- Portugal

- /

- Construction

- /

- ENXTLS:EGL

Take Care Before Jumping Onto Mota-Engil, SGPS, S.A. (ELI:EGL) Even Though It's 25% Cheaper

To the annoyance of some shareholders, Mota-Engil, SGPS, S.A. (ELI:EGL) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 22% share price drop.

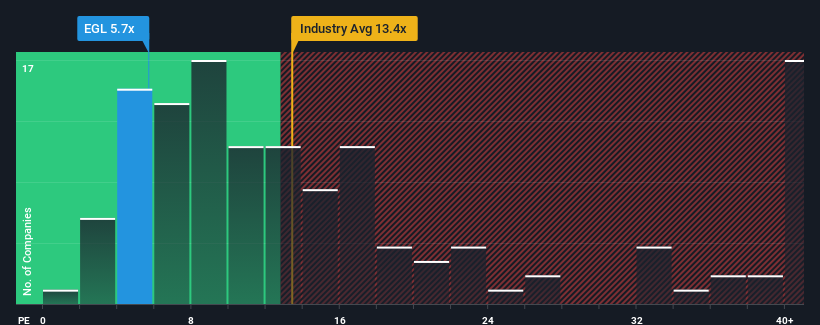

In spite of the heavy fall in price, Mota-Engil SGPS' price-to-earnings (or "P/E") ratio of 5.7x might still make it look like a strong buy right now compared to the market in Portugal, where around half of the companies have P/E ratios above 13x and even P/E's above 22x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Mota-Engil SGPS has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Mota-Engil SGPS

Does Growth Match The Low P/E?

Mota-Engil SGPS' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 126% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 1.2% each year over the next three years. With the market predicted to deliver 2.9% growth per annum, the company is positioned for a comparable earnings result.

With this information, we find it odd that Mota-Engil SGPS is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Mota-Engil SGPS' P/E

Mota-Engil SGPS' P/E looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Mota-Engil SGPS' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 4 warning signs for Mota-Engil SGPS that we have uncovered.

You might be able to find a better investment than Mota-Engil SGPS. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:EGL

Mota-Engil SGPS

Provides public and private construction works and related services in Europe, Africa, and Latin America.

Good value slight.

Similar Companies

Market Insights

Community Narratives