- Japan

- /

- Medical Equipment

- /

- TSE:7575

3 Reliable Dividend Stocks Yielding Up To 4.7%

Reviewed by Simply Wall St

As global markets grapple with rising U.S. Treasury yields and tepid economic growth, investors are increasingly seeking stability in their portfolios. In this environment, dividend stocks can offer a reliable income stream, providing a buffer against market volatility while potentially benefiting from long-term capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.94% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.20% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.00% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| Southside Bancshares (NasdaqGS:SBSI) | 4.51% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.03% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2042 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Bangkok Airways (SET:BA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bangkok Airways Public Company Limited, along with its subsidiaries, offers air transportation and airport services with a market cap of THB53.55 billion.

Operations: Bangkok Airways generates its revenue primarily from the Airlines Segment at THB17.15 billion, supplemented by Supporting Airlines Business at THB4.86 billion and Airports at THB0.49 billion.

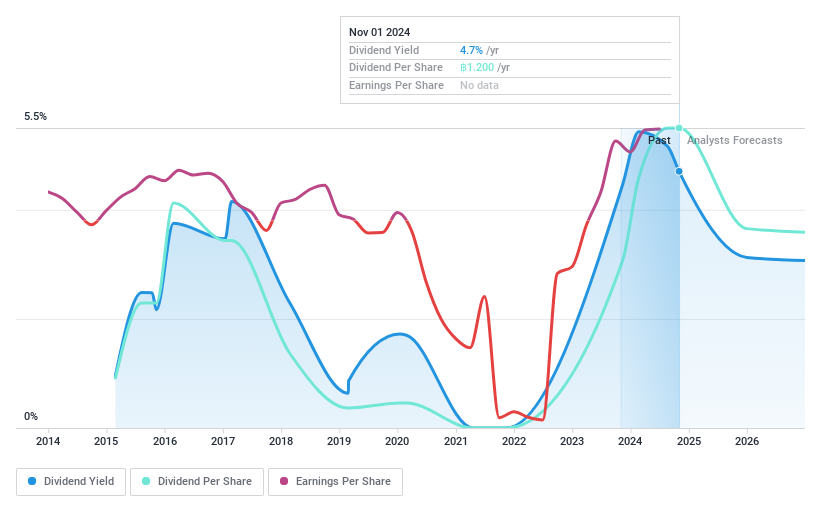

Dividend Yield: 4.7%

Bangkok Airways' dividend payments, with a payout ratio of 81%, are covered by both earnings and cash flows, indicating sustainability despite past volatility. The recent interim dividend of THB 0.60 reflects ongoing distribution efforts. However, its yield is lower than top-tier Thai market payers at 4.71%. Earnings have grown significantly over the past year, but future forecasts suggest potential declines, which may impact long-term dividend stability and growth prospects.

- Unlock comprehensive insights into our analysis of Bangkok Airways stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Bangkok Airways is priced lower than what may be justified by its financials.

Japan Lifeline (TSE:7575)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Lifeline Co., Ltd. is a medical device company that develops, produces, imports, distributes, and trades cardiovascular-related medical devices in Japan with a market cap of ¥84.21 billion.

Operations: Japan Lifeline Co., Ltd. generates revenue from the manufacture and sale of medical devices, amounting to ¥52.44 billion.

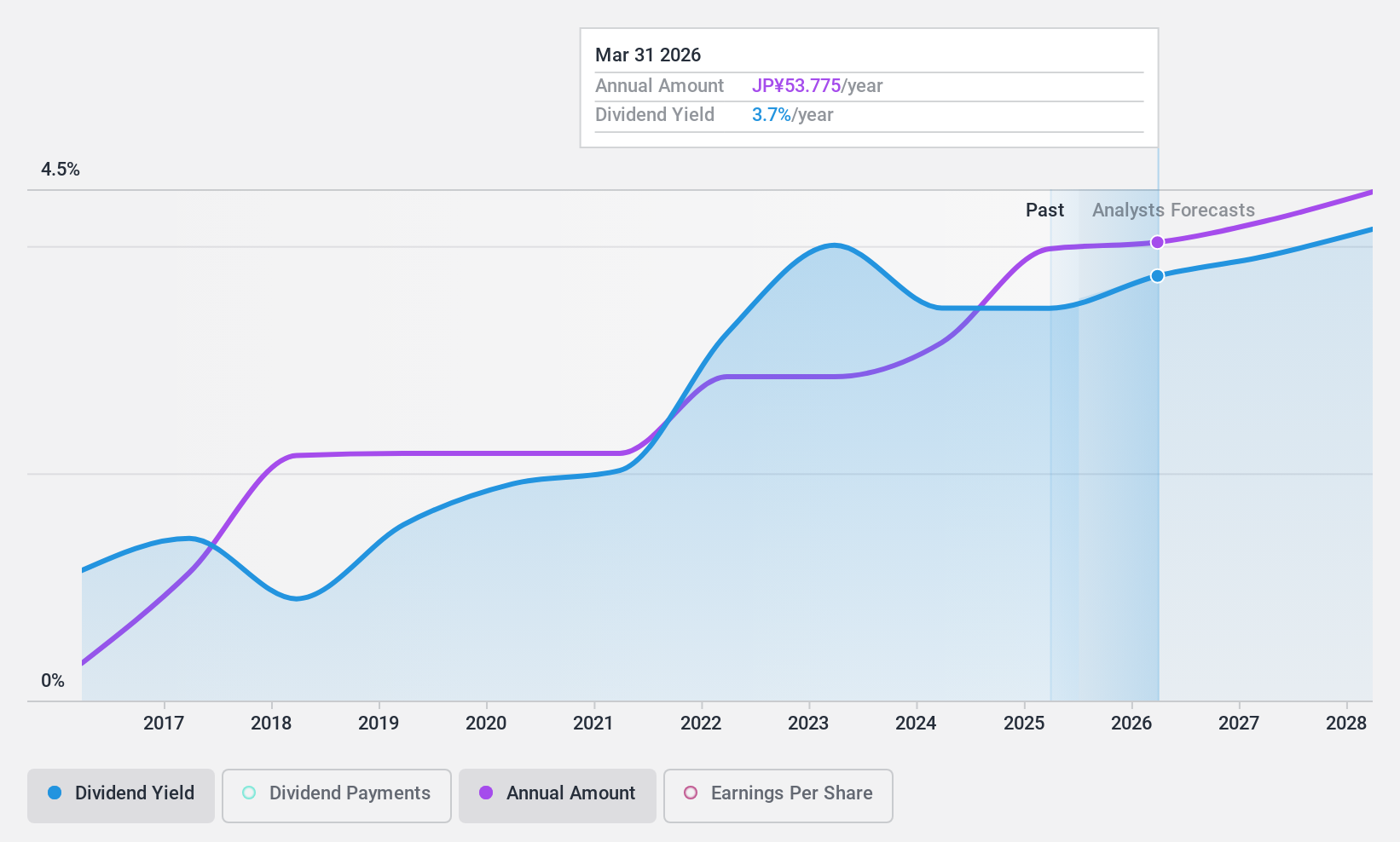

Dividend Yield: 3.7%

Japan Lifeline's dividend payments are reliable and stable, supported by a low payout ratio of 41.9%, indicating sustainability. Although its yield of 3.65% is slightly below top-tier Japanese market payers, it remains attractive due to consistent growth over the past decade. Recent organizational changes and new product launches, like the pRESET stent retriever, could bolster revenue streams, potentially enhancing future dividend prospects while maintaining coverage through cash flows with a 70.3% cash payout ratio.

- Navigate through the intricacies of Japan Lifeline with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Japan Lifeline is trading behind its estimated value.

Ichinen HoldingsLtd (TSE:9619)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ichinen Holdings Co., Ltd. operates in Japan across various sectors including automotive leasing, chemicals, parking services, machine tool sales, and synthetic resins, with a market capitalization of ¥43.39 billion.

Operations: Ichinen Holdings Co., Ltd.'s revenue is derived from several segments: Automobile Leasing Related Business at ¥59.14 billion, Machine Tool Sales Business contributing ¥36.41 billion, Synthetic Resin Business at ¥18.95 billion, Chemical Business generating ¥11.95 billion, and Parking Business with ¥7.62 billion in revenue.

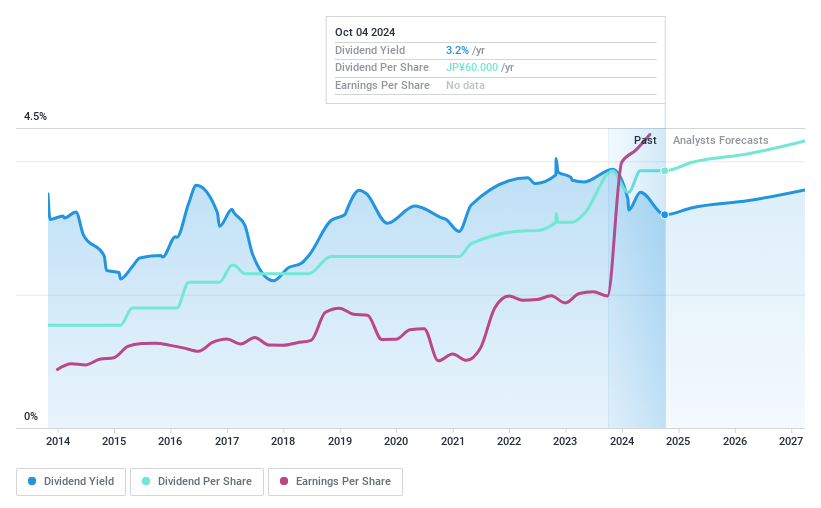

Dividend Yield: 3.2%

Ichinen Holdings Ltd. maintains a low payout ratio of 11.2%, ensuring dividends are well covered by earnings, with a cash payout ratio of 38.8%. Despite a volatile dividend history over the past decade, recent buyback activity and good relative value compared to peers suggest efforts to enhance shareholder returns. However, declining earnings forecasts and an unstable dividend track record raise concerns about long-term sustainability, despite recent growth in profits and dividends over the past year.

- Click here and access our complete dividend analysis report to understand the dynamics of Ichinen HoldingsLtd.

- Our valuation report unveils the possibility Ichinen HoldingsLtd's shares may be trading at a discount.

Key Takeaways

- Click this link to deep-dive into the 2042 companies within our Top Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7575

Japan Lifeline

A medical device company, develops, produces, imports, distributes, and trades in cardiovascular related medical devices in Japan.

Flawless balance sheet, undervalued and pays a dividend.