Exploring Three High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of global market fluctuations, including tariff uncertainties and mixed economic indicators, investors are closely watching the performance of key indices such as the S&P 500, which recently experienced a modest decline. In this environment, identifying high-growth tech stocks with robust earnings potential and resilience to economic shifts becomes crucial for those seeking opportunities in an ever-evolving landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 68.22% | 59.79% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1212 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Stemmer Imaging (HMSE:S9I)

Simply Wall St Growth Rating: ★★★★☆☆

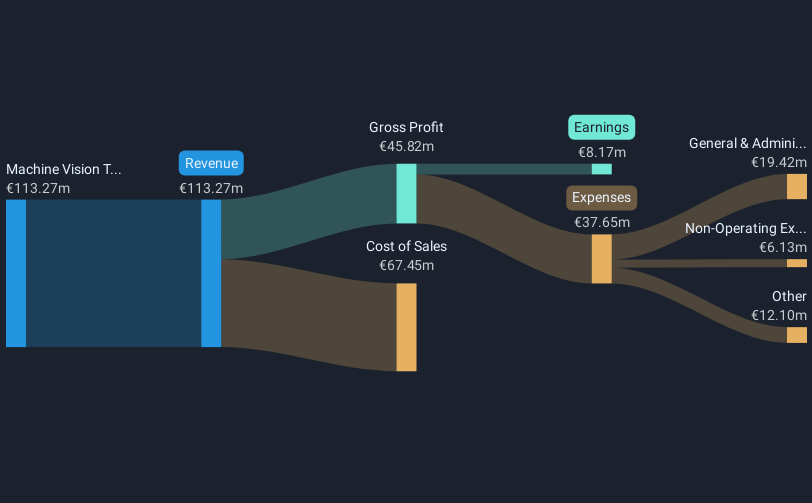

Overview: Stemmer Imaging AG offers machine vision technology solutions for various industry and non-industry applications globally, with a market cap of €345.80 million.

Operations: Stemmer Imaging AG generates revenue primarily from its machine vision technology segment, which accounts for €113.27 million.

Stemmer Imaging, amidst a challenging market, has demonstrated resilience with an expected annual revenue growth of 10.2%, outpacing the German market's 5.7%. Despite recent earnings fluctuations, with a significant drop in quarterly sales from €34.6 million to €21.64 million and transitioning from net income to a loss year-over-year, the company remains poised for recovery. Its robust R&D commitment is reflected in its strategic decisions during financial turbulence, including the acceptance of a delisting offer at €48 per share which may streamline operations and sharpen its competitive edge in high-tech imaging solutions.

- Get an in-depth perspective on Stemmer Imaging's performance by reading our health report here.

Examine Stemmer Imaging's past performance report to understand how it has performed in the past.

Vercom (WSE:VRC)

Simply Wall St Growth Rating: ★★★★☆☆

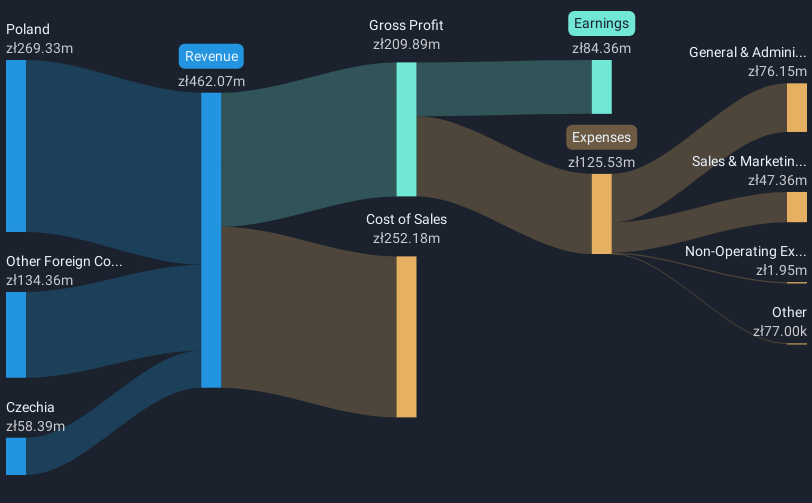

Overview: Vercom S.A. develops cloud communications platforms and has a market capitalization of PLN2.52 billion.

Operations: The company generates revenue primarily from its CPaaS segment, amounting to PLN462.07 million.

Vercom's trajectory in the tech sector is marked by robust growth metrics and strategic R&D investments. With a reported 14.2% annual revenue increase, outpacing Poland's average of 4.8%, the company demonstrates significant market outperformance. Earnings have surged by 50.3% over the past year, eclipsing the software industry's growth rate of 15.2%. This financial vigor is supported by a substantial R&D focus, which not only fuels innovation but also aligns with future tech trends, ensuring Vercom remains at the forefront of technological advancements while fostering sustainable growth.

- Navigate through the intricacies of Vercom with our comprehensive health report here.

Review our historical performance report to gain insights into Vercom's's past performance.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and internationally, with a market capitalization of approximately €603 million.

Operations: The company's primary revenue streams are IT-Services, generating €1.44 billion, and IT-Solutions, contributing €132.20 million. The business operates across multiple countries, providing a wide range of IT services and solutions to its clients.

Adesso SE showcases a compelling growth narrative in the tech sector, with its earnings projected to surge by 34.4% annually, significantly outpacing the German market's 19.3%. This financial ascent is bolstered by an impressive annual revenue growth rate of 11%, which also exceeds the broader market expectation of 5.7%. The company’s recent performance underscores this trajectory; for instance, in Q3 2024 alone, sales soared to €965.2 million from €836.75 million year-over-year, turning a prior net loss into a profit of €1.05 million. Such robust financial health is indicative of Adesso's strategic positioning for sustained advancement within the competitive tech landscape.

- Dive into the specifics of adesso here with our thorough health report.

Gain insights into adesso's historical performance by reviewing our past performance report.

Next Steps

- Discover the full array of 1212 High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VRC

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives