DataWalk (WSE:DAT shareholders incur further losses as stock declines 10% this week, taking three-year losses to 84%

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of DataWalk S.A. (WSE:DAT), who have seen the share price tank a massive 84% over a three year period. That would be a disturbing experience. The falls have accelerated recently, with the share price down 17% in the last three months. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for DataWalk

DataWalk isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, DataWalk's revenue dropped 3.9% per year. That is not a good result. The share price fall of 23% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. This business clearly needs to grow revenues if it is to perform as investors hope. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

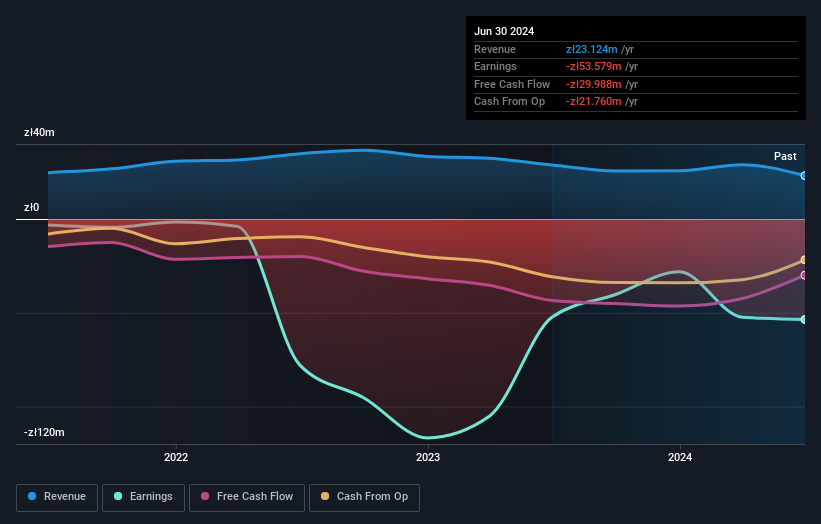

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on DataWalk's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that DataWalk has rewarded shareholders with a total shareholder return of 19% in the last twelve months. Notably the five-year annualised TSR loss of 5% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand DataWalk better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with DataWalk (including 2 which can't be ignored) .

We will like DataWalk better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:DAT

DataWalk

Provides enterprise-class software platform for data analysis in Poland and internationally.

Moderate with mediocre balance sheet.