I Built A List Of Growing Companies And Eurotel (WSE:ETL) Made The Cut

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Eurotel (WSE:ETL). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Eurotel

How Fast Is Eurotel Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Eurotel has managed to grow EPS by 18% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

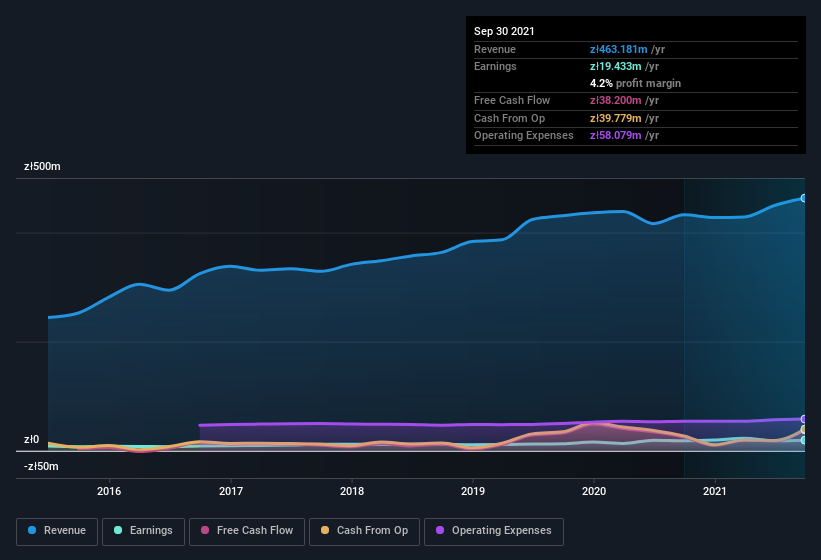

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Eurotel's EBIT margins were flat over the last year, revenue grew by a solid 7.1% to zł463m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Eurotel is no giant, with a market capitalization of zł153m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Eurotel Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Eurotel insiders own a significant number of shares certainly appeals to me. In fact, they own 64% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about zł97m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Eurotel with market caps under zł864m is about zł524k.

Eurotel offered total compensation worth zł435k to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Eurotel Deserve A Spot On Your Watchlist?

You can't deny that Eurotel has grown its earnings per share at a very impressive rate. That's attractive. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. Each to their own, but I think all this makes Eurotel look rather interesting indeed. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Eurotel , and understanding these should be part of your investment process.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Eurotel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ETL

Eurotel

Operates a chain of retail stores of telecommunications operators and various electronics manufacturers in Poland.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026