- Portugal

- /

- Food and Staples Retail

- /

- ENXTLS:SON

Discover 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and smaller-cap stocks outperforming their larger counterparts, investors are keenly observing the economic indicators that suggest a strong labor market and rising home sales. In this environment of broad-based gains, identifying promising small-cap companies can be particularly rewarding, especially those that demonstrate robust fundamentals and potential for growth amidst current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soft-World International | NA | -0.68% | 6.00% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Dareway SoftwareLtd | NA | 2.71% | -0.03% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 34.23% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interarch Building Products | 2.55% | 10.02% | 28.21% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sonae SGPS (ENXTLS:SON)

Simply Wall St Value Rating: ★★★★★☆

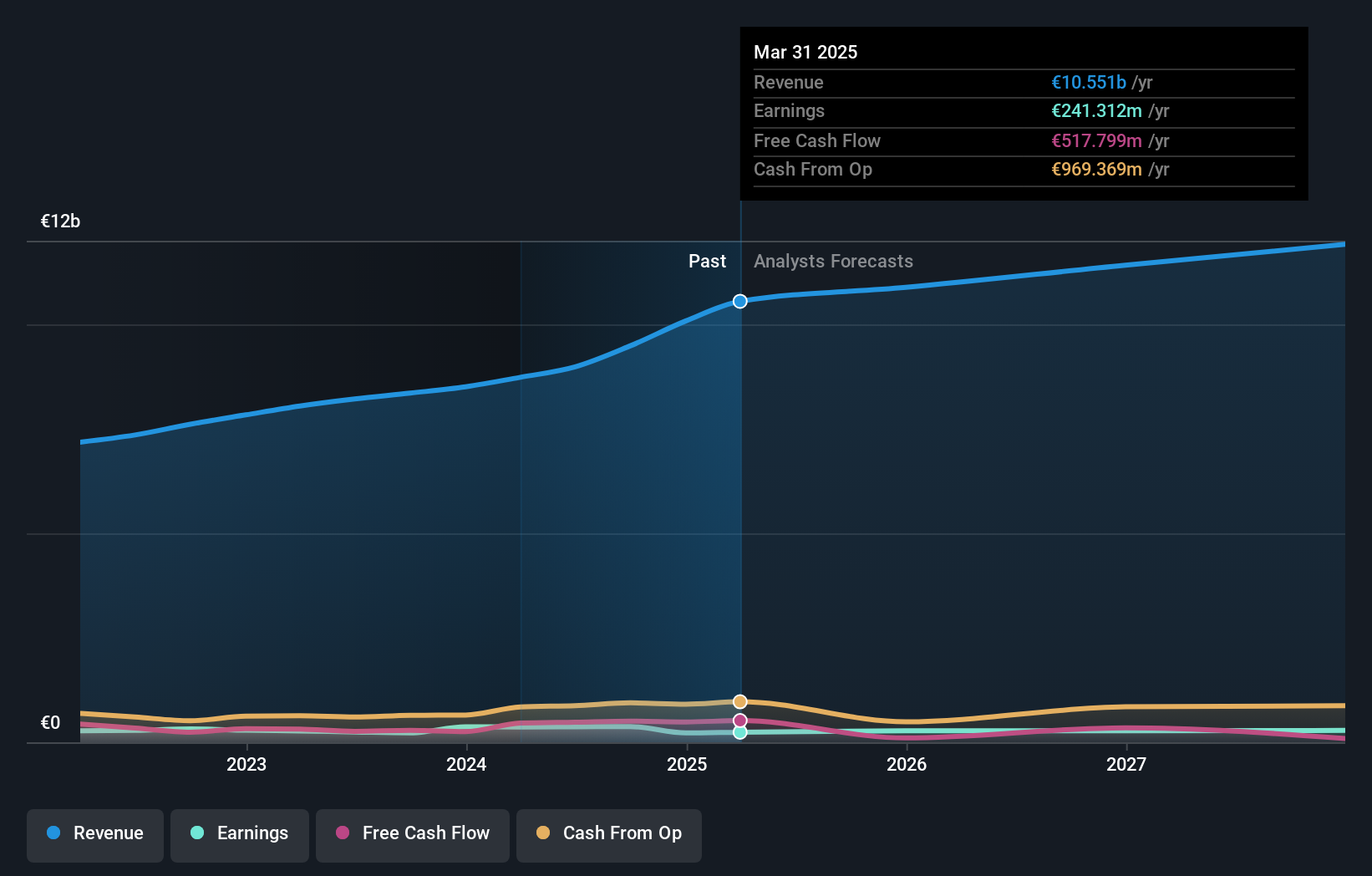

Overview: Sonae SGPS, S.A. operates in various sectors including retail, financial services, technology, shopping centers, and telecommunications with a market capitalization of approximately €1.79 billion.

Operations: Sonae SGPS generates significant revenue from its Sonae MC segment, amounting to €7.19 billion, and Worten, contributing €1.36 billion. The company exhibits a diverse revenue model across multiple sectors.

Sonae SGPS, a notable player in its sector, showcases robust financial health with high-quality earnings and a favorable price-to-earnings ratio of 4.7x compared to the Portuguese market's 12.5x. The company reported impressive earnings growth of 73% over the past year, far outpacing the Consumer Retailing industry’s 6.9%. Despite a forecasted decline in earnings by an average of 8.3% annually for the next three years, Sonae remains profitable with well-covered interest payments (7x EBIT coverage) and reduced debt levels from 73.3% to a satisfactory net debt to equity ratio of 38.3%.

- Take a closer look at Sonae SGPS' potential here in our health report.

Gain insights into Sonae SGPS' past trends and performance with our Past report.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

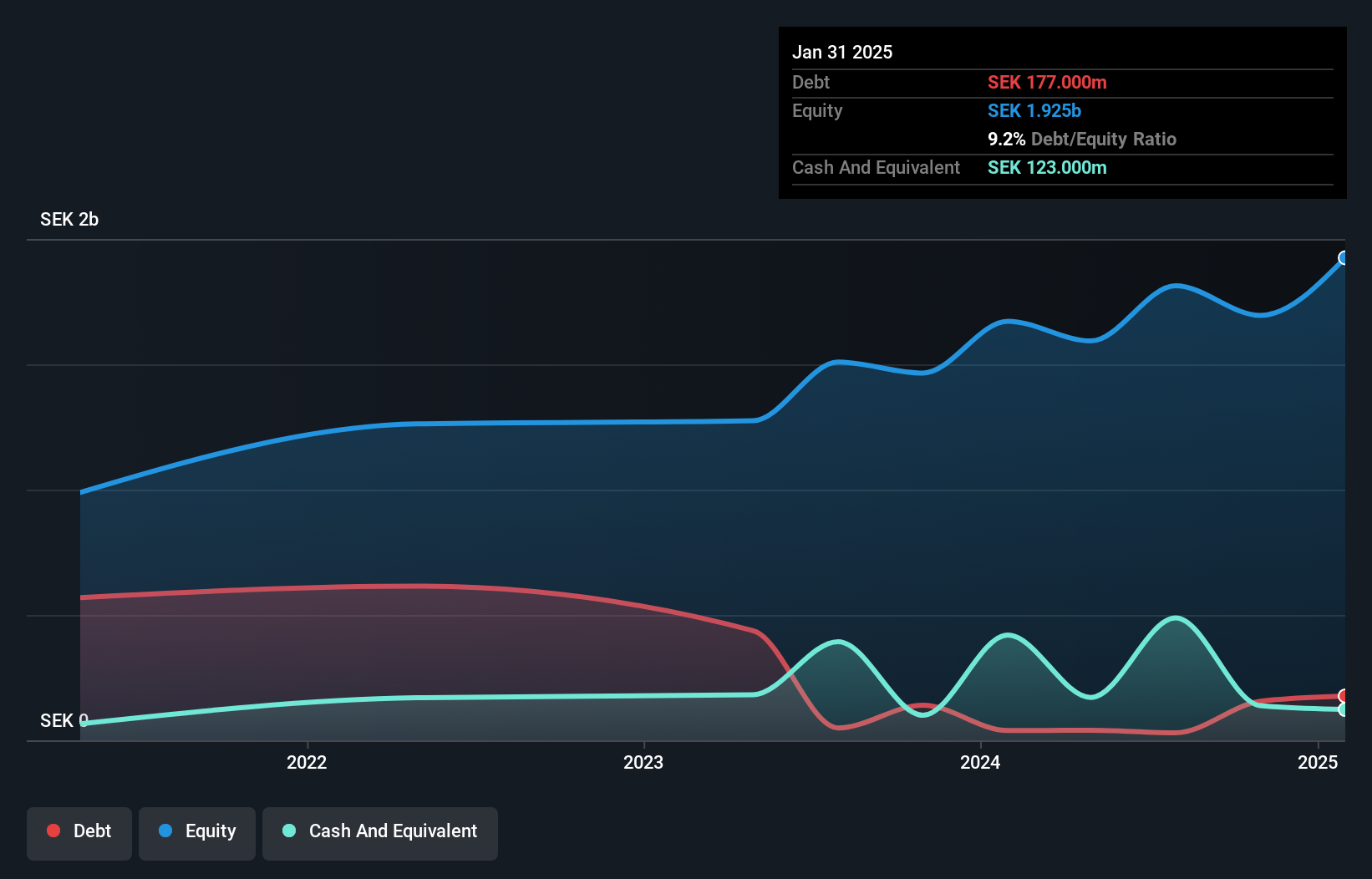

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK10.08 billion.

Operations: Rusta generates revenue primarily from its operations in Sweden, Norway, and other markets, with Sweden contributing SEK6.43 billion and Norway SEK2.39 billion.

Rusta, a dynamic player in the retail sector, has been making waves with its robust performance and strategic expansions. Over the past year, earnings surged by 48%, outpacing the industry average of -13%. The company is trading at a significant discount of 71% below its estimated fair value. With high-quality earnings and interest payments well-covered by EBIT at 3.5 times, Rusta's financial health looks solid. Recent store openings in Sweden and Norway signal aggressive growth plans, while a dividend increase to SEK 1.15 per share underscores confidence in future prospects.

Guangxi Yuegui Guangye Holdings (SZSE:000833)

Simply Wall St Value Rating: ★★★★☆☆

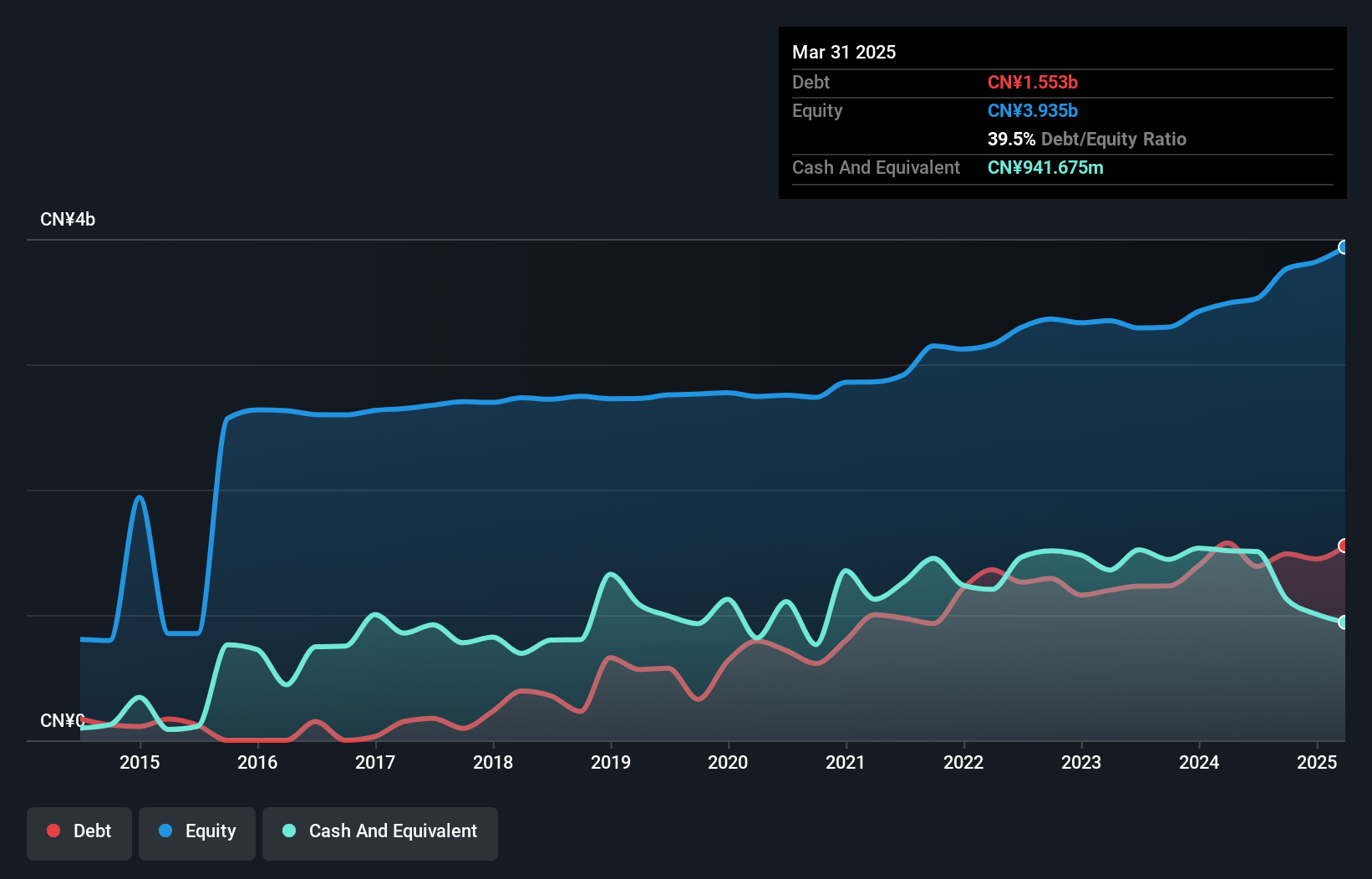

Overview: Guangxi Yuegui Guangye Holdings Co., Ltd. operates in various sectors, including real estate development and industrial manufacturing, with a market capitalization of CN¥13.29 billion.

Operations: The company's revenue streams are primarily derived from its operations in real estate development and industrial manufacturing. It has a market capitalization of CN¥13.29 billion.

With a significant earnings growth of 1472% over the past year, Guangxi Yuegui Guangye Holdings seems to be making waves in the forestry industry, outpacing its peers' 19% growth. The company’s net debt to equity ratio stands at a satisfactory 9.6%, indicating prudent financial management, while EBIT covers interest payments by 13 times, showcasing strong profitability. Despite a volatile share price recently and sales dropping from CNY 2.84 billion to CNY 2.02 billion for nine months ending September, net income surged from CNY 48 million to CNY 225 million, suggesting effective cost control or operational efficiency improvements amidst challenges.

Turning Ideas Into Actions

- Embark on your investment journey to our 4637 Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:SON

Sonae SGPS

Engages in retail, real estate, telecommunications, financial services, and technology businesses.

Undervalued established dividend payer.

Market Insights

Community Narratives