- Poland

- /

- Telecom Services and Carriers

- /

- WSE:KOR

Earnings Working Against Korbank S.A.'s (WSE:KOR) Share Price

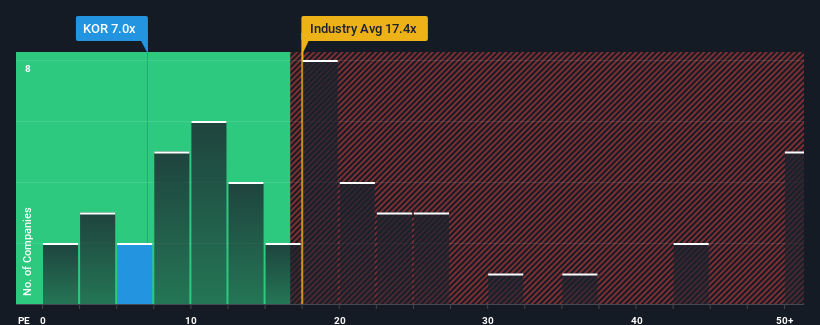

When close to half the companies in Poland have price-to-earnings ratios (or "P/E's") above 13x, you may consider Korbank S.A. (WSE:KOR) as an attractive investment with its 7x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at Korbank over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Korbank

Is There Any Growth For Korbank?

There's an inherent assumption that a company should underperform the market for P/E ratios like Korbank's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.6% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 2.7% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 13% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Korbank's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On Korbank's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Korbank revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Korbank (at least 2 which are significant), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Korbank, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Korbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:KOR

Korbank

A telecommunications operator, provides various services to companies, institutions, and housing estates in Poland and internationally.

Good value slight.

Market Insights

Community Narratives