Stock Analysis

- Japan

- /

- Entertainment

- /

- TSE:5253

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields, with large-cap stocks faring better than their small-cap counterparts and growth stocks outperforming value, investors are closely monitoring economic indicators and central bank policies for guidance. In this environment, identifying high-growth tech stocks involves assessing companies that can leverage technological advancements to drive innovation and maintain robust growth trajectories despite broader market challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.90% | 101.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.21% | 70.72% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 28.78% | 72.86% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Simplex Holdings (TSE:4373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Simplex Holdings, Inc. offers strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and public sectors globally with a market cap of ¥145.94 billion.

Operations: Simplex Holdings generates revenue through strategic consulting, design and development, and operation and maintenance services aimed at financial institutions, corporations, and public sectors globally. With a market capitalization of ¥145.94 billion, the company leverages its expertise to deliver comprehensive solutions across various industries.

Simplex Holdings, despite a modest 4% earnings growth in the past year, which lagged behind the IT industry's 10.1%, is positioned for significant future expansion with anticipated earnings growth of 21% annually, outpacing the Japanese market forecast of 8.8%. With R&D expenses robustly supporting this trajectory, the firm invested heavily in innovation, aligning with an industry trend towards more substantial development funding to fuel future technologies. Moreover, revenue forecasts at a steady increase of 14.1% per year suggest a sustainable growth path above Japan's average of 4.2%. This strategic focus on R&D and aggressive growth projections underscore Simplex’s commitment to maintaining its competitive edge in a rapidly evolving tech landscape.

- Click to explore a detailed breakdown of our findings in Simplex Holdings' health report.

Explore historical data to track Simplex Holdings' performance over time in our Past section.

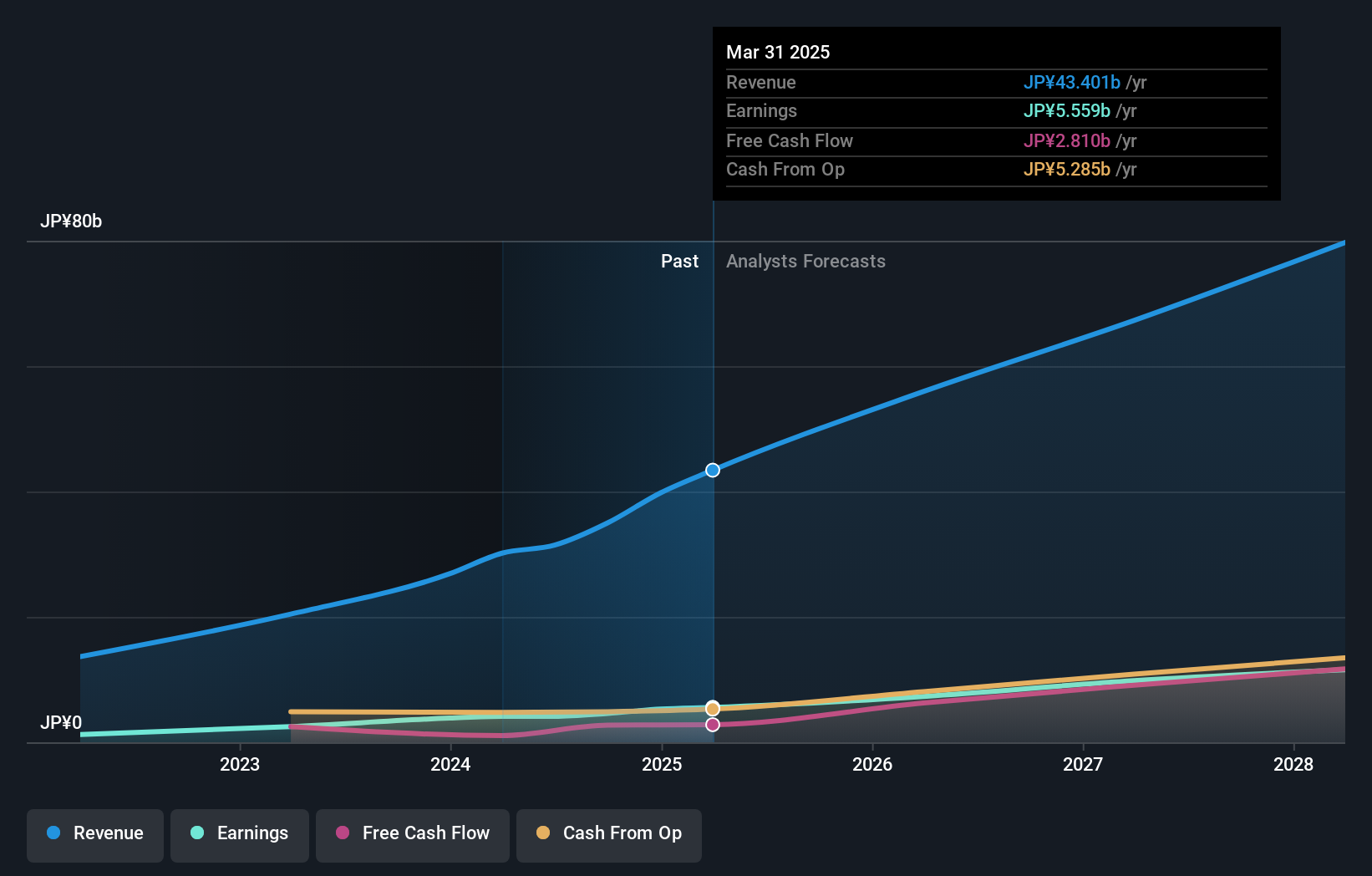

COVER (TSE:5253)

Simply Wall St Growth Rating: ★★★★★★

Overview: COVER Corporation operates in the virtual platform, VTuber production, and media mix sectors with a market capitalization of ¥119.34 billion.

Operations: COVER Corporation generates revenue through its virtual platform, VTuber production, and media mix businesses. The company focuses on creating digital content and experiences, leveraging the growing popularity of virtual entertainment and online media.

COVER, amidst a volatile market, demonstrates robust potential with its R&D expenses significantly contributing to innovation. Last year, the company allocated 20.2% of its revenue towards R&D, underscoring a strategic focus on developing cutting-edge technologies. This investment aligns with an industry-wide shift towards substantial development funding to fuel future growth and technological advancements. Additionally, COVER's earnings are expected to grow by 20.2% annually, outpacing the broader market forecast of 8.8%. With high-profile clients like Apple relying on its advanced solutions, COVER is well-positioned to leverage its technological prowess for sustained growth and industry leadership.

- Dive into the specifics of COVER here with our thorough health report.

Review our historical performance report to gain insights into COVER's's past performance.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland, with a market capitalization of PLN1.22 billion.

Operations: With a focus on e-commerce in Poland, Shoper SA generates revenue primarily from its Solutions segment, contributing PLN133.13 million, and Subscriptions, adding PLN38.24 million.

Shoper, amidst a competitive market landscape, has demonstrated robust financial and operational growth. Over the past year, the company's earnings surged by 43.6%, significantly outpacing the software industry's average of 0.8%. This growth is supported by a strategic allocation of resources towards R&D, which accounted for 16.6% of its revenue, fostering innovation and technological advancements critical in maintaining its market position. Furthermore, with an expected annual profit growth rate of 25%, Shoper is poised to continue its upward trajectory, leveraging strong earnings quality and market performance that eclipses broader Polish market forecasts.

- Unlock comprehensive insights into our analysis of Shoper stock in this health report.

Gain insights into Shoper's past trends and performance with our Past report.

Summing It All Up

- Dive into all 1280 of the High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5253

COVER

Engages in the virtual platform, VTuber production, and media mix businesses.