Some Talex (WSE:TLX) Shareholders Have Copped A Big 57% Share Price Drop

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Talex S.A. (WSE:TLX), since the last five years saw the share price fall 57%. Shareholders have had an even rougher run lately, with the share price down 20% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 27% in the same timeframe.

Check out our latest analysis for Talex

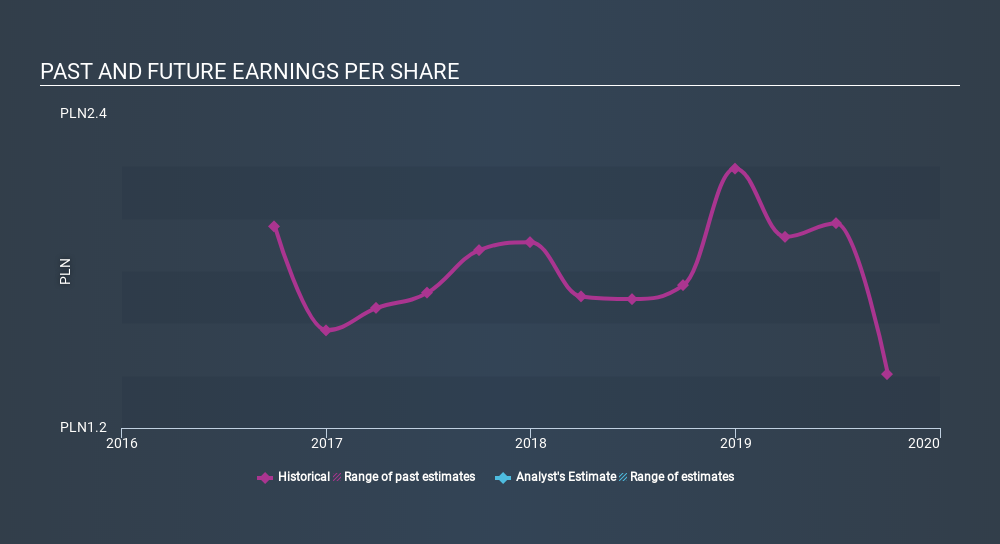

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Talex's share price and EPS declined; the latter at a rate of 12% per year. Notably, the share price has fallen at 16% per year, fairly close to the change in the EPS. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price change has reflected changes in earnings per share.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Talex's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Talex's TSR for the last 5 years was -39%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While it's never nice to take a loss, Talex shareholders can take comfort that , including dividends, their trailing twelve month loss of 17% wasn't as bad as the market loss of around 31%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 9.4% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Talex better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Talex (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:TLX

Flawless balance sheet low.

Market Insights

Community Narratives