There's A Lot To Like About Quantum Software's (WSE:QNT) Upcoming zł1.35 Dividend

Quantum Software S.A. (WSE:QNT) stock is about to trade ex-dividend in three days. You will need to purchase shares before the 23rd of December to receive the dividend, which will be paid on the 5th of January.

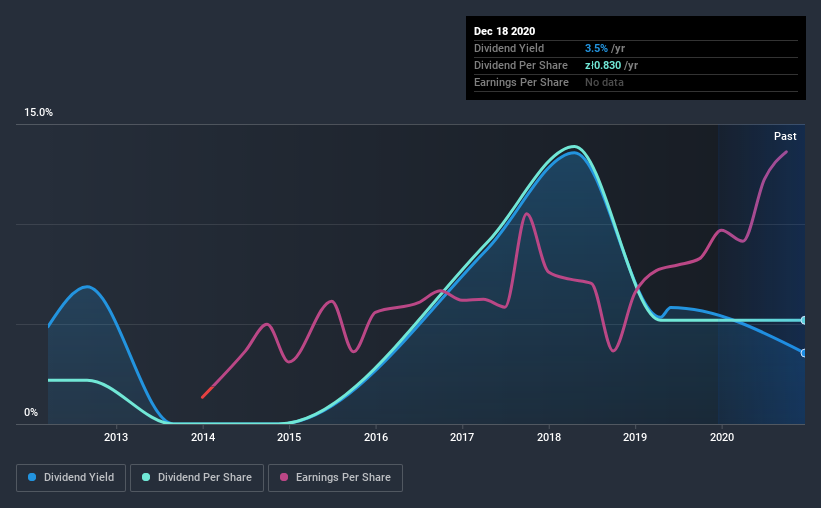

The upcoming dividend for Quantum Software will put a total of zł1.35 per share in shareholders' pockets, up from last year's total dividends of zł0.83. If you buy this business for its dividend, you should have an idea of whether Quantum Software's dividend is reliable and sustainable. As a result, readers should always check whether Quantum Software has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Quantum Software

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately Quantum Software's payout ratio is modest, at just 27% of profit. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Fortunately, it paid out only 28% of its free cash flow in the past year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Quantum Software paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That's why it's comforting to see Quantum Software's earnings have been skyrocketing, up 57% per annum for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. Companies with growing earnings and low payout ratios are often the best long-term dividend stocks, as the company can both grow its earnings and increase the percentage of earnings that it pays out, essentially multiplying the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last nine years, Quantum Software has lifted its dividend by approximately 10% a year on average. It's great to see earnings per share growing rapidly over several years, and dividends per share growing right along with it.

Final Takeaway

Should investors buy Quantum Software for the upcoming dividend? Quantum Software has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past nine years, but the conservative payout ratio makes the current dividend look sustainable. Overall we think this is an attractive combination and worthy of further research.

In light of that, while Quantum Software has an appealing dividend, it's worth knowing the risks involved with this stock. Our analysis shows 3 warning signs for Quantum Software that we strongly recommend you have a look at before investing in the company.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Quantum Software or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Quantum software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:QNT

Quantum software

Provides IT systems for enterprises in the domain of logistics and delivery chain management in Poland and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.