Exploring High Growth Tech Stocks Including Brogent Technologies

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with notable economic indicators such as the Chicago PMI showing contraction and the Atlanta Fed adjusting GDP forecasts, investors are keenly observing sectors that promise potential growth amid these fluctuations. In this context, high-growth tech stocks like those of Brogent Technologies stand out for their ability to leverage innovation and adaptability—key traits that can help companies thrive despite broader market challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Brogent Technologies (TPEX:5263)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Brogent Technologies Inc. is a technology company specializing in digital content creation services across Taiwan, Asia, Europe, the Americas, and internationally with a market cap of NT$10.06 billion.

Operations: The company generates revenue primarily from its entertainment software segment, amounting to NT$1.14 billion.

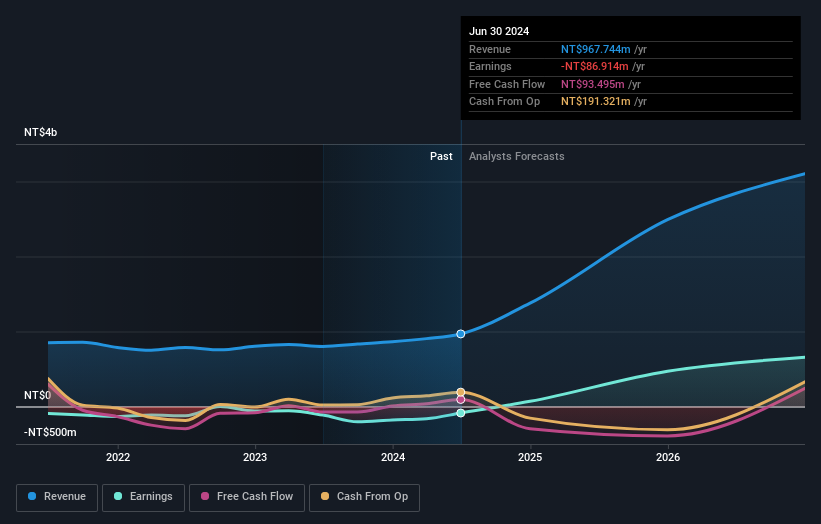

Brogent Technologies has demonstrated a robust trajectory with its recent earnings surge, reporting a substantial increase in sales to TWD 402.17 million from TWD 230.77 million year-over-year for Q3 2024, and transforming a net loss into a profit of TWD 28.99 million. This performance is underpinned by an impressive forecasted annual revenue growth of 44.1%, significantly outpacing the broader TW market's growth rate of 12.4%. Despite current unprofitability, Brogent is expected to shift towards profitability within three years, with earnings projected to grow at an annual rate of 102.15%. This potential is further highlighted by their strategic R&D investments which are essential for sustaining innovation and competitiveness in the fast-evolving tech landscape.

Appier Group (TSE:4180)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Appier Group, Inc. is a software-as-a-service company that offers artificial intelligence platforms to help enterprises make data-driven decisions both in Japan and internationally, with a market capitalization of ¥147.99 billion.

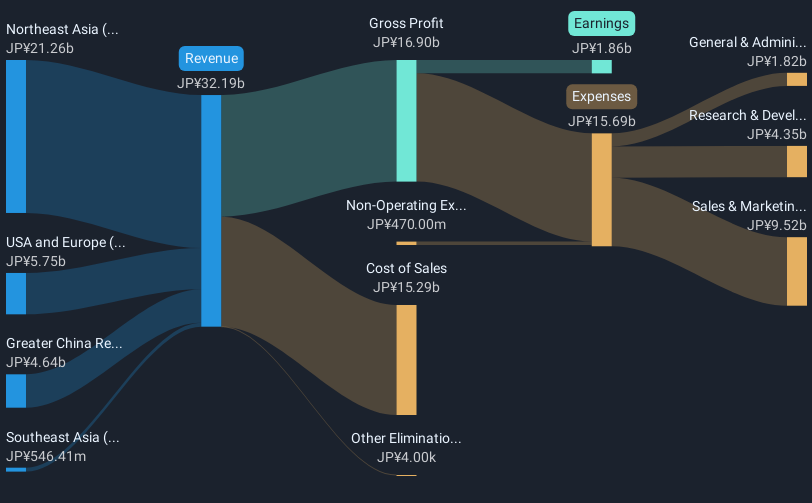

Operations: Appier generates revenue primarily through its AI SaaS business, which reported ¥32.19 billion in sales.

Appier Group's recent strategic moves underscore its commitment to growth and shareholder value, evidenced by a robust annual revenue increase of 17.8% and an impressive earnings growth forecast of 31.6% per year. The company has actively repurchased shares, with 566,700 shares bought back for ¥854.61 million from October to December 2024, reflecting confidence in its financial health and future prospects. This period also marked the initiation of a dividend policy, setting a dividend at JPY 2 per share, signaling strong future cash flows anticipated from innovative offerings like the AIXPERT platform—a GenAI-driven tool enhancing app marketing effectiveness on Apple's App Store. These initiatives are part of Appier’s broader strategy to leverage AI for operational efficiency and market penetration in the competitive tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Appier Group.

Understand Appier Group's track record by examining our Past report.

Vercom (WSE:VRC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vercom S.A. develops cloud communications platforms and has a market cap of PLN2.78 billion.

Operations: The company primarily generates revenue from its CPaaS segment, amounting to PLN 462.07 million.

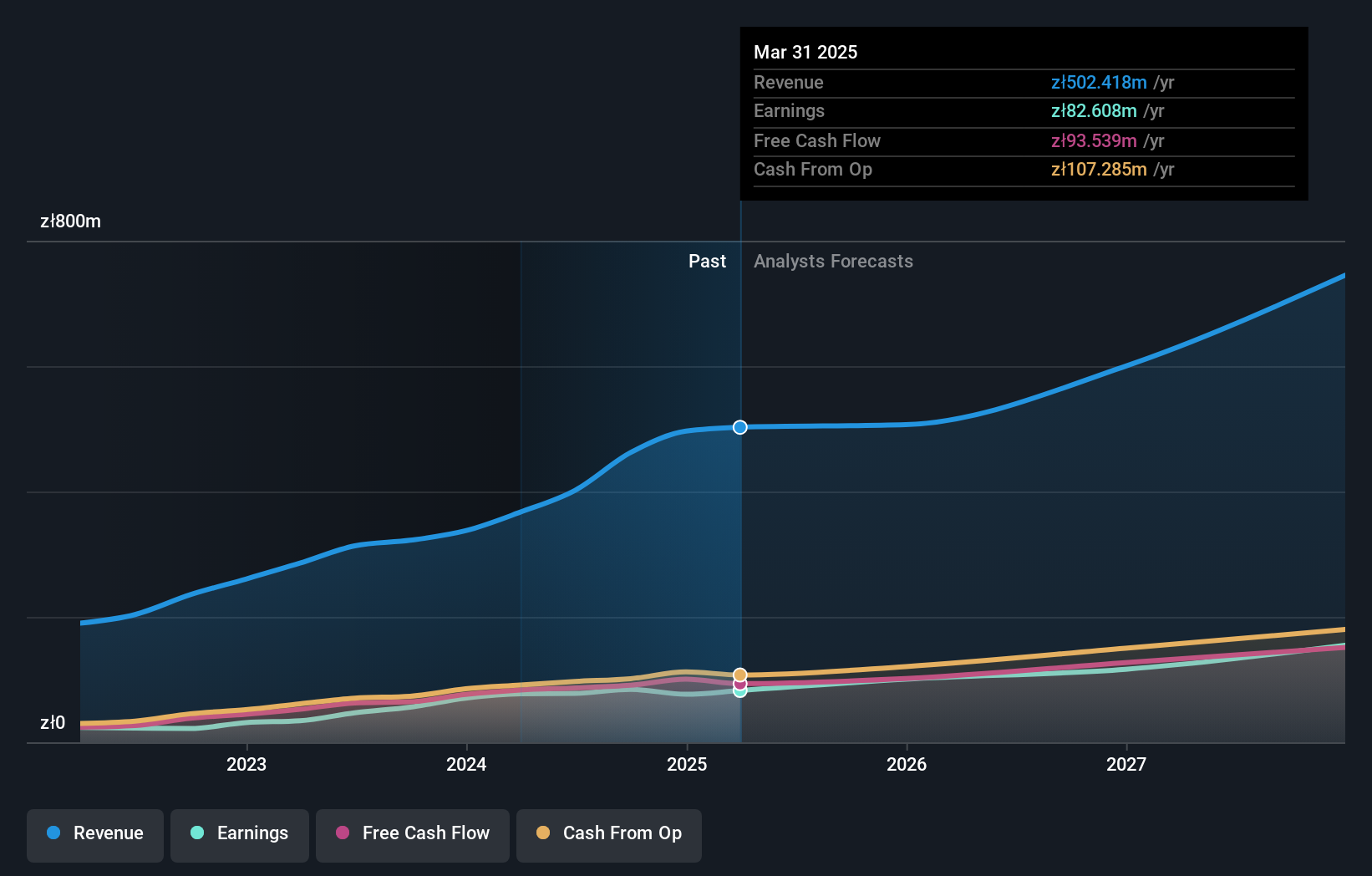

Vercom S.A. has demonstrated a robust growth trajectory, with its recent earnings showing a significant uptick: third-quarter sales surged to PLN 145.11 million from PLN 84.93 million year-over-year, and net income rose to PLN 19.4 million from PLN 13.05 million in the same period. This performance is underscored by an annual revenue growth rate of 12.8% and an impressive forecast for earnings growth at 21.9% per year, outpacing the broader Polish market's projections significantly (15.3%). The company's commitment to innovation is evident in its R&D investments, crucial for maintaining competitive advantage in the fast-evolving tech landscape where software companies increasingly pivot towards scalable solutions like SaaS models.

- Click here and access our complete health analysis report to understand the dynamics of Vercom.

Gain insights into Vercom's historical performance by reviewing our past performance report.

Make It Happen

- Delve into our full catalog of 1258 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4180

Appier Group

A software-as-a-service company, provides artificial intelligence (AI) platforms for enterprises to make data-driven decisions in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives