- Portugal

- /

- Hospitality

- /

- ENXTLS:ESON

Is Estoril Sol, SGPS, S.A.'s(ELI:ESON) Recent Stock Performance Tethered To Its Strong Fundamentals?

Estoril Sol SGPS''s (ELI:ESON) stock is up by a considerable 13% over the past week. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. In this article, we decided to focus on Estoril Sol SGPS' ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Estoril Sol SGPS

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Estoril Sol SGPS is:

14% = €14m ÷ €104m (Based on the trailing twelve months to December 2019).

The 'return' is the yearly profit. One way to conceptualize this is that for each €1 of shareholders' capital it has, the company made €0.14 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learnt that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Estoril Sol SGPS' Earnings Growth And 14% ROE

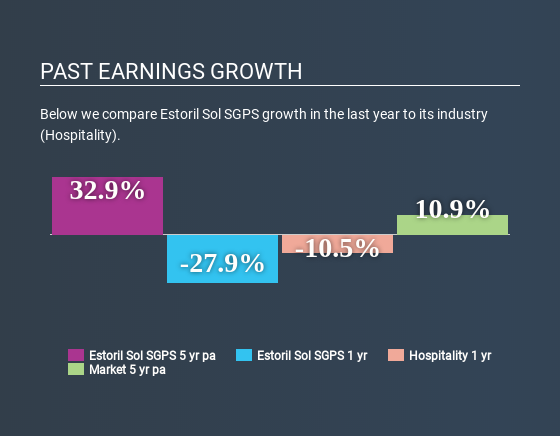

To begin with, Estoril Sol SGPS seems to have a respectable ROE. Especially when compared to the industry average of 8.3% the company's ROE looks pretty impressive. This probably laid the ground for Estoril Sol SGPS' significant 33% net income growth seen over the past five years. We believe that there might also be other aspects that are positively influencing the company's earnings growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared Estoril Sol SGPS' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 9.1% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Estoril Sol SGPS fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Estoril Sol SGPS Efficiently Re-investing Its Profits?

Estoril Sol SGPS has a three-year median payout ratio of 41% (where it is retaining 59% of its income) which is not too low or not too high. So it seems that Estoril Sol SGPS is reinvesting efficiently in a way that it sees impressive growth in its earnings (discussed above) and pays a dividend that's well covered.

Additionally, Estoril Sol SGPS has paid dividends over a period of three years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

In total, we are pretty happy with Estoril Sol SGPS' performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. Our risks dashboard would have the 2 risks we have identified for Estoril Sol SGPS.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTLS:ESON

Estoril Sol SGPS

Through its subsidiaries, engages in the gaming activities and real estate businesses in Portugal and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)