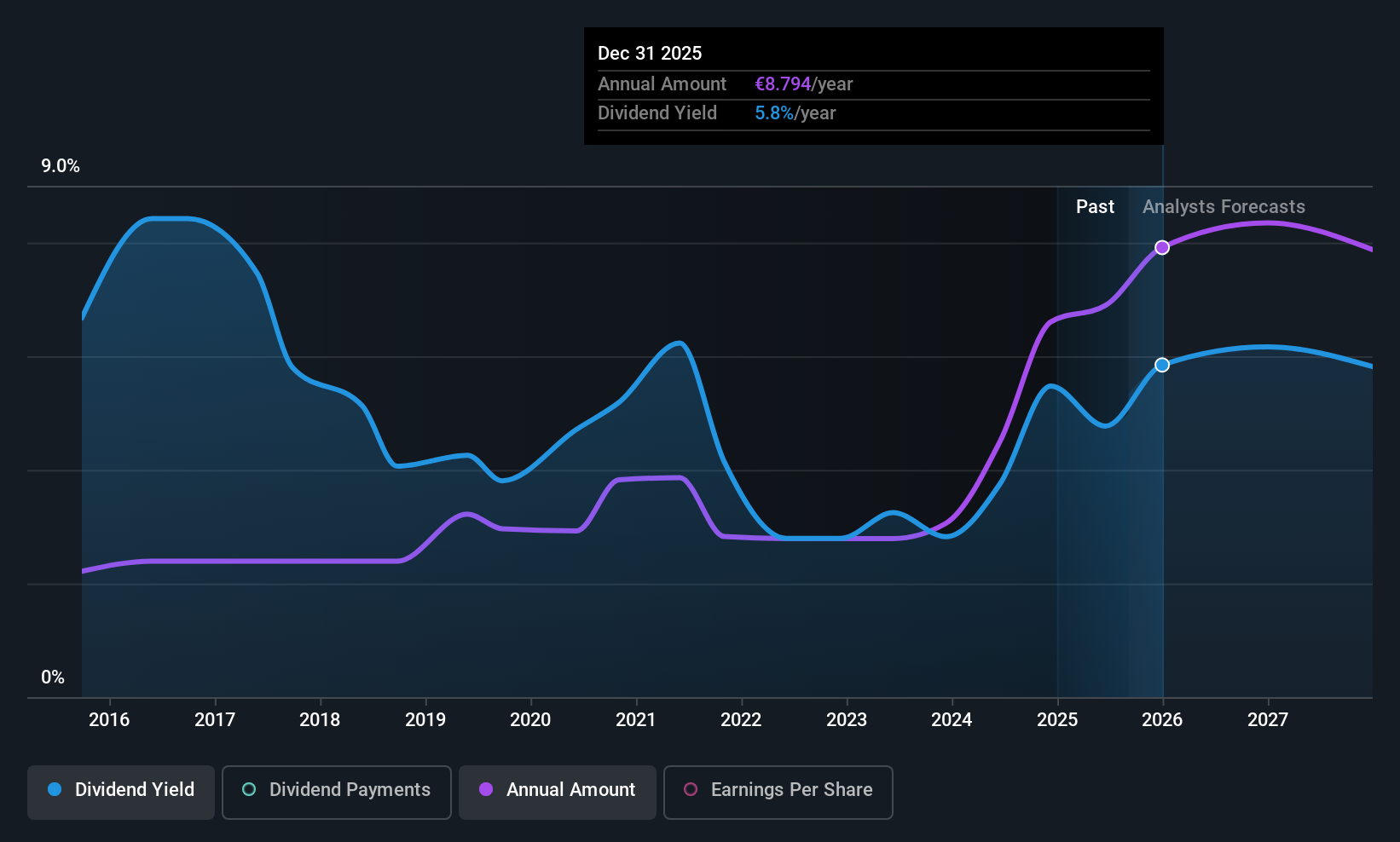

Gaztransport & Technigaz (ENXTPA:GTT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gaztransport & Technigaz SA is a technology and engineering company that specializes in providing cryogenic membrane containment systems for the maritime transportation and storage of liquefied gases globally, with a market cap of €6.32 billion.

Operations: Gaztransport & Technigaz SA generates revenue primarily from its core business, including services (€727.52 million), and also from hydrogen (€7.78 million).

Dividend Yield: 4.7%

Gaztransport & Technigaz's dividends are supported by earnings, with a payout ratio of 81.1%, and cash flows, at 87.8%. However, the dividend track record is unstable with past volatility and yields below France's top-tier at 4.69%. Despite recent earnings growth of 24.3%, the dividend reliability remains questionable due to historical fluctuations. The company affirmed its revenue guidance for 2025 between €750 million and €800 million, indicating potential stability in operations amidst leadership changes in its digital division.

- Click to explore a detailed breakdown of our findings in Gaztransport & Technigaz's dividend report.

- Upon reviewing our latest valuation report, Gaztransport & Technigaz's share price might be too optimistic.

NCC (OM:NCC B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NCC AB (publ) is a construction company operating in Sweden, Norway, Denmark, and Finland with a market cap of SEK21.68 billion.

Operations: NCC AB (publ) generates revenue from several segments: NCC Industry with SEK12.62 billion, NCC Infrastructure at SEK18.41 billion, NCC Building Sweden contributing SEK13.10 billion, NCC Building Nordics at SEK13.53 billion, and NCC Property Development adding SEK4.28 billion.

Dividend Yield: 4.1%

NCC's dividends are well-covered by earnings and cash flows, with a payout ratio of 55.5% and a low cash payout ratio of 21.6%. Despite being in the top 25% for dividend yield in Sweden at 4.06%, its dividend history shows volatility and unreliability over the past decade. Recent earnings growth of SEK 534 million in Q3 suggests potential stability, but past fluctuations raise concerns about future consistency. The company's strategic projects like those in Stockholm and Finland may influence future financial health positively.

- Click here and access our complete dividend analysis report to understand the dynamics of NCC.

- According our valuation report, there's an indication that NCC's share price might be on the cheaper side.

Where To Now?

- Get an in-depth perspective on all 225 Top European Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:GALP

Galp Energia SGPS

Operates as an integrated energy operator in Portugal and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives