As European markets navigate the complexities of geopolitical tensions and economic shifts, the pan-European STOXX Europe 600 Index recently recorded a decline, reflecting broader market apprehensions. Amidst this backdrop, investors are increasingly seeking opportunities in lesser-known stocks that demonstrate resilience and potential for growth despite prevailing uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Storytel (OM:STORY B)

Simply Wall St Value Rating: ★★★★★★

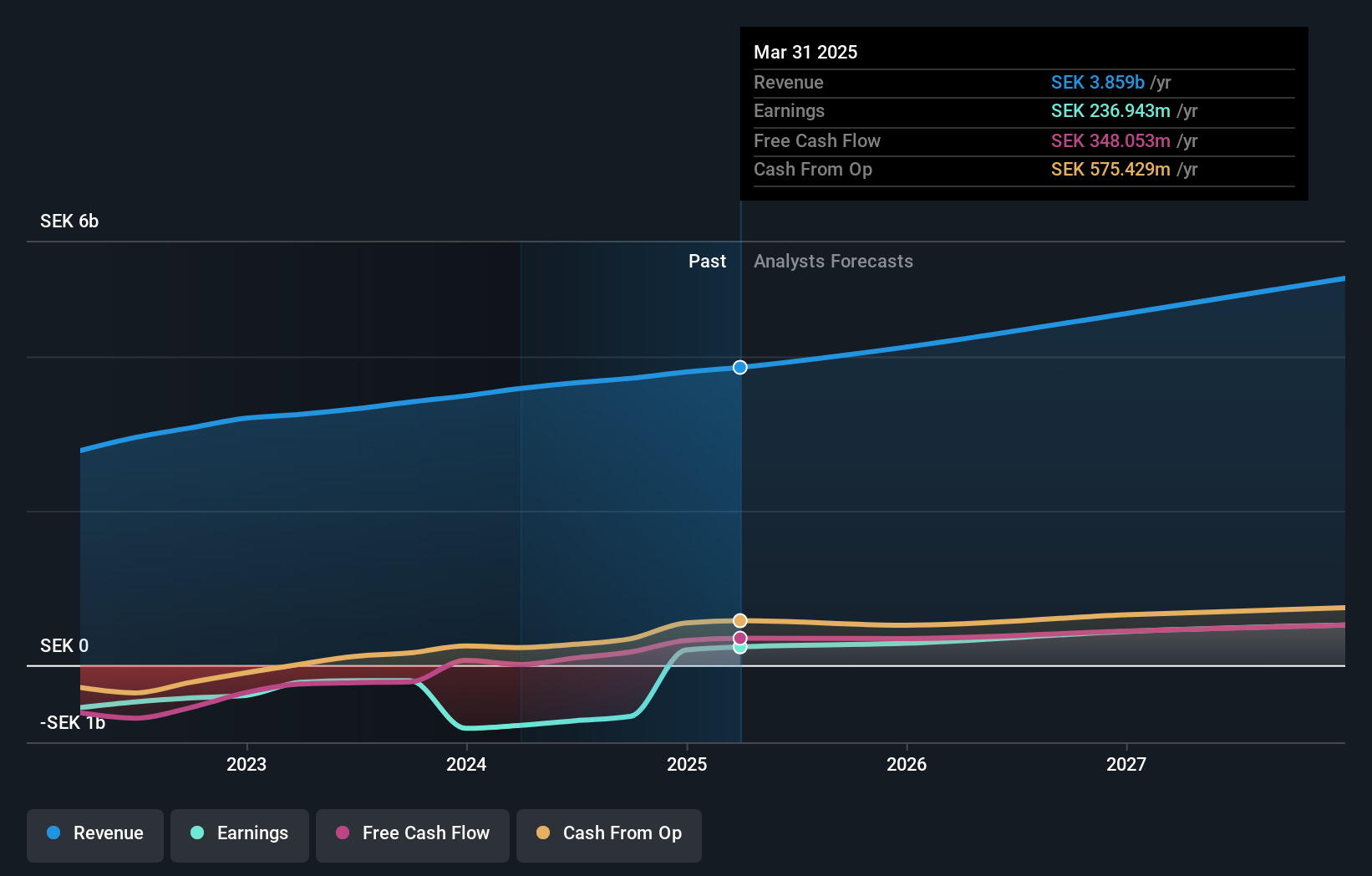

Overview: Storytel AB (publ) offers audiobooks and e-books streaming services, with a market capitalization of SEK7.17 billion.

Operations: Storytel generates revenue primarily from its streaming and publishing segments, with SEK3.43 billion from streaming and SEK1.16 billion from publishing. The company faces deductions in group-wide items and eliminations amounting to -SEK730.79 million, impacting overall financials.

Storytel, a dynamic player in the media industry, has recently turned profitable and is trading at 60.3% below its estimated fair value. The company reported Q1 sales of SEK 952.93 million, up from SEK 891.89 million the previous year, with net income reaching SEK 15.42 million compared to a loss of SEK 24.82 million earlier. Storytel's strategic acquisition of Bokfabriken and AI-driven enhancements are expected to bolster growth outside Nordic regions despite challenges like negative cash flow from investments and competitive pressures from giants such as Spotify. Analysts predict revenue growth of about 10% annually over the next three years, although opinions on earnings estimates vary widely among experts.

Asseco Business Solutions (WSE:ABS)

Simply Wall St Value Rating: ★★★★★★

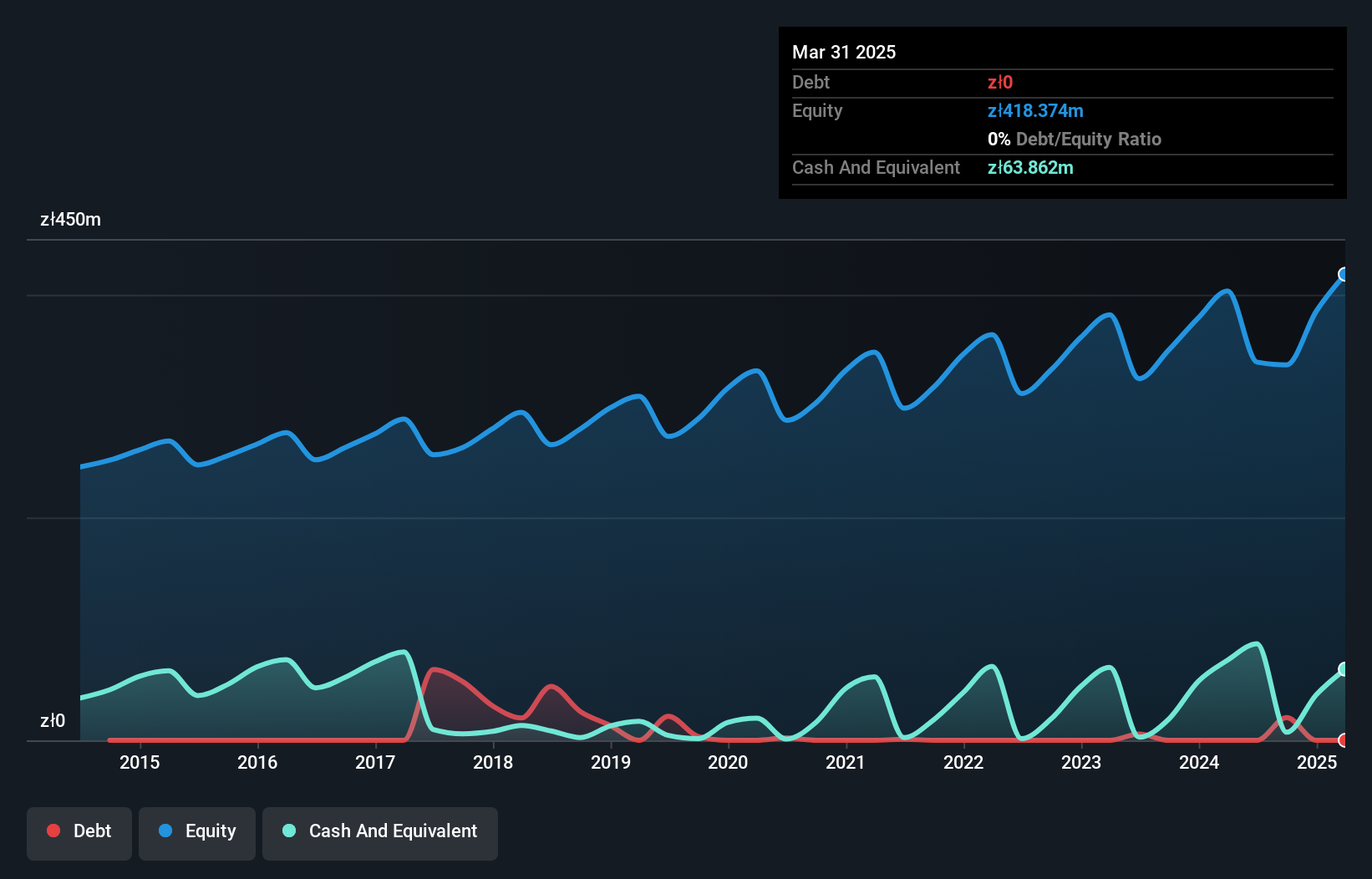

Overview: Asseco Business Solutions S.A. designs and develops enterprise software solutions in Poland and internationally, with a market capitalization of PLN2.76 billion.

Operations: Asseco Business Solutions generates revenue primarily from its ERP segment, which accounted for PLN417.51 million. The company's market capitalization stands at PLN2.76 billion.

Asseco Business Solutions, a nimble player in the software sector, has shown steady growth with earnings increasing by 9.1% annually over the past five years. The company boasts high-quality earnings and remains debt-free, eliminating concerns about interest coverage. Recent results for Q1 2025 highlight sales of PLN 108.08 million and net income of PLN 28.41 million, reflecting an uptick from last year's figures of PLN 99.82 million and PLN 24.03 million respectively. Basic earnings per share rose to PLN 0.87 from PLN 0.72 a year ago, signaling robust financial health and potential for future expansion in its market niche.

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Value Rating: ★★★★★★

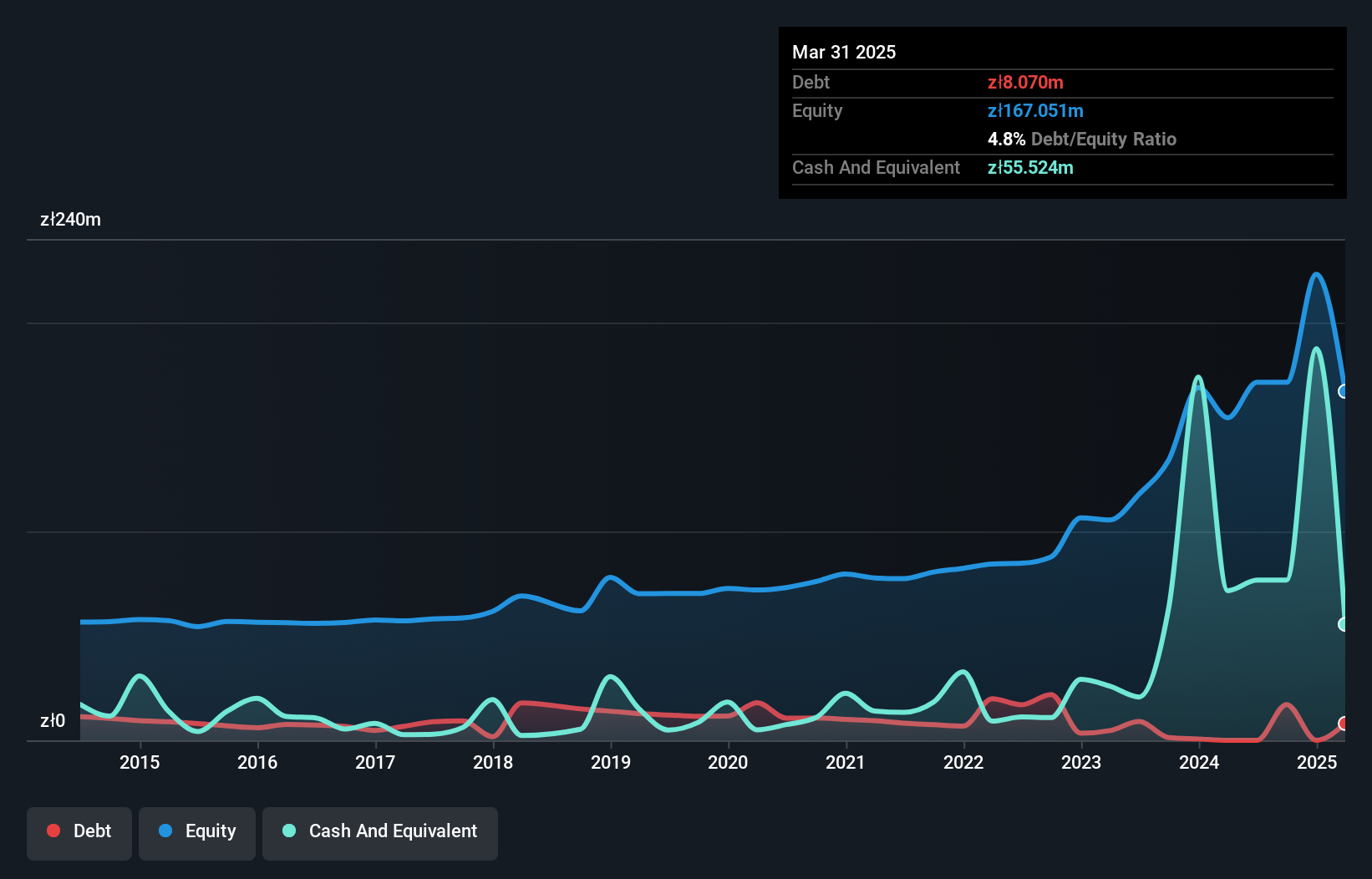

Overview: Synektik Spólka Akcyjna is a Polish company offering products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications with a market capitalization of PLN1.89 billion.

Operations: Synektik Spólka Akcyjna generates revenue primarily from its Diagnostic and IT Equipment segment, which reported PLN57.90 billion, and the Production of Radio Pharmaceuticals segment, with PLN4.66 billion.

Synektik Spólka Akcyjna, a notable player in the healthcare services sector, has shown resilience with earnings growth of 9.2% over the past year, outpacing its industry peers who faced a 6.9% decrease. The company is trading at an attractive valuation, approximately 29.6% below its estimated fair value. With strong financial health evidenced by a debt-to-equity ratio reduction from 25.1% to 4.8%, Synektik's interest obligations are comfortably covered by EBIT at 67 times over the past five years. Recent results show stable net income of PLN 47.56 million for half-year ending March, slightly up from PLN 46.9 million previously.

- Click to explore a detailed breakdown of our findings in Synektik Spólka Akcyjna's health report.

Understand Synektik Spólka Akcyjna's track record by examining our Past report.

Next Steps

- Reveal the 332 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ABS

Asseco Business Solutions

Designs and develops enterprise software solutions in Poland and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives