- Portugal

- /

- Consumer Durables

- /

- ENXTLS:VAF

With EPS Growth And More, Vista Alegre Atlantis SGPS (ELI:VAF) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Vista Alegre Atlantis SGPS (ELI:VAF). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Vista Alegre Atlantis SGPS

Vista Alegre Atlantis SGPS' Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Vista Alegre Atlantis SGPS grew its EPS from €0.004 to €0.062, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

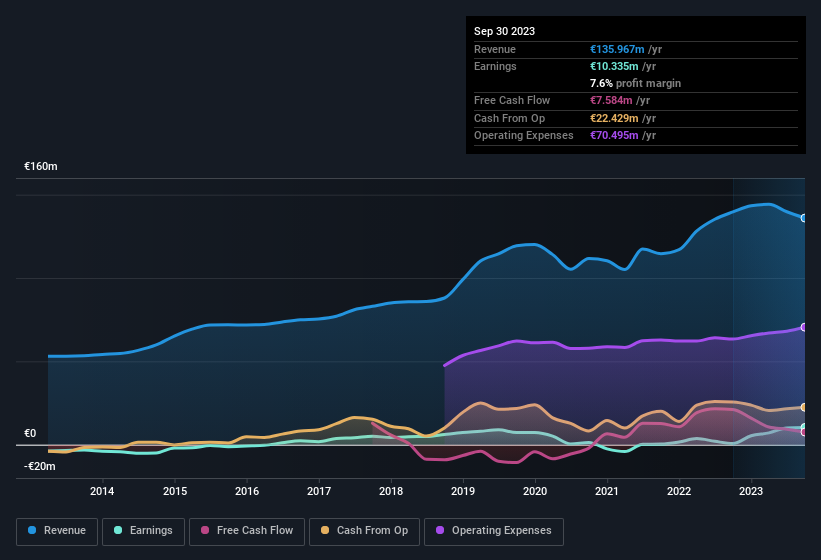

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. We note that while EBIT margins have improved from 3.9% to 12%, the company has actually reported a fall in revenue by 2.6%. While not disastrous, these figures could be better.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Vista Alegre Atlantis SGPS.

Are Vista Alegre Atlantis SGPS Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations between €93m and €370m, like Vista Alegre Atlantis SGPS, the median CEO pay is around €518k.

The Vista Alegre Atlantis SGPS CEO received total compensation of just €79k in the year to December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Vista Alegre Atlantis SGPS Deserve A Spot On Your Watchlist?

Vista Alegre Atlantis SGPS' earnings per share have been soaring, with growth rates sky high. This appreciable increase in earnings could be a sign of an upward trajectory for the company. Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. So faced with these facts, it seems that researching this stock a little more may lead you to discover an investment opportunity that meets your quality standards. What about risks? Every company has them, and we've spotted 1 warning sign for Vista Alegre Atlantis SGPS you should know about.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in PT with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:VAF

Vista Alegre Atlantis SGPS

Produces, distributes, and sells articles of porcelain, crystal and hand glass, stoneware, and earthenware in Portugal.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success