Toyota Caetano Portugal (ENXTLS:SCT) Earnings Growth Trails Five-Year Pace, Raising Quality Debate

Reviewed by Simply Wall St

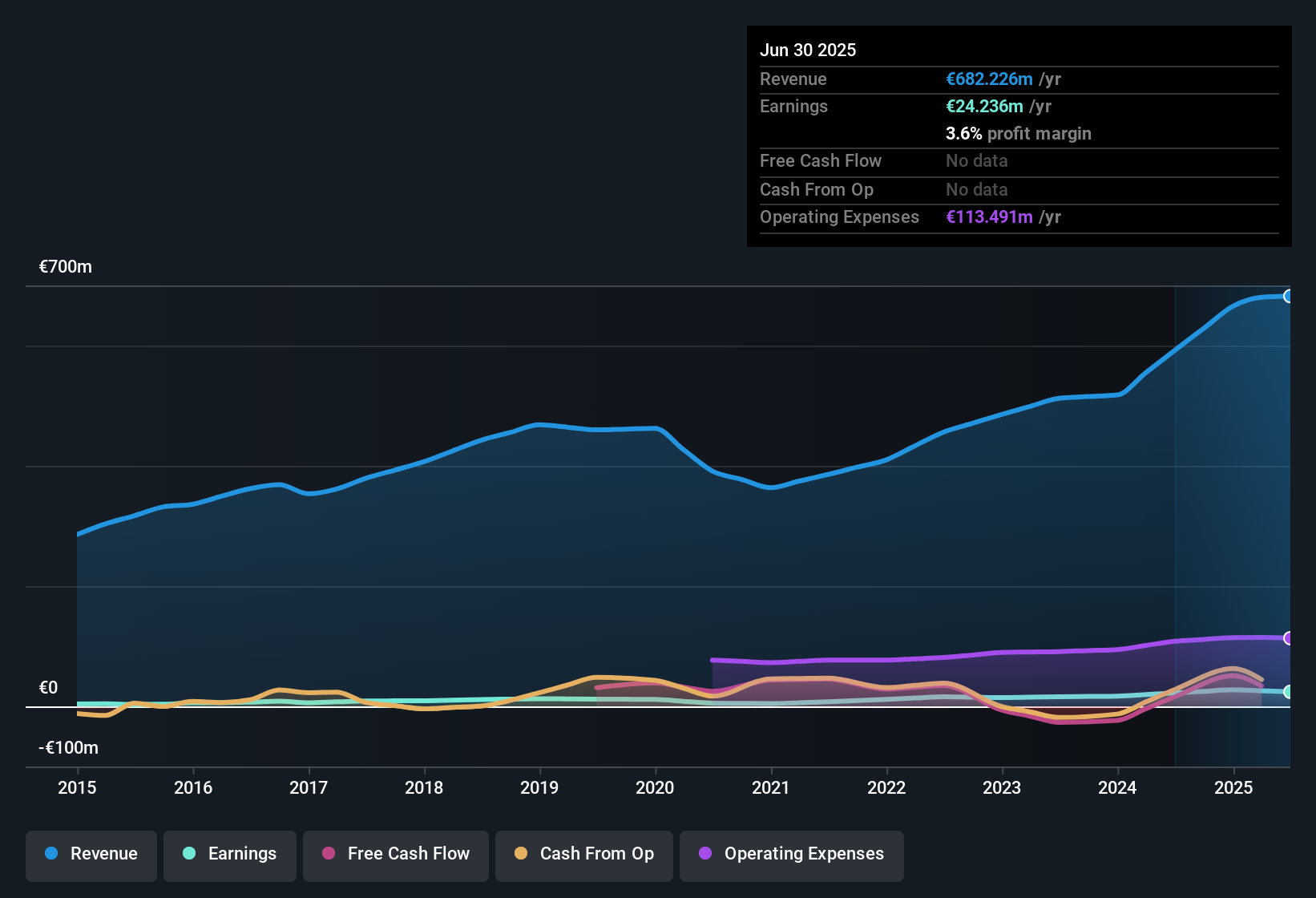

Toyota Caetano Portugal (ENXTLS:SCT) booked 8.9% earnings growth over the past year, coming in well below its 5-year compound average of 29.5% per year. Investors should note that these results are backed by high profit quality, even as there are no explicit updates on revenue or margin movements in the latest filing. In this context, SCT finds itself recognized both for sustained profitability and for being flagged with questions about the company’s financial position and dividend track record. This sets the stage for a nuanced earnings season.

See our full analysis for Toyota Caetano Portugal.Next, we’ll see how the current numbers check out when weighed against the major community narratives. Sometimes the headlines get confirmed, and sometimes they get a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-To-Earnings Discount to Industry Benchmarks

- SCT’s current Price-To-Earnings Ratio stands at 8.8x, less than half the global auto sector average of 17.8x and far below its peer average of 51.2x. However, its shares are trading above the DCF fair value of €2.94, with the current price at €6.10.

- Bulls highlight how this steep P/E discount offers value compared to global and peer benchmarks, yet the premium to DCF fair value raises questions about whether market enthusiasm for past profitability is already fully capitalized on.

- A low 8.8x P/E typically draws value investors, but the stock price’s disconnect from the €2.94 DCF fair value suggests bargains may be less obvious than they appear.

- Bulls might argue this valuation gap reflects long-term confidence, while skeptics point to the need for future growth or margin expansion to justify the current premium.

Profit Quality and Historical Growth Outperformance

- High profit quality supports SCT’s 8.9% annual earnings growth, backing the company’s reputation for reliable financial delivery, even as this pace trails its 5-year compound rate of 29.5% per year.

- The prevailing market view takes notice of sustained profitability, seeing SCT’s strong track record as a foundation, but questions whether this deceleration marks a transition from high growth into a steadier phase.

- The contrast between a robust historical average and recent lower growth may prompt debate over the durability of SCT’s operating model, especially without new revenue or margin disclosures.

- This growth slowdown could either reflect temporary headwinds or signal emerging structural limits. Without fresh operating data, markets must rely on SCT’s historical reliability for comfort.

Financial Position and Dividend Profile Under Watch

- Current risks noted in the EDGAR summary center on SCT’s financial position and dividend sustainability, both flagged but not deemed major, creating a complex risk-reward profile for investors focused on income or balance sheet strength.

- The prevailing market view acknowledges that SCT’s recognized history of profitability and value could offset modest concerns about dividends, but this balance may shift if flagged financial or payout risks materialize.

- Investors may be willing to accept muted dividend signals as long as SCT maintains its value credentials and past growth reliability.

- Continued risk monitoring is warranted, as even lesser-flagged concerns might weigh more heavily if sector momentum or company fundamentals drift.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Toyota Caetano Portugal's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.See What Else Is Out There

SCT’s valuation trades at a significant premium to its DCF fair value. This adds to recent modest earnings growth and highlighted financial position risks.

Want more attractive pricing and fewer valuation concerns? Look for stronger value among companies highlighted by our undervalued stocks based on cash flows. Discover stocks where the upside is clearer and the premiums are much harder to find.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Caetano Portugal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:SCT

Toyota Caetano Portugal

Imports, assembles, and commercializes light and heavy vehicles.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives