- Portugal

- /

- Construction

- /

- ENXTLS:MAR

Martifer SGPS (ELI:MAR) delivers shareholders splendid 23% CAGR over 5 years, surging 24% in the last week alone

While Martifer SGPS, S.A. (ELI:MAR) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 15% in the last quarter. But that doesn't change the fact that the returns over the last five years have been very strong. We think most investors would be happy with the 183% return, over that period. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. The more important question is whether the stock is too cheap or too expensive today.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out the opportunities and risks within the XX Construction industry.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

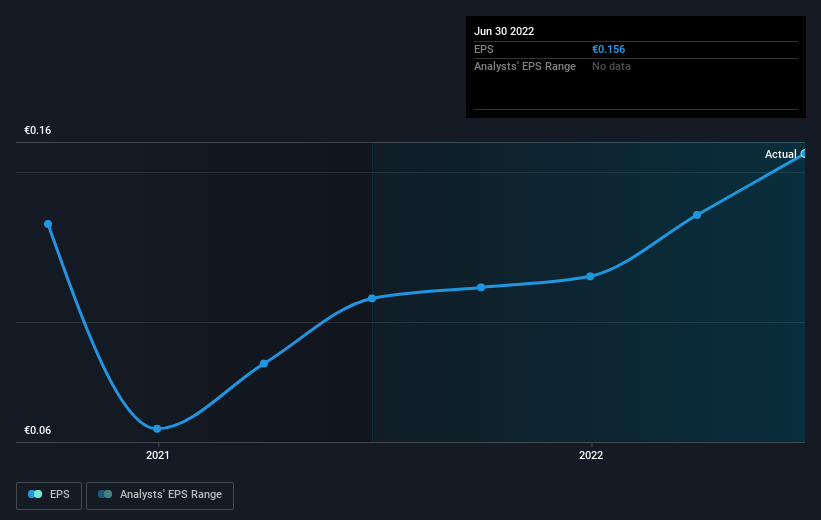

During the last half decade, Martifer SGPS became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Martifer SGPS share price is up 161% in the last three years. During the same period, EPS grew by 34% each year. This EPS growth is reasonably close to the 38% average annual increase in the share price (over three years, again). So one might argue that investor sentiment towards the stock hss not changed much over time. There's a strong correlation between the share price and EPS.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Martifer SGPS' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Martifer SGPS shareholders have received a total shareholder return of 28% over the last year. That's better than the annualised return of 23% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Martifer SGPS (2 are a bit concerning!) that you should be aware of before investing here.

Of course Martifer SGPS may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PT exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:MAR

Martifer SGPS

Operates in the metallic constructions and renewable energy development sectors in Portugal, Angola, Saudi Arabia, Europe, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives