- Norway

- /

- Marine and Shipping

- /

- OB:MPCC

Unveiling Three Undiscovered Gems In Europe With Strong Potential

Reviewed by Simply Wall St

As the European market navigates a landscape shaped by easing inflation and potential interest rate cuts from the European Central Bank, investors are increasingly looking for opportunities in small-cap stocks that may benefit from these economic shifts. In this context, identifying stocks with strong fundamentals and growth potential becomes crucial for those seeking to capitalize on the evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

MPC Container Ships (OB:MPCC)

Simply Wall St Value Rating: ★★★★★☆

Overview: MPC Container Ships ASA owns and operates a portfolio of container vessels and has a market capitalization of NOK7.41 billion.

Operations: The company's primary revenue stream is from container shipping, generating $520.40 million.

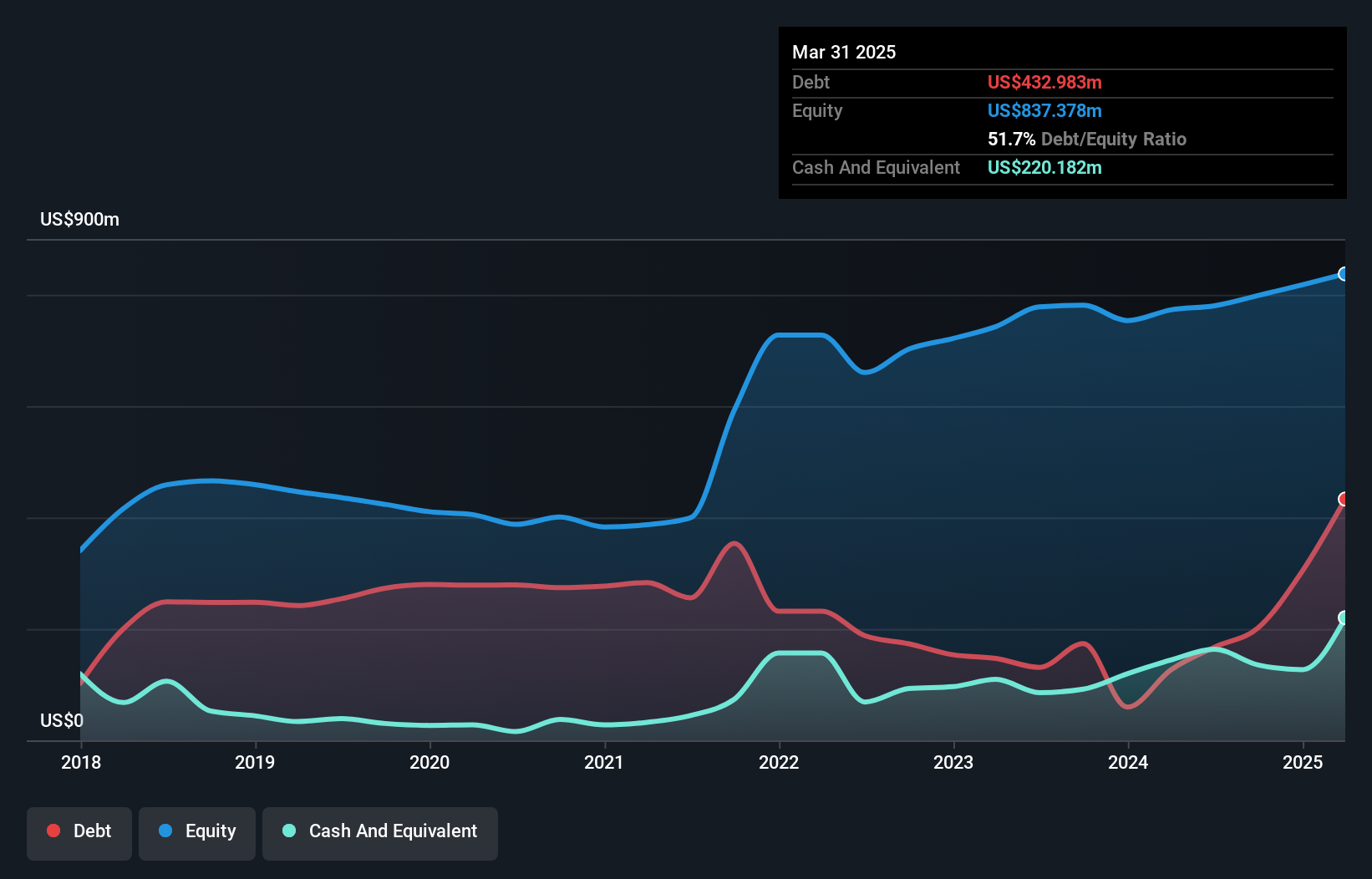

MPC Container Ships, a smaller player in the shipping sector, has seen its debt to equity ratio improve significantly from 68.8% to 51.7% over five years, indicating better financial health. Despite trading at 40.8% below estimated fair value and having well-covered interest payments with an EBIT coverage of 17.1x, the company faces challenges with a negative earnings growth of -11.3%. Recent efforts include strategic fleet optimization and maintaining a charter backlog worth $1.1 billion for 2025, though revenue is projected to decrease by an average of 21.5% annually over three years amidst geopolitical risks and regulatory changes.

Norion Bank (OM:NORION)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Norion Bank AB (publ) offers financial solutions to medium-sized corporates, real estate companies, merchants, and private individuals across Sweden, Germany, Norway, Denmark, Finland, and internationally with a market cap of approximately SEK9.57 billion.

Operations: Norion Bank generates revenue primarily from its Real Estate and Consumer segments, contributing SEK1.22 billion and SEK930 million, respectively. The Payments segment adds another SEK501 million, while the Corporate segment brings in SEK827 million.

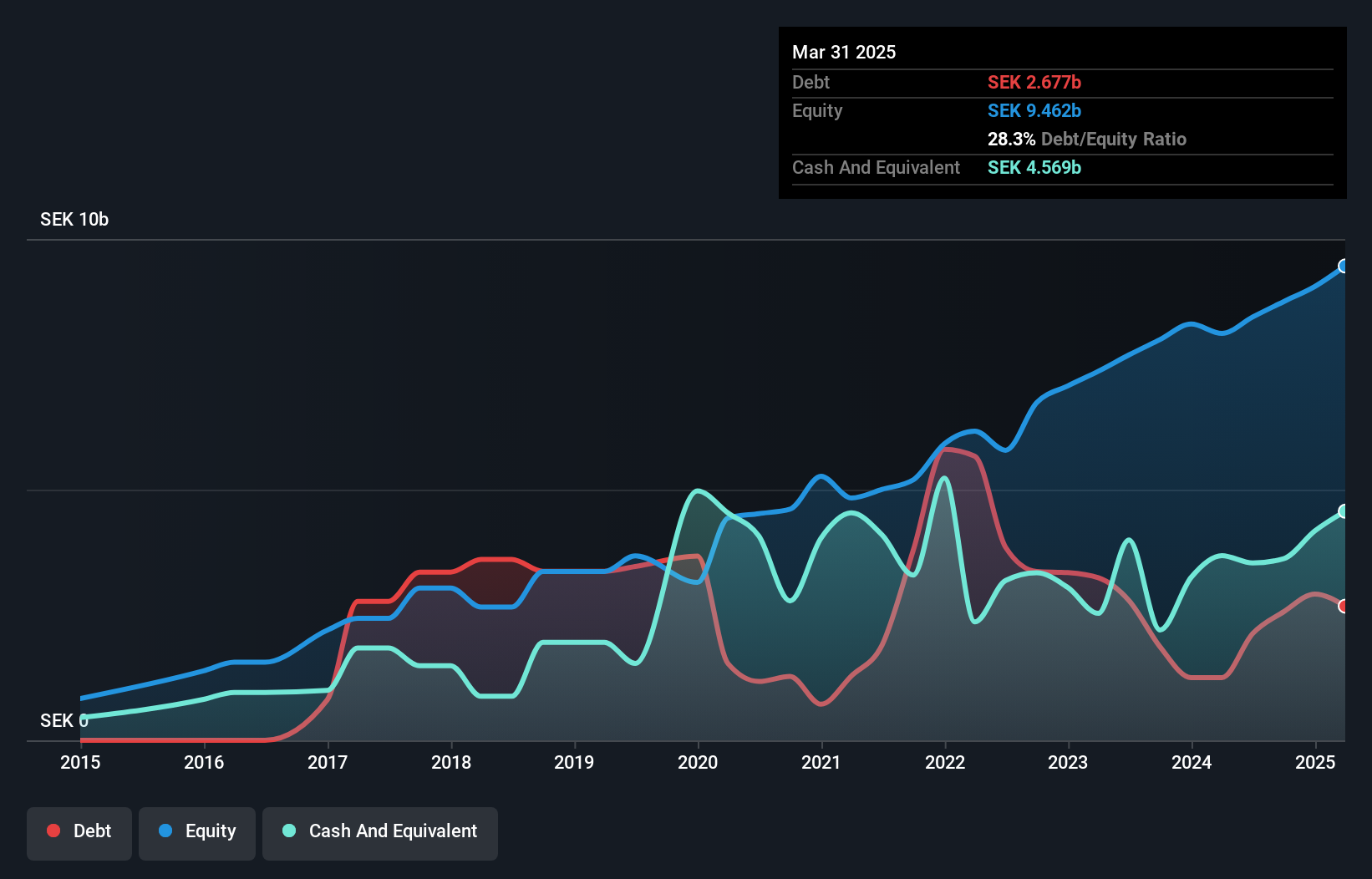

Norion Bank, a notable player in the European financial landscape, shows potential despite some challenges. With total assets of SEK67.6 billion and equity at SEK9.5 billion, it stands solidly in its market segment. The bank's earnings grew by 7% last year, outpacing the industry average of -1.5%. However, it grapples with a high level of bad loans at 21%, paired with a low allowance for these loans at 49%. Trading at 73% below estimated fair value and backed by low-risk funding sources comprising 93% of liabilities, Norion presents an intriguing investment opportunity amidst its hurdles.

- Navigate through the intricacies of Norion Bank with our comprehensive health report here.

Examine Norion Bank's past performance report to understand how it has performed in the past.

Zespól Elektrocieplowni Wroclawskich KOGENERACJA (WSE:KGN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zespól Elektrocieplowni Wroclawskich KOGENERACJA S.A. operates in the energy sector, focusing on the generation and distribution of electricity and heat, with a market capitalization of PLN1.04 billion.

Operations: KOGENERACJA generates revenue primarily through the sale of electricity and heat. The company's net profit margin is a key financial metric, reflecting its efficiency in converting revenue into actual profit.

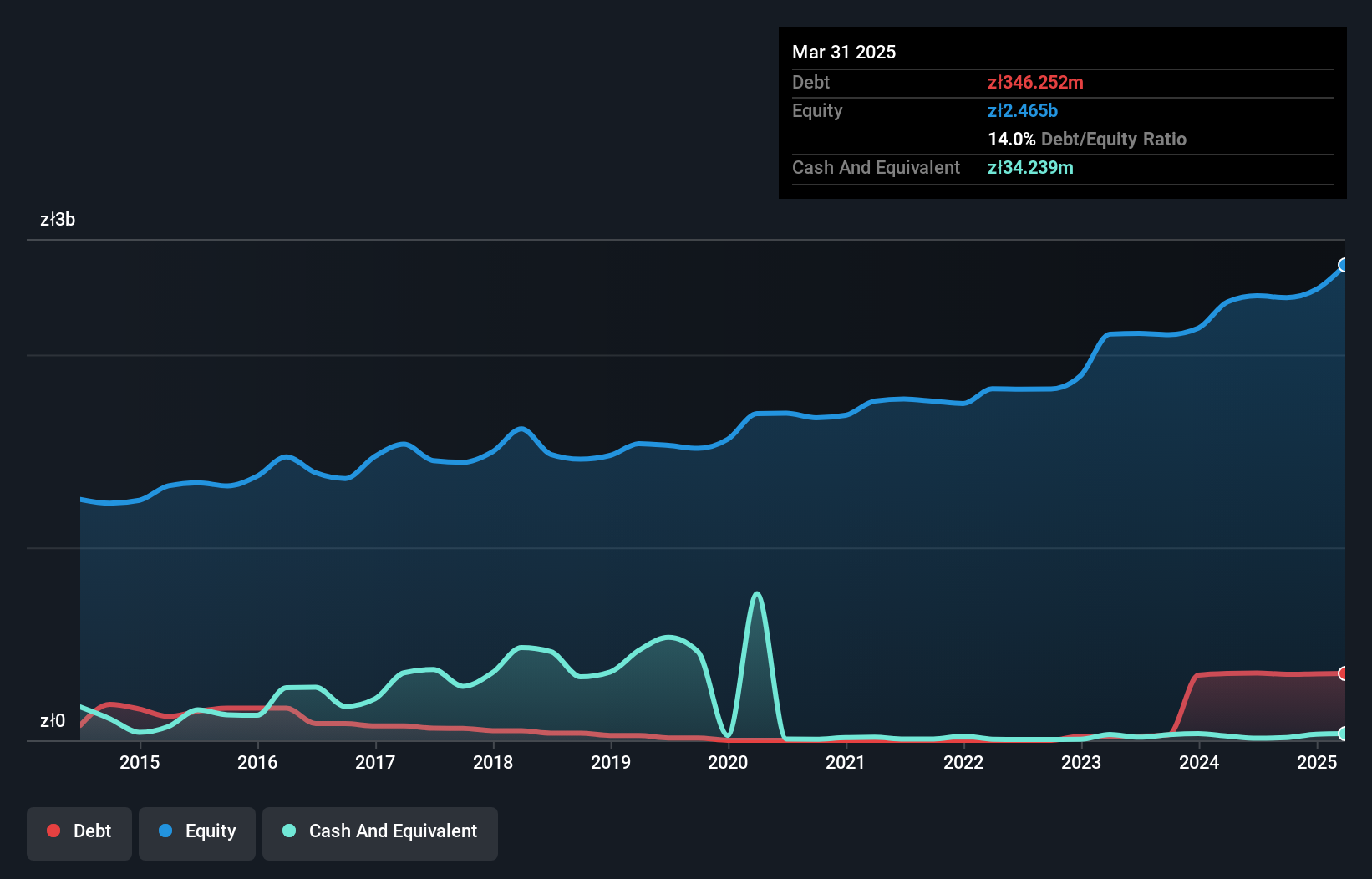

KOGENERACJA, a notable player in the energy sector, has shown resilience despite challenges. Trading significantly below its estimated fair value, it offers potential for value seekers. The company's net debt to equity ratio stands at a satisfactory 12.7%, indicating prudent financial management. Over the past five years, earnings have grown by 17.8% annually; however, recent performance saw earnings growth of 7.2%, which lagged behind the industry average of 15.4%. In Q1 2025, sales reached PLN 880 million with net income at PLN 127 million compared to higher figures last year, reflecting some pressure on margins and profitability.

- Take a closer look at Zespól Elektrocieplowni Wroclawskich KOGENERACJA's potential here in our health report.

Learn about Zespól Elektrocieplowni Wroclawskich KOGENERACJA's historical performance.

Next Steps

- Gain an insight into the universe of 331 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MPCC

Excellent balance sheet and fair value.

Market Insights

Community Narratives