- Portugal

- /

- Construction

- /

- ENXTLS:EGL

News Flash: 2 Analysts Think Mota-Engil, SGPS, S.A. (ELI:EGL) Earnings Are Under Threat

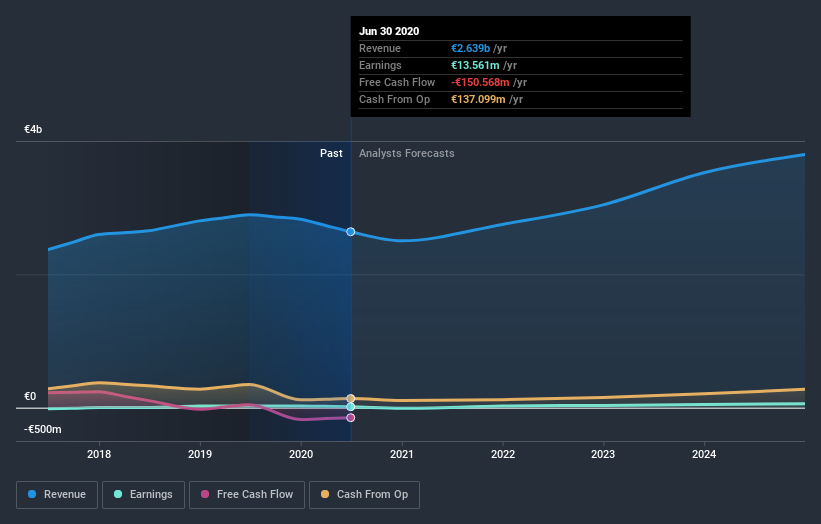

Today is shaping up negative for Mota-Engil, SGPS, S.A. (ELI:EGL) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

Following the latest downgrade, the twin analysts covering Mota-Engil SGPS provided consensus estimates of €2.5b revenue in 2020, which would reflect a small 5.2% decline on its sales over the past 12 months. Statutory earnings per share are anticipated to crater 82% to €0.01 in the same period. Before this latest update, the analysts had been forecasting revenues of €2.9b and earnings per share (EPS) of €0.049 in 2020. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a pretty serious decline to earnings per share numbers as well.

Check out our latest analysis for Mota-Engil SGPS

Despite the cuts to forecast earnings, there was no real change to the €3.20 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Mota-Engil SGPS analyst has a price target of €4.50 per share, while the most pessimistic values it at €2.00. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with the forecast 5.2% revenue decline a notable change from historical growth of 4.7% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 5.4% annually for the foreseeable future. It's pretty clear that Mota-Engil SGPS' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of Mota-Engil SGPS.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with Mota-Engil SGPS, including its declining profit margins. For more information, you can click here to discover this and the 4 other concerns we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Mota-Engil SGPS or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Mota-Engil SGPS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTLS:EGL

Mota-Engil SGPS

Provides public and private construction works and related services in Europe, Africa, and Latin America.

Good value slight.

Similar Companies

Market Insights

Community Narratives