Unsurprisingly, Cloud Technologies S.A.'s (WSE:CLD) stock price was strong on the back of its healthy earnings report. However, we think that shareholders may be missing some concerning details in the numbers.

See our latest analysis for Cloud Technologies

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, Cloud Technologies increased the number of shares on issue by 9.6% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Cloud Technologies' historical EPS growth by clicking on this link.

How Is Dilution Impacting Cloud Technologies' Earnings Per Share? (EPS)

We don't have any data on the company's profits from three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. Therefore, the dilution is having a noteworthy influence on shareholder returns.

If Cloud Technologies' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Cloud Technologies.

Our Take On Cloud Technologies' Profit Performance

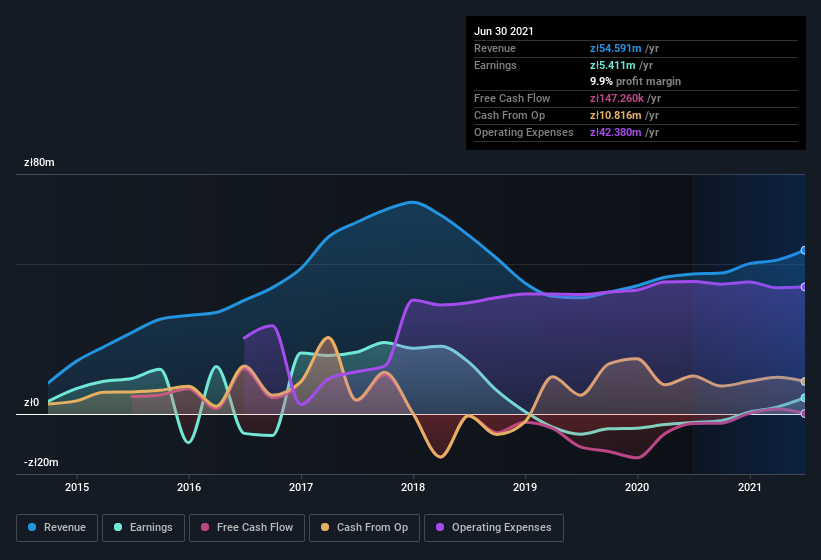

Over the last year Cloud Technologies issued new shares and so, there's a noteworthy divergence between EPS and net income growth. Therefore, it seems possible to us that Cloud Technologies' true underlying earnings power is actually less than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 2 warning signs for Cloud Technologies you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Cloud Technologies' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Cloud Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:CLD

Cloud Technologies

Engages in the big data marketing and data monetization businesses.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

DroneShield: Structural Tailwind, Execution Still the Real Test

ISRG Riding the Lightning

Duolingo (DUOL): The AI Learning Architect – Trading Profits for a 100M User Vision

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion