- Switzerland

- /

- Electric Utilities

- /

- SWX:NEAG

Discovering Hidden Opportunities With These 3 Undiscovered Gems

Reviewed by Simply Wall St

As global markets continue to navigate the evolving economic landscape, recent optimism surrounding U.S. trade policies and AI investments has propelled major indexes like the S&P 500 to new heights, while smaller-cap stocks have lagged behind their larger counterparts. In this context of shifting market dynamics, discerning investors often seek out undiscovered gems—stocks that may be overlooked yet possess strong fundamentals or growth potential—to capitalize on hidden opportunities amidst broader trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Grupo Empresarial San José (BME:GSJ)

Simply Wall St Value Rating: ★★★★★★

Overview: Grupo Empresarial San José, S.A. operates primarily in the construction sector both within Spain and internationally, with a market capitalization of €366.75 million.

Operations: San José generates most of its revenue from the construction segment, amounting to €1.39 billion, followed by concessions and services at €74.68 million. The energy and real estate segments contribute smaller amounts, with revenues of €10.33 million and €10.44 million respectively.

Grupo Empresarial San José, a notable player in the construction sector, has shown impressive earnings growth of 70.9% over the past year, outpacing the industry's 19.7%. The company reported sales of €1.15 billion for the first nine months of 2024, up from €975 million in the previous year, with net income rising to €23.17 million from €11.81 million. Its debt-to-equity ratio has significantly improved from 208% to 49% over five years, indicating better financial health. With a price-to-earnings ratio at 11.8x compared to Spain's market average of 19.6x, GSJ appears attractively valued relative to its peers and industry standards.

- Click to explore a detailed breakdown of our findings in Grupo Empresarial San José's health report.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

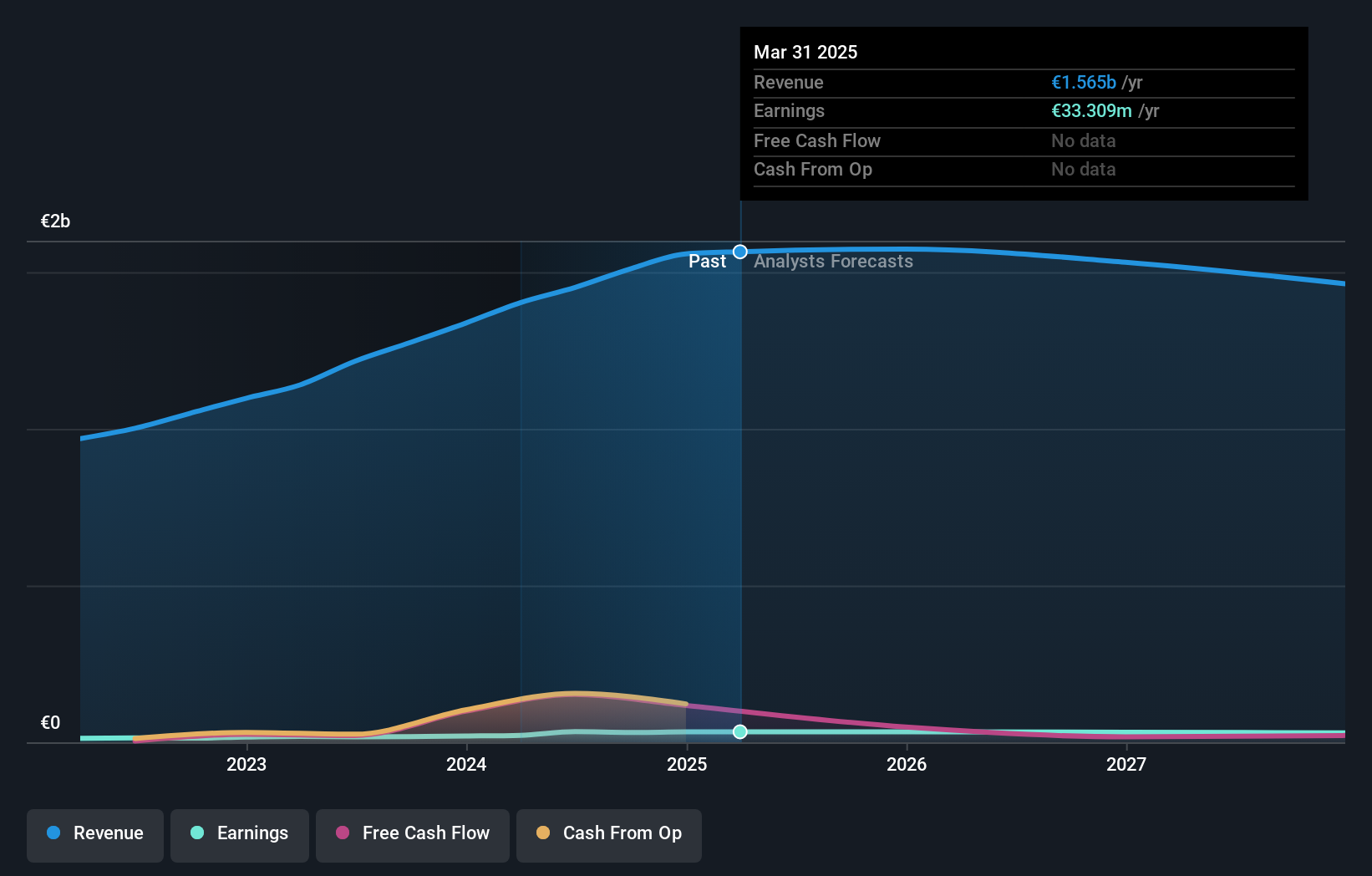

Overview: Naturenergie Holding AG, with a market cap of CHF1.12 billion, operates through its subsidiaries in the production, distribution, and sale of electricity under the naturenergie brand both in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€1.15 billion) and Renewable Generation Infrastructure (€1.09 billion), with additional income from System Relevant Infrastructure (€403.5 million). The company's market cap stands at CHF1.12 billion, reflecting its significant role in the energy sector across Switzerland and internationally.

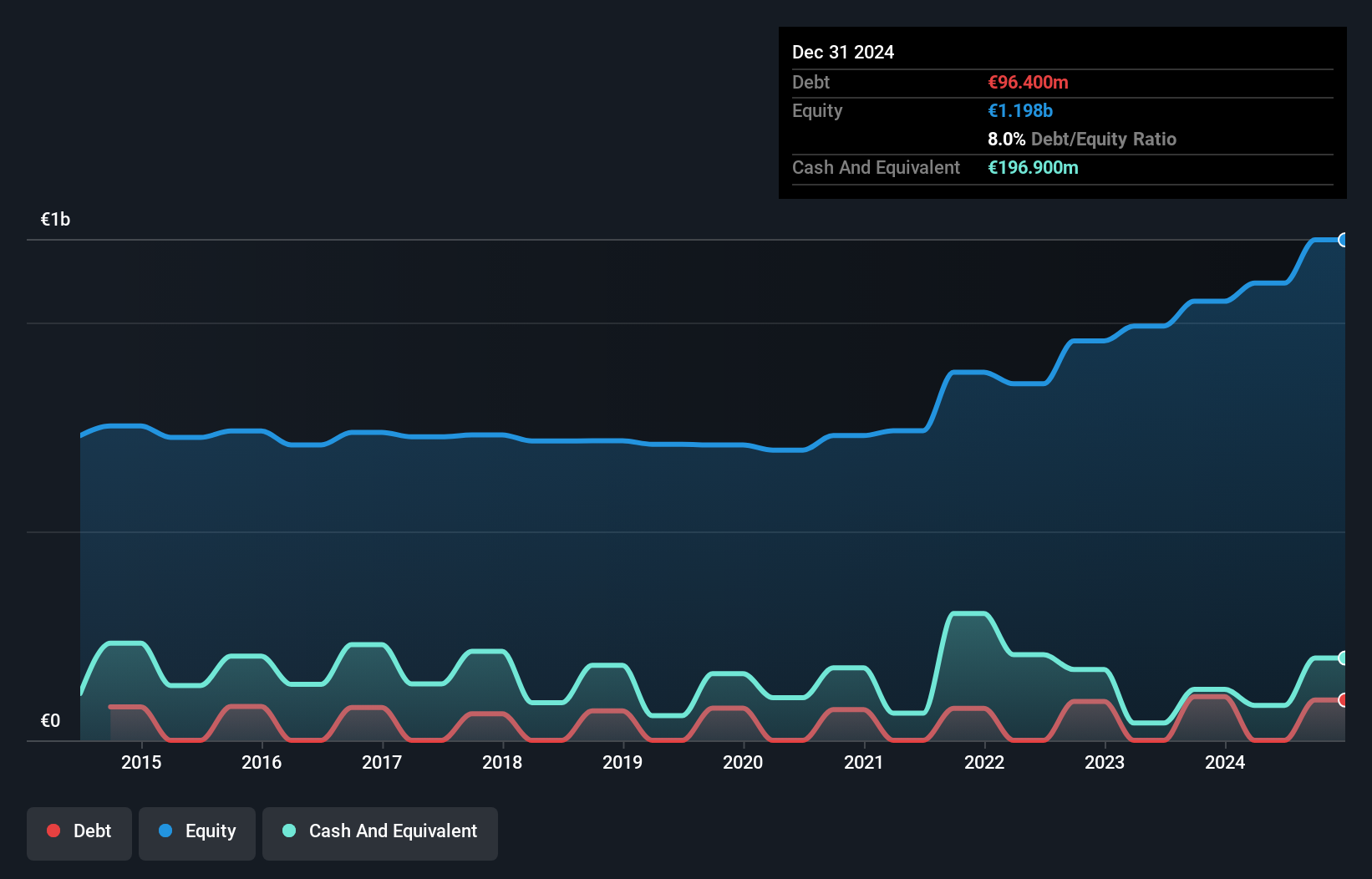

Naturenergie Holding, a small player in the energy sector, stands out for its impressive earnings growth of 40% over the past year, significantly outperforming the Electric Utilities industry's -11%. The company is debt-free, a rarity in its field, which negates any concerns about interest coverage. Trading at a price-to-earnings ratio of 10x compared to the Swiss market's 22x suggests it's undervalued relative to peers. With high-quality earnings and profitability ensuring a stable cash runway, Naturenergie seems well-positioned for steady growth with projected annual earnings increase of 3%.

- Click here and access our complete health analysis report to understand the dynamics of naturenergie holding.

Gain insights into naturenergie holding's past trends and performance with our Past report.

Cyber_Folks (WSE:CBF)

Simply Wall St Value Rating: ★★★★★★

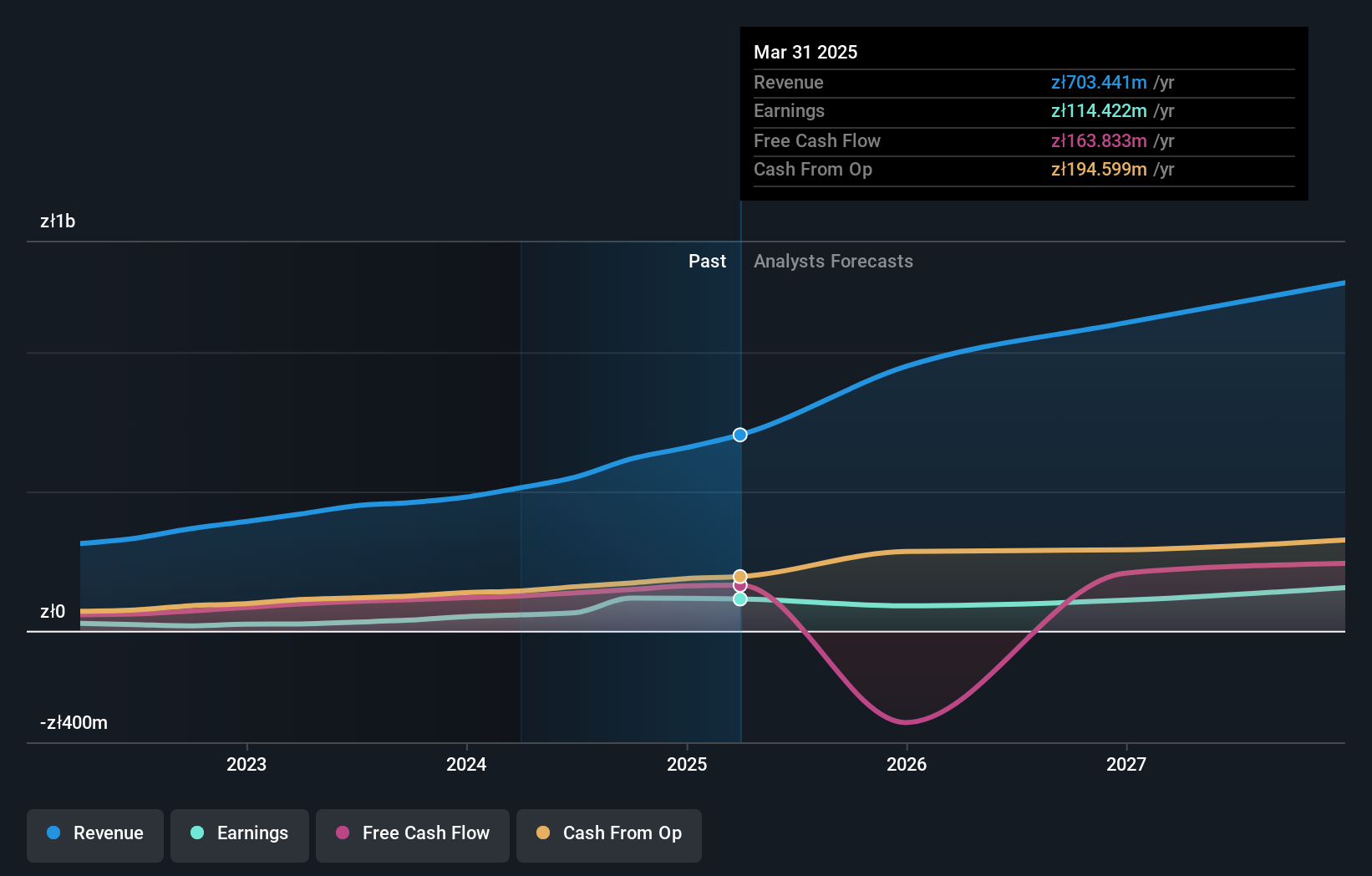

Overview: Cyber_Folks S.A. is a technology company focused on business digitization and enterprise support in Poland and internationally, with a market cap of PLN2.25 billion.

Operations: Cyber_Folks generates revenue primarily from its VERCOM segment, contributing PLN462.11 million, and the Cyber Folks segment, adding PLN151.63 million. The SaaS and Corporate segments contribute smaller amounts of PLN2.34 million and PLN2.36 million respectively, while exclusions reduce total reported revenue by PLN2.07 million.

Cyber_Folks has shown impressive financial performance, with earnings growth of 203.8% over the past year, significantly outpacing the Telecom industry's 7.5%. The company's net debt to equity ratio stands at a satisfactory 11.5%, indicating prudent financial management. Recent reports highlight strong sales figures for Q3 2024 at PLN 185.4 million, up from PLN 120.17 million

- Delve into the full analysis health report here for a deeper understanding of Cyber_Folks.

Evaluate Cyber_Folks' historical performance by accessing our past performance report.

Where To Now?

- Explore the 4687 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NEAG

naturenergie holding

Through its subsidiaries, engages in the production, distribution, and sale of electricity under the naturenergie brand in Switzerland and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives