Is Ifirma SA's(WSE:IFI) Recent Stock Performance Tethered To Its Strong Fundamentals?

Most readers would already be aware that Ifirma's (WSE:IFI) stock increased significantly by 35% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. In this article, we decided to focus on Ifirma's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Ifirma

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Ifirma is:

21% = zł2.0m ÷ zł9.4m (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. That means that for every PLN1 worth of shareholders' equity, the company generated PLN0.21 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Ifirma's Earnings Growth And 21% ROE

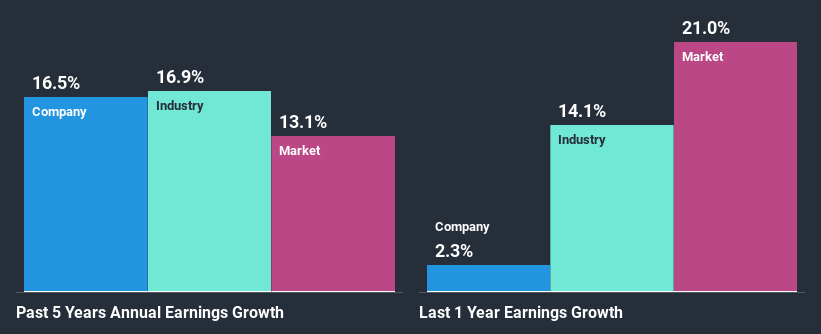

At first glance, Ifirma seems to have a decent ROE. Further, the company's ROE is similar to the industry average of 24%. This probably goes some way in explaining Ifirma's moderate 16% growth over the past five years amongst other factors.

As a next step, we compared Ifirma's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 17% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Ifirma fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Ifirma Making Efficient Use Of Its Profits?

With a three-year median payout ratio of 48% (implying that the company retains 52% of its profits), it seems that Ifirma is reinvesting efficiently in a way that it sees respectable amount growth in its earnings and pays a dividend that's well covered.

Additionally, Ifirma has paid dividends over a period of nine years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

Overall, we are quite pleased with Ifirma's performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Remember, the price of a stock is also dependent on the perceived risk. Therefore investors must keep themselves informed about the risks involved before investing in any company. To know the 3 risks we have identified for Ifirma visit our risks dashboard for free.

If you’re looking to trade Ifirma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:IFI

Ifirma

IFirma SA provides accounting services. The company operates a website, ifirma.pl, which offers services and tools for tax settlements and supporting business activities.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion