High Growth Tech Stocks In Europe Featuring Crayon Group Holding And 2 Others

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index experiences a modest rise of 0.90% amid easing inflation and favorable monetary policy shifts by the European Central Bank, investors are keeping a close eye on high-growth tech stocks in the region. In this environment, identifying promising companies often involves looking for those with strong innovation capabilities and resilience to economic fluctuations, such as Crayon Group Holding and other key players poised to capitalize on technological advancements.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| argenx | 21.82% | 26.90% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

We'll examine a selection from our screener results.

Crayon Group Holding (OB:CRAYN)

Simply Wall St Growth Rating: ★★★★★☆

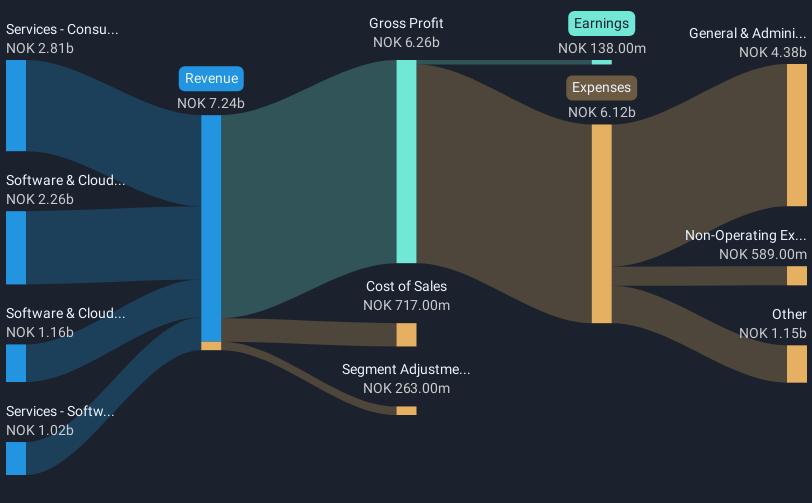

Overview: Crayon Group Holding ASA is an IT consultancy company with operations spanning the Nordics, Europe, the Asia-Pacific, the Middle East and Africa, and the United States, and has a market cap of NOK12.66 billion.

Operations: Crayon Group Holding ASA generates revenue primarily through its services in consulting and software & cloud solutions, with notable segments including Software & Cloud Direct (NOK2.33 billion) and Consulting Services (NOK2.98 billion). The company operates across multiple regions, providing a comprehensive range of IT consultancy services.

Crayon Group Holding has demonstrated significant growth, with a notable 35.7% forecast in annual earnings growth outpacing the Norwegian market's 8.6%. This performance is bolstered by a strategic expansion with Google Cloud, enhancing Crayon's AI and cloud distribution capabilities across broader markets. The firm’s R&D commitment is evident from its latest financials, marking an impressive increase in net income to NOK 48 million from NOK 12 million year-over-year. These developments not only highlight Crayon’s robust position in leveraging advanced technologies but also suggest promising prospects for sustaining high growth trajectories in the evolving tech landscape.

- Take a closer look at Crayon Group Holding's potential here in our health report.

Assess Crayon Group Holding's past performance with our detailed historical performance reports.

Landis+Gyr Group (SWX:LAND)

Simply Wall St Growth Rating: ★★★★☆☆

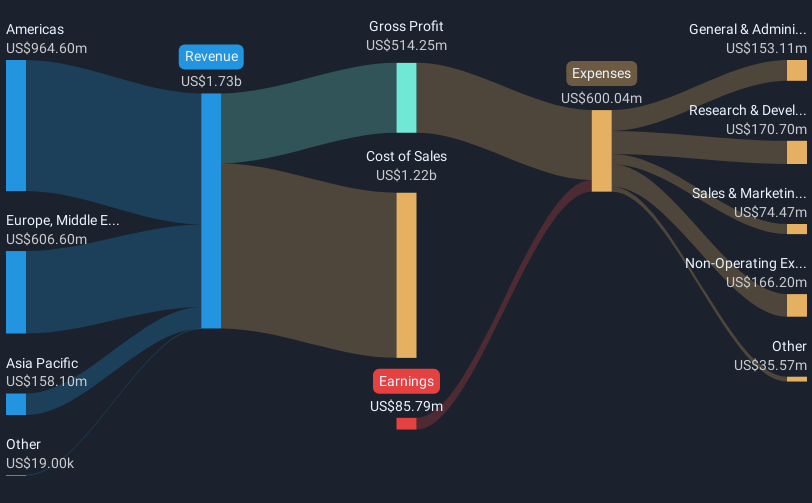

Overview: Landis+Gyr Group AG, with a market cap of CHF1.61 billion, offers integrated energy management solutions to the utility sector across the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Operations: The company generates revenue primarily from its operations in the Americas, contributing $967.49 million, followed by Europe, the Middle East, and Africa (EMEA) with $639.04 million, and Asia Pacific at $158.68 million.

Landis+Gyr Group AG, navigating through a challenging fiscal year with a reported net loss of $150.46 million from a previous profit of $109.98 million, is pivoting towards future growth with strategic technological upgrades and partnerships. The company's recent initiatives include enhancing its Advanced Metering Infrastructure (AMI), which now integrates smart meters with diverse energy resources, demonstrating Landis+Gyr's commitment to innovation in energy management systems. This approach not only supports the utility sector's transition to smarter energy solutions but also positions Landis+Gyr to capitalize on the growing demand for efficient and integrated energy systems globally. With an expected revenue growth between 5% and 8%, these developments could steer the company back towards profitability and solidify its role in advancing smart grid technologies.

- Click to explore a detailed breakdown of our findings in Landis+Gyr Group's health report.

Examine Landis+Gyr Group's past performance report to understand how it has performed in the past.

Vercom (WSE:VRC)

Simply Wall St Growth Rating: ★★★★★☆

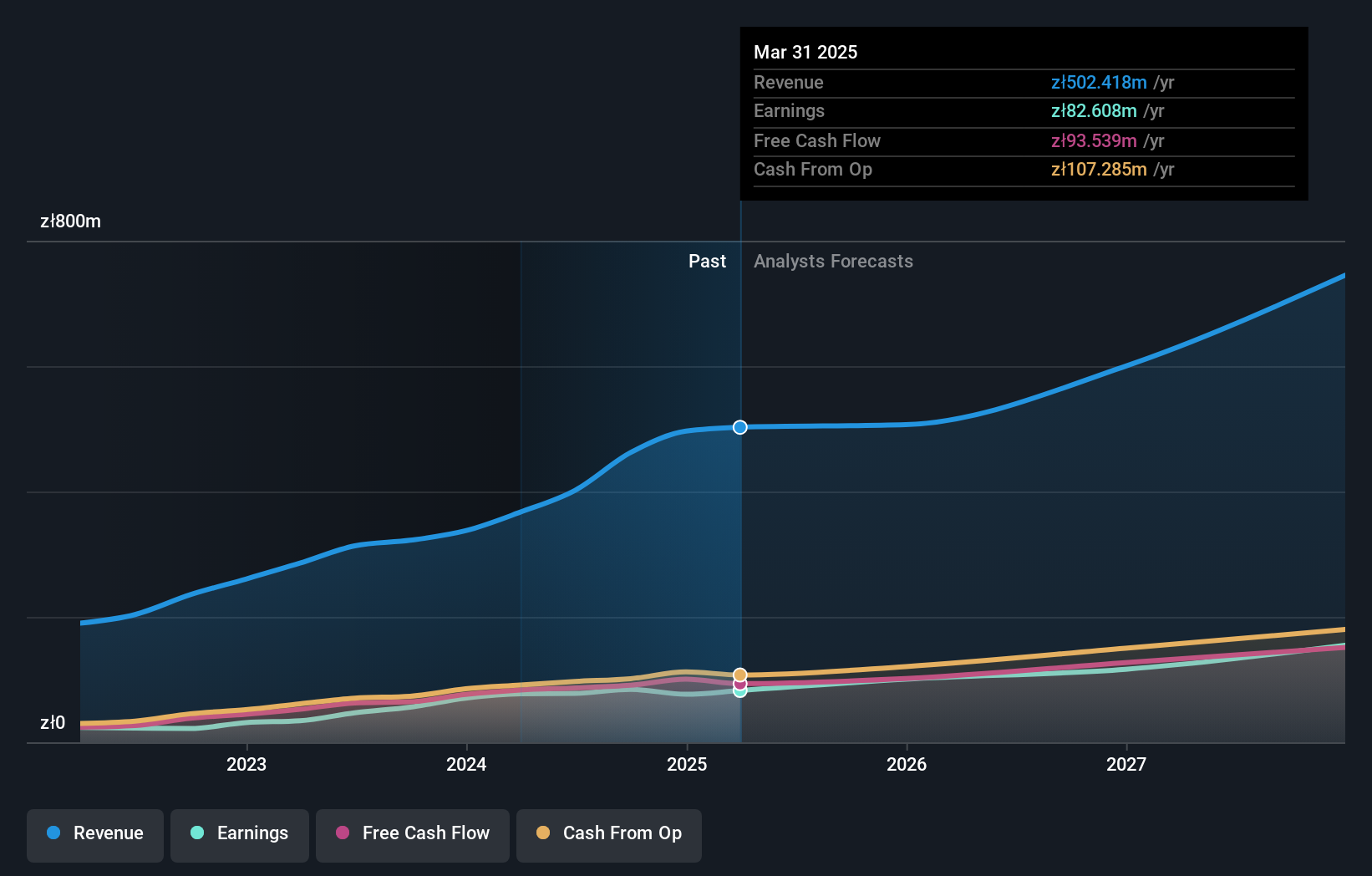

Overview: Vercom S.A. develops cloud communications platforms and has a market capitalization of PLN2.62 billion.

Operations: The company generates revenue primarily through its CPaaS segment, with reported earnings of PLN502.42 million.

Vercom S.A. has demonstrated robust financial performance with a notable increase in quarterly sales to PLN 110.76 million from PLN 104.57 million year-over-year, alongside a rise in net income to PLN 22.53 million from PLN 16.5 million, reflecting a strong operational momentum. This growth trajectory is underpinned by an annual earnings growth forecast of 21.1% and revenue growth at an impressive rate of 13.5% per year, outpacing the Polish market's average of 4.3%. Additionally, the company's strategic participation in key industry conferences and its commitment to shareholder returns through increased dividends—PLN 2.03 per share—highlight its proactive approach in capital management and industry engagement.

- Get an in-depth perspective on Vercom's performance by reading our health report here.

Evaluate Vercom's historical performance by accessing our past performance report.

Taking Advantage

- Navigate through the entire inventory of 225 European High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LAND

Landis+Gyr Group

Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion