- Sweden

- /

- Medical Equipment

- /

- NGM:GTAB B

European Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

As European markets continue to show resilience, with the STOXX Europe 600 Index climbing 3.44% amid easing tariff concerns, investors are keenly observing the shifting economic landscape. Penny stocks, often associated with smaller or newer companies, remain a niche yet intriguing segment of the market. Despite their somewhat outdated label, these stocks can still offer surprising value and potential growth opportunities when backed by solid financial health.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.205 | SEK2.11B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.70 | SEK276.52M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.82 | SEK286.44M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.54 | SEK215.37M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.65 | PLN123.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.58 | €54.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €1.00 | €33.49M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.67 | €17.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22.01M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.13 | €294.08M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 437 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Glycorex Transplantation (NGM:GTAB B)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Glycorex Transplantation AB (publ) is a medical technology company specializing in transplantation, blood transfusion, and autoimmune diseases, with a market cap of SEK174.27 million.

Operations: The company's revenue is primarily derived from its Organ Transplantation segment, which generated SEK35.16 million.

Market Cap: SEK174.27M

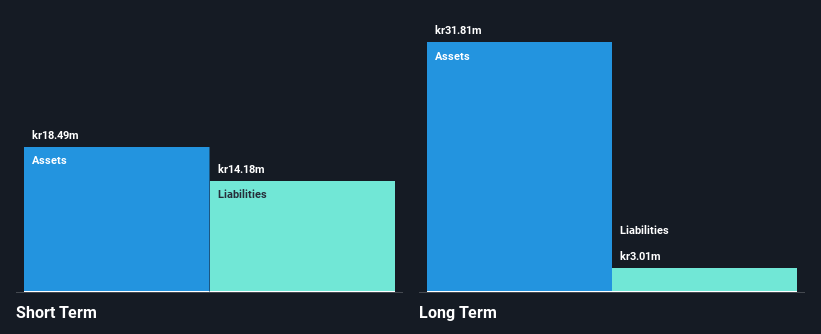

Glycorex Transplantation AB, a medical technology company, is navigating the penny stock landscape with some promising developments despite its challenges. The company remains unprofitable with a negative Return on Equity and losses increasing at 38.4% annually over the past five years. However, it maintains a strong cash position that covers both short and long-term liabilities and has not undergone significant shareholder dilution recently. Glycorex's recent distribution agreement with Rontis Hellas SA in Greece for its Glycosorb® ABO product range marks a strategic move to penetrate the Greek transfusion market, potentially enhancing revenue streams in transplantation and transfusion sectors.

- Click here to discover the nuances of Glycorex Transplantation with our detailed analytical financial health report.

- Learn about Glycorex Transplantation's historical performance here.

Ekobox (WSE:EBX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ekobox S.A. is an engineering company operating in Poland with a market capitalization of PLN55.60 million.

Operations: The company generates revenue of PLN60.59 million from its heavy construction segment.

Market Cap: PLN55.6M

Ekobox S.A., operating in Poland's heavy construction sector, holds a market cap of PLN55.60 million and reported revenues of PLN60.59 million for 2024, reflecting a decline from the previous year. Despite this, Ekobox has demonstrated significant profit growth over the past five years and maintains high-quality earnings with interest payments well covered by profits. The company benefits from more cash than debt, with its debt-to-equity ratio significantly reduced to 6.3%. However, recent earnings growth has been negative, and profit margins have decreased to 5.1%, indicating challenges amidst stable yet higher-than-average volatility in stock performance.

- Click here and access our complete financial health analysis report to understand the dynamics of Ekobox.

- Examine Ekobox's past performance report to understand how it has performed in prior years.

Milisystem (WSE:MLM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Milisystem S.A. specializes in producing and distributing shooting training technologies for both military and civilian markets, with a market cap of PLN18.81 million.

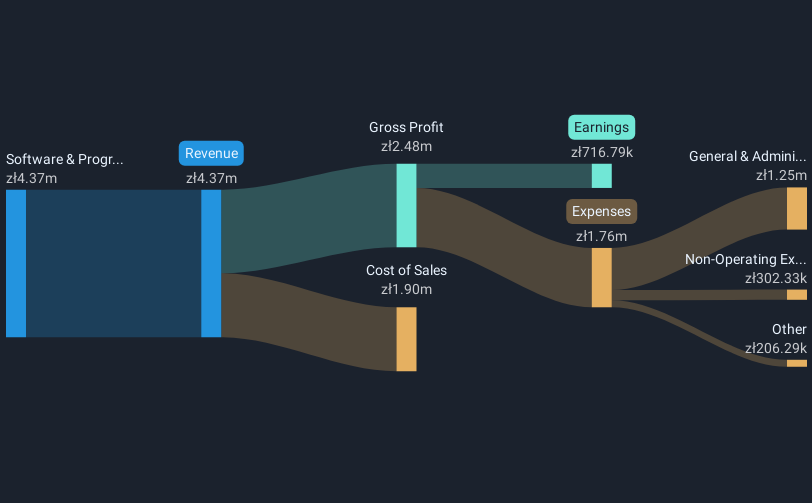

Operations: The company generates revenue of PLN4.37 million from its Software & Programming segment.

Market Cap: PLN18.81M

Milisystem S.A., with a market cap of PLN18.81 million, specializes in shooting training technologies and generates PLN4.37 million from its Software & Programming segment, indicating limited revenue streams. Despite impressive profit growth over the past five years, recent earnings have declined sharply by 72.3%. The company maintains a high Return on Equity at 25.5% and has more cash than debt, ensuring strong financial health with interest payments well covered by EBIT (39.5x). However, increased weekly volatility to 25% and significant undervaluation compared to fair value present both opportunities and risks for investors in this penny stock space.

- Jump into the full analysis health report here for a deeper understanding of Milisystem.

- Understand Milisystem's track record by examining our performance history report.

Turning Ideas Into Actions

- Reveal the 437 hidden gems among our European Penny Stocks screener with a single click here.

- Curious About Other Options? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:GTAB B

Glycorex Transplantation

A medical technology company, focuses on transplantation, blood transfusion, and autoimmune diseases.

Excellent balance sheet low.

Market Insights

Community Narratives