Asseco South Eastern Europe (WSE:ASE) Seems To Use Debt Rather Sparingly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Asseco South Eastern Europe S.A. (WSE:ASE) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Asseco South Eastern Europe

How Much Debt Does Asseco South Eastern Europe Carry?

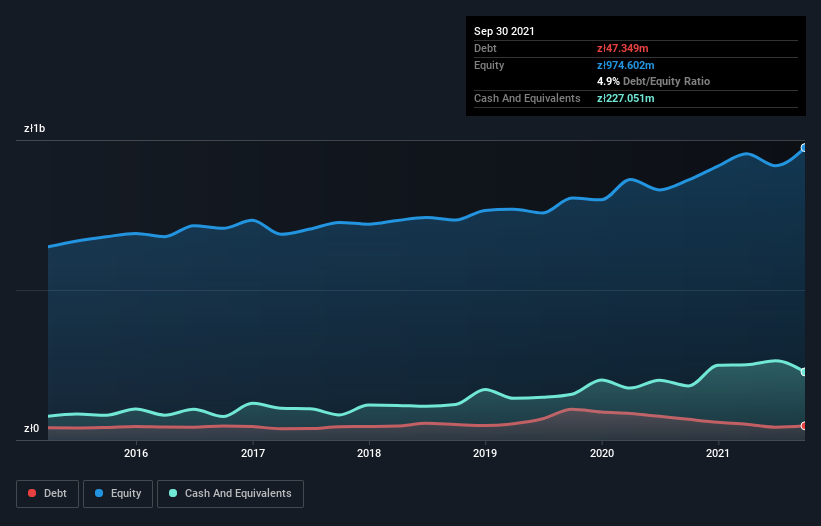

The image below, which you can click on for greater detail, shows that Asseco South Eastern Europe had debt of zł47.3m at the end of September 2021, a reduction from zł59.3m over a year. However, it does have zł227.1m in cash offsetting this, leading to net cash of zł179.7m.

A Look At Asseco South Eastern Europe's Liabilities

According to the last reported balance sheet, Asseco South Eastern Europe had liabilities of zł290.3m due within 12 months, and liabilities of zł91.4m due beyond 12 months. Offsetting these obligations, it had cash of zł227.1m as well as receivables valued at zł201.7m due within 12 months. So it actually has zł47.1m more liquid assets than total liabilities.

Having regard to Asseco South Eastern Europe's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the zł2.65b company is struggling for cash, we still think it's worth monitoring its balance sheet. Simply put, the fact that Asseco South Eastern Europe has more cash than debt is arguably a good indication that it can manage its debt safely.

Another good sign is that Asseco South Eastern Europe has been able to increase its EBIT by 25% in twelve months, making it easier to pay down debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Asseco South Eastern Europe can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Asseco South Eastern Europe may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Asseco South Eastern Europe actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Asseco South Eastern Europe has net cash of zł179.7m, as well as more liquid assets than liabilities. The cherry on top was that in converted 109% of that EBIT to free cash flow, bringing in zł203m. So we don't think Asseco South Eastern Europe's use of debt is risky. Over time, share prices tend to follow earnings per share, so if you're interested in Asseco South Eastern Europe, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ASE

Asseco South Eastern Europe

Engages in the sale of its own and third-party software.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives