- Switzerland

- /

- Media

- /

- SWX:APGN

Discovering Europe's Hidden Stock Gems In July 2025

Reviewed by Simply Wall St

As the European market navigates a landscape of mixed returns, with indices like the STOXX Europe 600 remaining relatively flat, investors are closely watching economic indicators such as eurozone inflation hitting the ECB's target and a steady labor market. In this environment, identifying promising small-cap stocks requires an eye for companies that demonstrate resilience and potential in their fundamentals amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| va-Q-tec | 43.54% | 9.84% | -34.33% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

APG|SGA (SWX:APGN)

Simply Wall St Value Rating: ★★★★★★

Overview: APG|SGA SA operates by offering advertising services mainly in Switzerland and Serbia, with a market capitalization of CHF725.28 million.

Operations: The company generates revenue primarily through the acquisition, sale, and management of advertising spaces, totaling CHF328.94 million.

APG|SGA stands out with its robust earnings growth of 12.9% over the past year, surpassing the Media industry's modest 0.5% increase. This debt-free company is trading at a compelling 32.1% below its estimated fair value, suggesting potential undervaluation in the market. With no debt on its books for five years, APG|SGA's financial health seems solid, and it consistently generates positive free cash flow, reaching US$36 million recently. These factors highlight APG|SGA's strong position within the industry and suggest it could be an attractive opportunity for investors seeking value in Europe’s market landscape.

Shoper (WSE:SHO)

Simply Wall St Value Rating: ★★★★★★

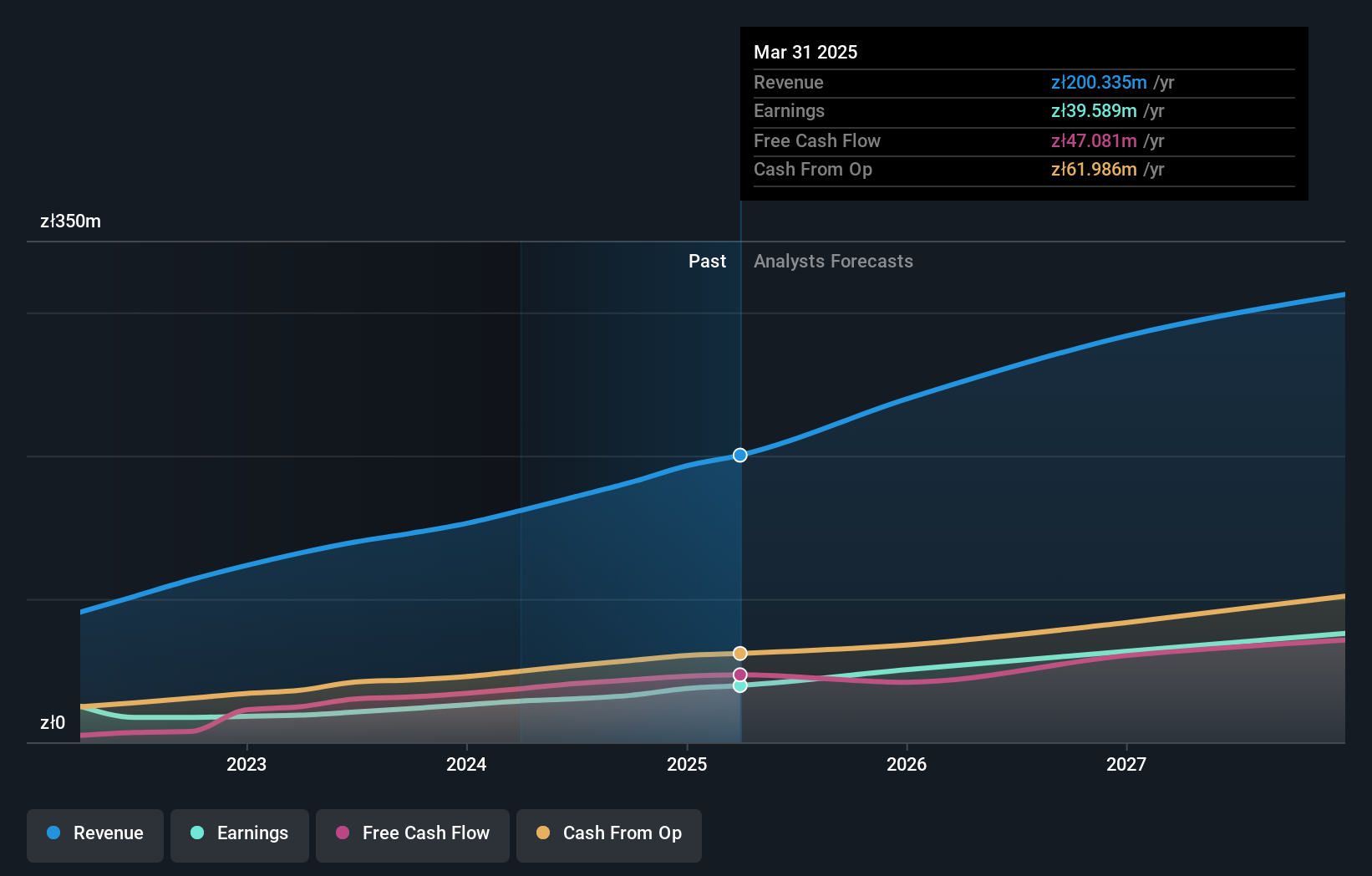

Overview: Shoper SA is a Polish company offering Software as a Service solutions for e-commerce, with a market capitalization of PLN1.46 billion.

Operations: Shoper SA generates revenue primarily through its Solutions and Subscriptions segments, with Solutions contributing PLN157.26 million and Subscriptions adding PLN43.08 million.

Shoper, a nimble player in the software sector, has been making waves with its robust financial health and impressive growth. With earnings surging 37.8% over the past year, it outpaced the broader industry average of 20.9%, showcasing its competitive edge. The company boasts high-quality earnings and remains debt-free, eliminating concerns over interest payments. Its recent quarterly revenue reached PLN 51.73 million compared to PLN 44.19 million last year, while net income climbed to PLN 9.84 million from PLN 7.76 million a year ago, reflecting strong operational performance and potential for future expansion within its market niche.

- Click here to discover the nuances of Shoper with our detailed analytical health report.

Evaluate Shoper's historical performance by accessing our past performance report.

Baader Bank (XTRA:BWB)

Simply Wall St Value Rating: ★★★★☆☆

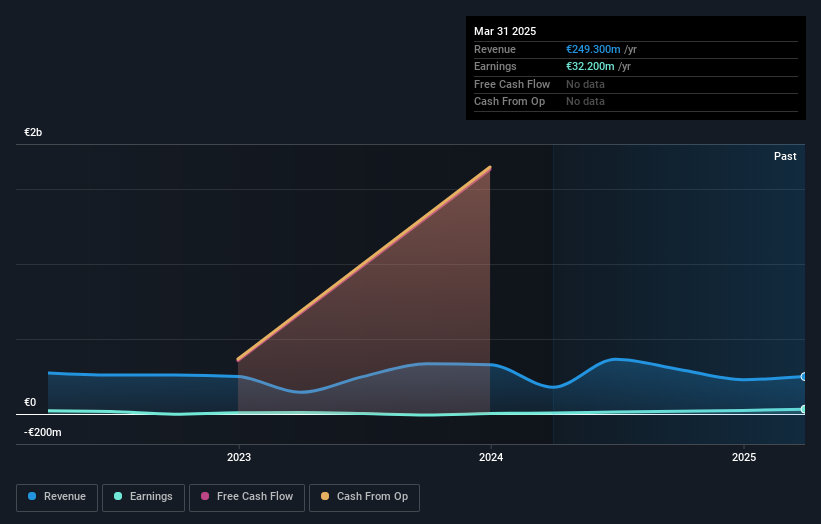

Overview: Baader Bank Aktiengesellschaft offers investment and banking services across Europe, with a market capitalization of €233.25 million.

Operations: Baader Bank generates revenue primarily from its investment and banking services across Europe. The bank's financial performance is influenced by various operational costs, which impact its profitability. Notably, the net profit margin reflects the efficiency of its operations within the competitive banking sector.

Baader Bank, a nimble player in the financial sector, is making waves with impressive earnings growth of 335% over the past year. Its price-to-earnings ratio at 7.2x suggests it's undervalued compared to the broader German market's 19x. The bank's debt to equity ratio has notably decreased from 82.7% to 33.9% over five years, reflecting prudent financial management. Recently awarded a MiCAR crypto trading license, Baader is poised to expand its crypto services across the EU, enhancing its role as a trusted partner for investors in this burgeoning market segment.

- Click to explore a detailed breakdown of our findings in Baader Bank's health report.

Gain insights into Baader Bank's past trends and performance with our Past report.

Seize The Opportunity

- Explore the 324 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:APGN

APG|SGA

Provides advertising services primarily in Switzerland and Serbia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives