- Israel

- /

- Oil and Gas

- /

- TASE:CDEV

Undiscovered Gems With Potential To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and geopolitical tensions, small-cap stocks have experienced mixed performance, with indices such as the S&P 600 showing varied results amid broader market volatility. In this environment, identifying undiscovered gems—stocks that exhibit strong fundamentals and potential for growth despite current uncertainties—can offer investors intriguing opportunities to consider.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 18.60% | 31.35% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.78% | 27.31% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Linedata Services (ENXTPA:LIN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Linedata Services S.A. is a company that specializes in developing, publishing, and distributing financial software across Southern Europe, Northern Europe, North America, and Asia with a market capitalization of €400.75 million.

Operations: Linedata Services generates revenue primarily from two segments: Asset Management (€122.12 million) and Lending & Leasing (€63.39 million).

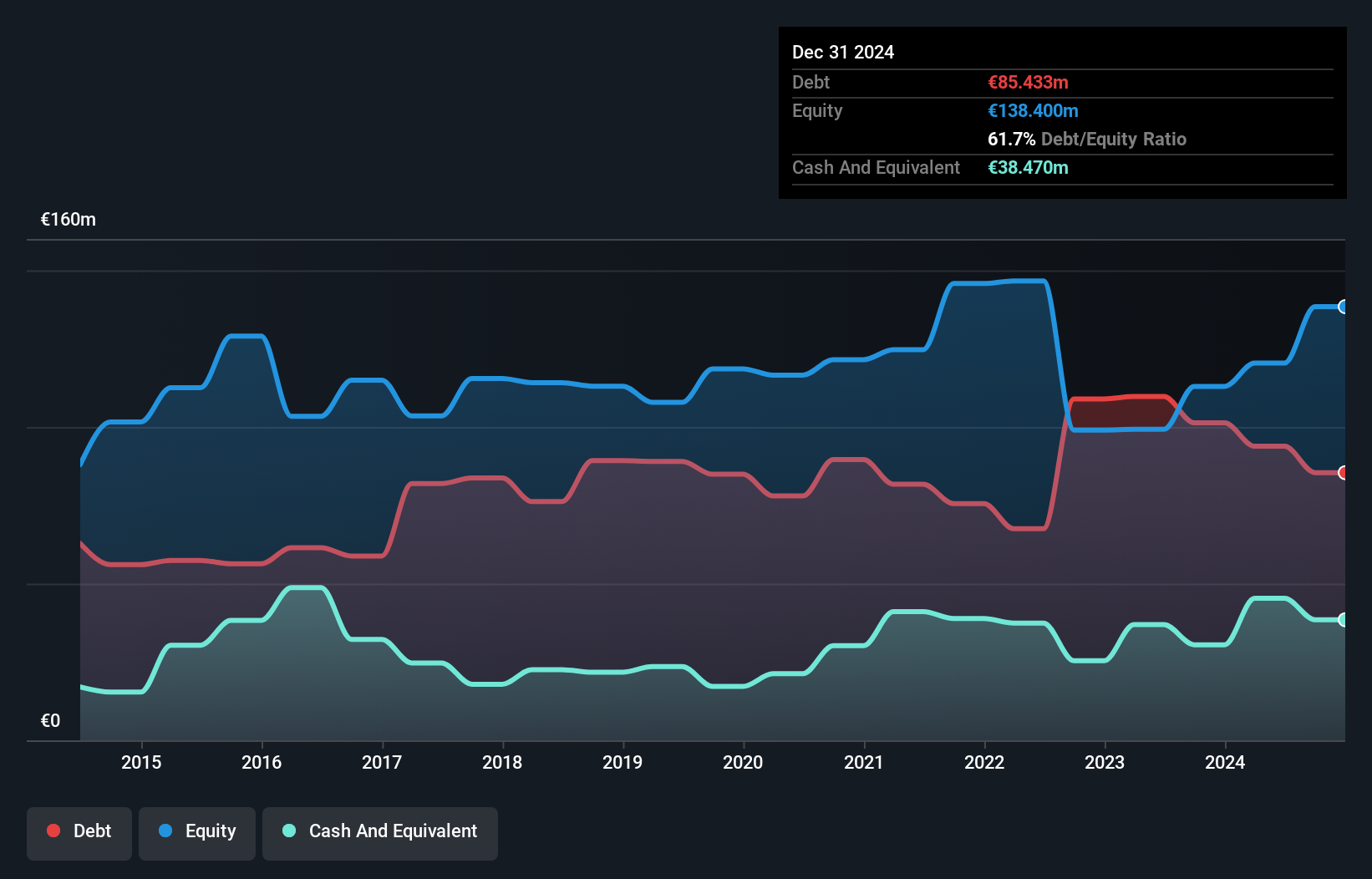

Linedata, a niche player in the software industry, has shown robust earnings growth of 22% over the past year, outpacing the industry's 11.8%. Despite a high net debt to equity ratio of 40.3%, its interest payments are well covered by EBIT at 9.7 times coverage. The company is trading at an attractive valuation, being 11.9% below its estimated fair value and has reduced its debt to equity ratio from 82.5% to 77.9% over five years. Recent implementation of Linedata Global Hedge for Bank of Shanghai highlights its capability in delivering efficiency and precision for complex financial needs.

Cohen Development Gas & Oil (TASE:CDEV)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohen Development Gas & Oil Ltd. is involved in the exploration, development, production, and marketing of natural gas, condensate, and oil across Israel, Cyprus, and Morocco with a market cap of ₪973.55 million.

Operations: Cohen Development Gas & Oil generates revenue primarily from the production and management of oil and gas exploration, amounting to $28.94 million.

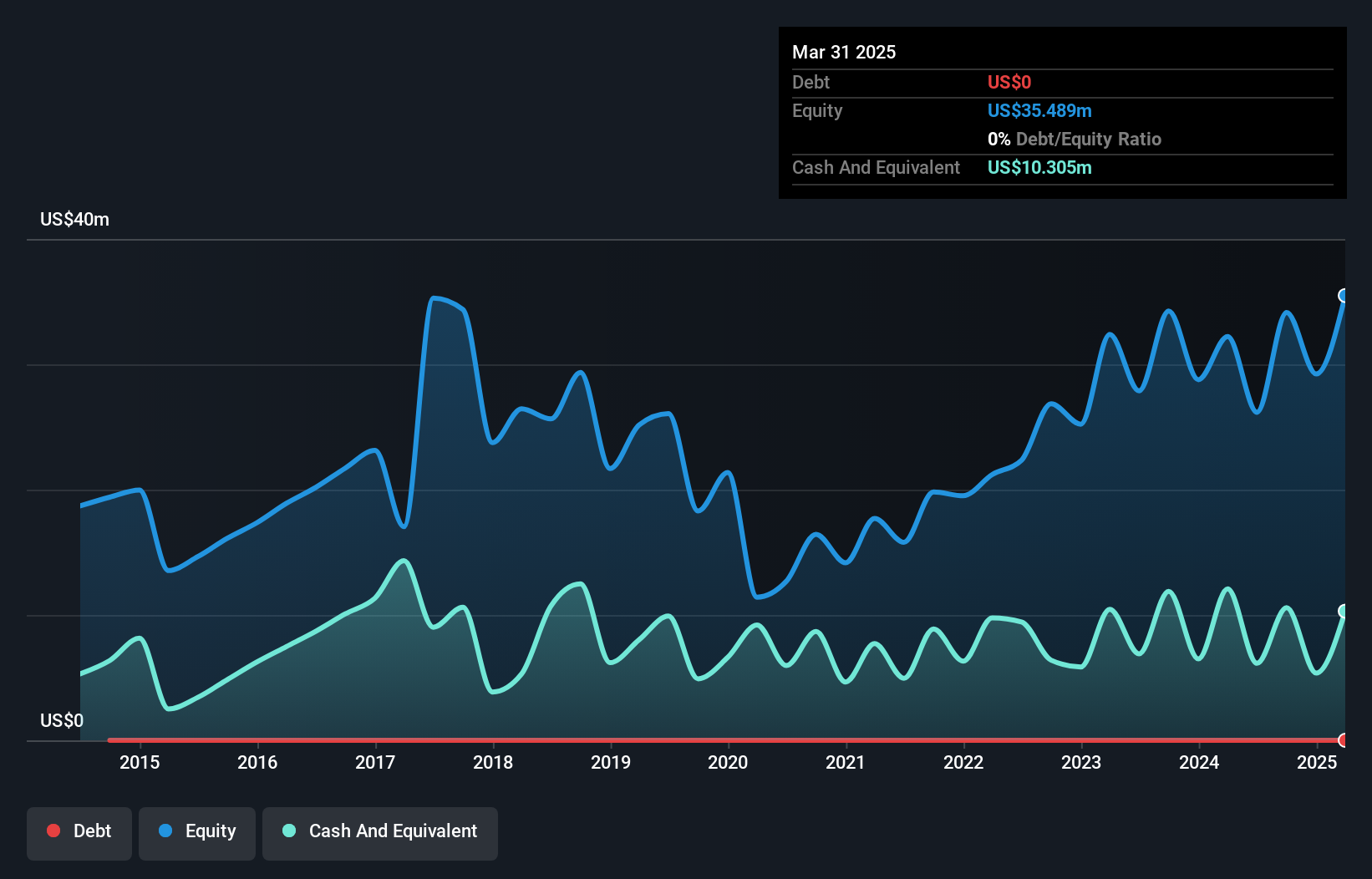

Cohen Development Gas & Oil, a smaller player in the energy sector, presents an intriguing mix of financial stability and challenges. The company is debt-free, which removes concerns about interest coverage and suggests prudent financial management. Despite this, its earnings growth over the past year was negative at -3.2%, contrasting sharply with the industry average of 12.8%. However, it reported a net income increase to US$7.96 million for Q3 2024 from US$6.37 million in Q3 2023, showcasing some resilience. Trading just below fair value estimates by 0.9%, it seems poised for potential value recognition if growth can be reignited.

Asseco Business Solutions (WSE:ABS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Asseco Business Solutions S.A. designs and develops enterprise software solutions in Poland and internationally, with a market capitalization of PLN2.03 billion.

Operations: The ERP segment generates revenue of PLN388.19 million for Asseco Business Solutions S.A. The company's market capitalization is PLN2.03 billion.

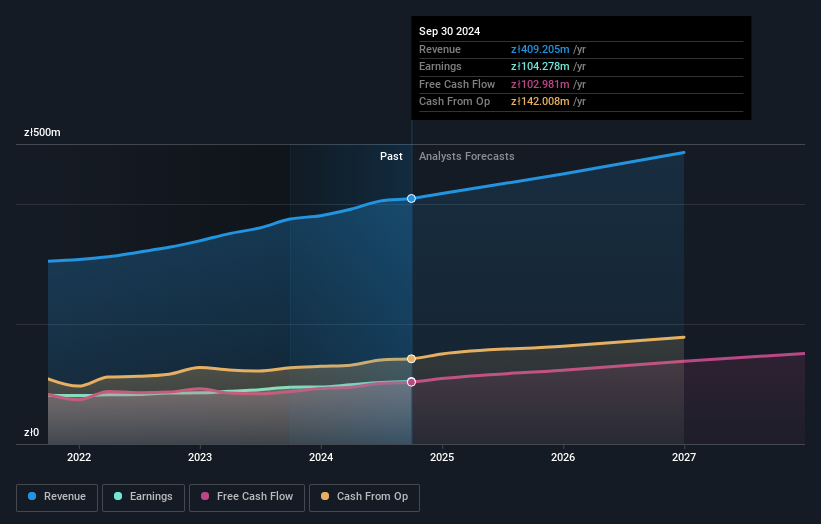

Asseco Business Solutions, a smaller player in the software sector, trades at 16.8% below its estimated fair value, suggesting potential undervaluation. The company's net debt to equity ratio stands at a satisfactory 3.9%, though it has risen from 1.2% over five years, indicating increased leverage. Earnings have grown by an average of 7.8% annually during this period, showcasing robust performance despite not outpacing the industry's recent growth rate of 15.2%. With high-quality earnings and positive free cash flow consistently reported, Asseco seems well-positioned for steady revenue growth projected at 7.7% per year moving forward.

Seize The Opportunity

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4679 more companies for you to explore.Click here to unveil our expertly curated list of 4682 Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CDEV

Cohen Development Gas & Oil

Engages in the exploration for, development, production, and marketing of natural gas, condensate, and oil in Israel, Cyprus, and Morocco.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives