Should Banco Comercial Português's Rising Profits Prompt Action From ENXTLS:BCP Investors?

Reviewed by Sasha Jovanovic

- Banco Comercial Português, S.A. announced earnings for the nine months ended September 30, 2025, reporting net income of €775.92 million, up from €714.1 million in the prior year period.

- Both basic and diluted earnings per share from continuing operations increased to €0.067 from €0.061, highlighting incremental gains in profitability.

- With the reported rise in earnings per share, we'll explore how stronger profitability could shape Banco Comercial Português’s investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Banco Comercial Português' Investment Narrative?

The recent earnings results from Banco Comercial Português show a clear uptick in profitability, with net income for the nine months ending September 30, 2025, coming in ahead of last year, and earnings per share modestly higher as well. For investors, the main narrative to buy into has long centered on the company's ability to sustain improving profit metrics while balancing growth against risks such as its relatively high price-to-earnings ratio and board independence concerns. The latest profit update could bolster near term confidence, potentially easing worries about the pace of recovery after the bank's large one-off loss last year and supporting market optimism. However, this earnings beat does not erase underlying risks; the net profit margin is still slightly lower than a year ago, and structural issues like an unstable dividend record and a premium valuation versus peers remain relevant. It’s a case where the news stabilizes immediate expectations, but doesn’t fundamentally change the picture on longer-term governance and value questions.

By contrast, the low net profit margin warrants closer attention going forward.

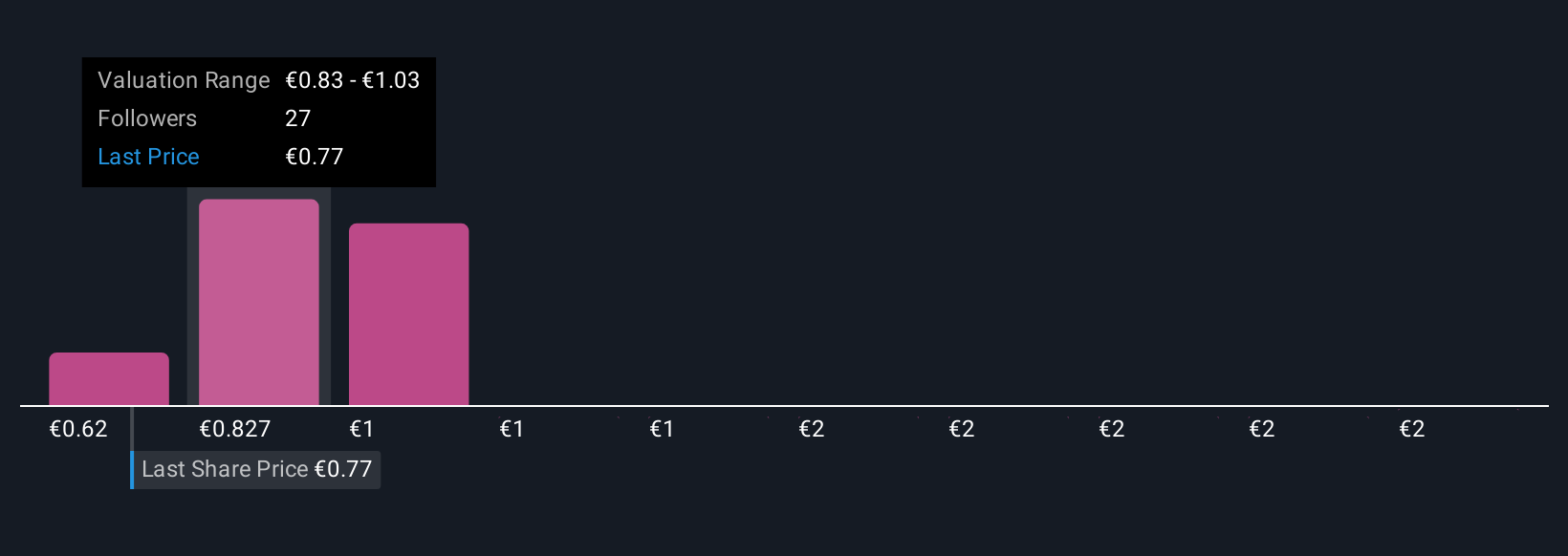

Banco Comercial Português' shares have been on the rise but are still potentially undervalued by 20%. Find out what it's worth.Exploring Other Perspectives

Explore 12 other fair value estimates on Banco Comercial Português - why the stock might be worth over 3x more than the current price!

Build Your Own Banco Comercial Português Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco Comercial Português research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Banco Comercial Português research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco Comercial Português' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Comercial Português might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:BCP

Banco Comercial Português

Engages in the provision of various banking and financial products and services in Portugal and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives