- Poland

- /

- Consumer Durables

- /

- WSE:FTE

Fabryki Mebli FORTE S.A.'s (WSE:FTE) Shares Bounce 25% But Its Business Still Trails The Industry

Fabryki Mebli FORTE S.A. (WSE:FTE) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

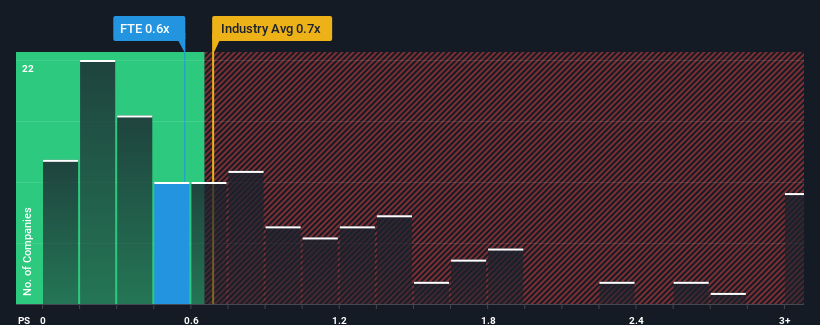

Although its price has surged higher, given about half the companies operating in Poland's Consumer Durables industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Fabryki Mebli FORTE as an attractive investment with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Fabryki Mebli FORTE

How Has Fabryki Mebli FORTE Performed Recently?

Fabryki Mebli FORTE could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Fabryki Mebli FORTE will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Fabryki Mebli FORTE?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Fabryki Mebli FORTE's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 24% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 9.3% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 14% per annum, which is noticeably more attractive.

With this information, we can see why Fabryki Mebli FORTE is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Despite Fabryki Mebli FORTE's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Fabryki Mebli FORTE's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Fabryki Mebli FORTE with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:FTE

Fabryki Mebli FORTE

Designs, manufactures, and exports furniture worldwide.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success