Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Is Ibersol, S.G.P.S., S.A. (ELI:IBS) a good dividend stock? How would you know? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

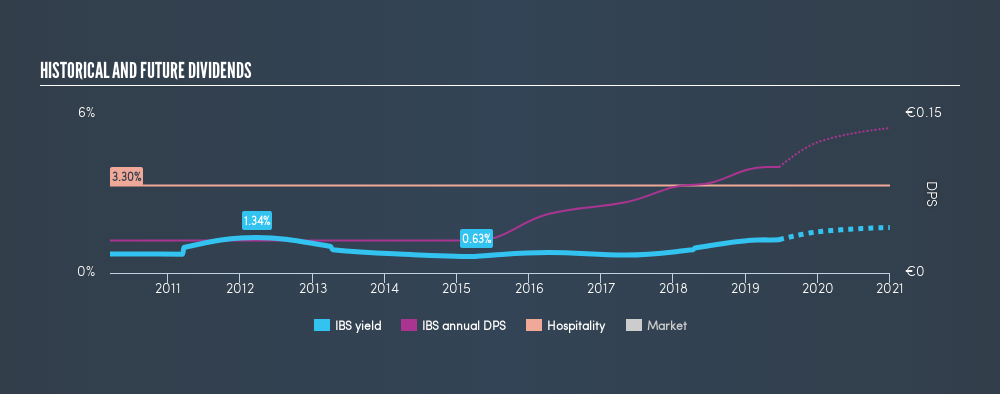

With a 1.3% yield and a nine-year payment history, investors probably think Ibersol S.G.P.S looks like a reliable dividend stock. A 1.3% yield is not inspiring, but the longer payment history has some appeal. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Ibersol S.G.P.S!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 17% of Ibersol S.G.P.S's profits were paid out as dividends in the last 12 months. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Ibersol S.G.P.S's cash payout ratio in the last year was 27%, which suggests dividends were well covered by cash generated by the business. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Remember, you can always get a snapshot of Ibersol S.G.P.S's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. The first recorded dividend for Ibersol S.G.P.S, in the last decade, was nine years ago. The dividend has been quite stable over the past nine years, which is great to see - although we usually like to see the dividend maintained for a decade before giving it full marks, though. During the past nine-year period, the first annual payment was €0.031 in 2010, compared to €0.10 last year. This works out to be a compound annual growth rate (CAGR) of approximately 14% a year over that time.

We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. It's good to see Ibersol S.G.P.S has been growing its earnings per share at 40% a year over the past 5 years. The company is only paying out a fraction of its earnings as dividends, and in the past been able to use the retained earnings to grow its profits rapidly - an ideal combination.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we like that the company's dividend payments appear well covered, although the retained capital also needs to be effectively reinvested. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. All things considered, Ibersol S.G.P.S looks like a strong prospect. At the right valuation, it could be something special.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 3 Ibersol S.G.P.S analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTLS:IBS

Ibersol S.G.P.S

Through its subsidiaries, operates a network of restaurants in Portugal, Spain, and Angola.

Good value with reasonable growth potential.

Market Insights

Community Narratives