Asseco Business Solutions And 2 Other Undiscovered Gems in Europe

Reviewed by Simply Wall St

As the European market experiences a wave of optimism with the STOXX Europe 600 Index climbing 3.44% amid easing tariff concerns, investors are increasingly drawn to opportunities within the region's small-cap segment. In this environment, identifying stocks that combine solid fundamentals with growth potential is crucial for navigating market fluctuations and capitalizing on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Moury Construct | 2.93% | 10.42% | 27.28% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| BAUER | 78.29% | 4.31% | nan | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

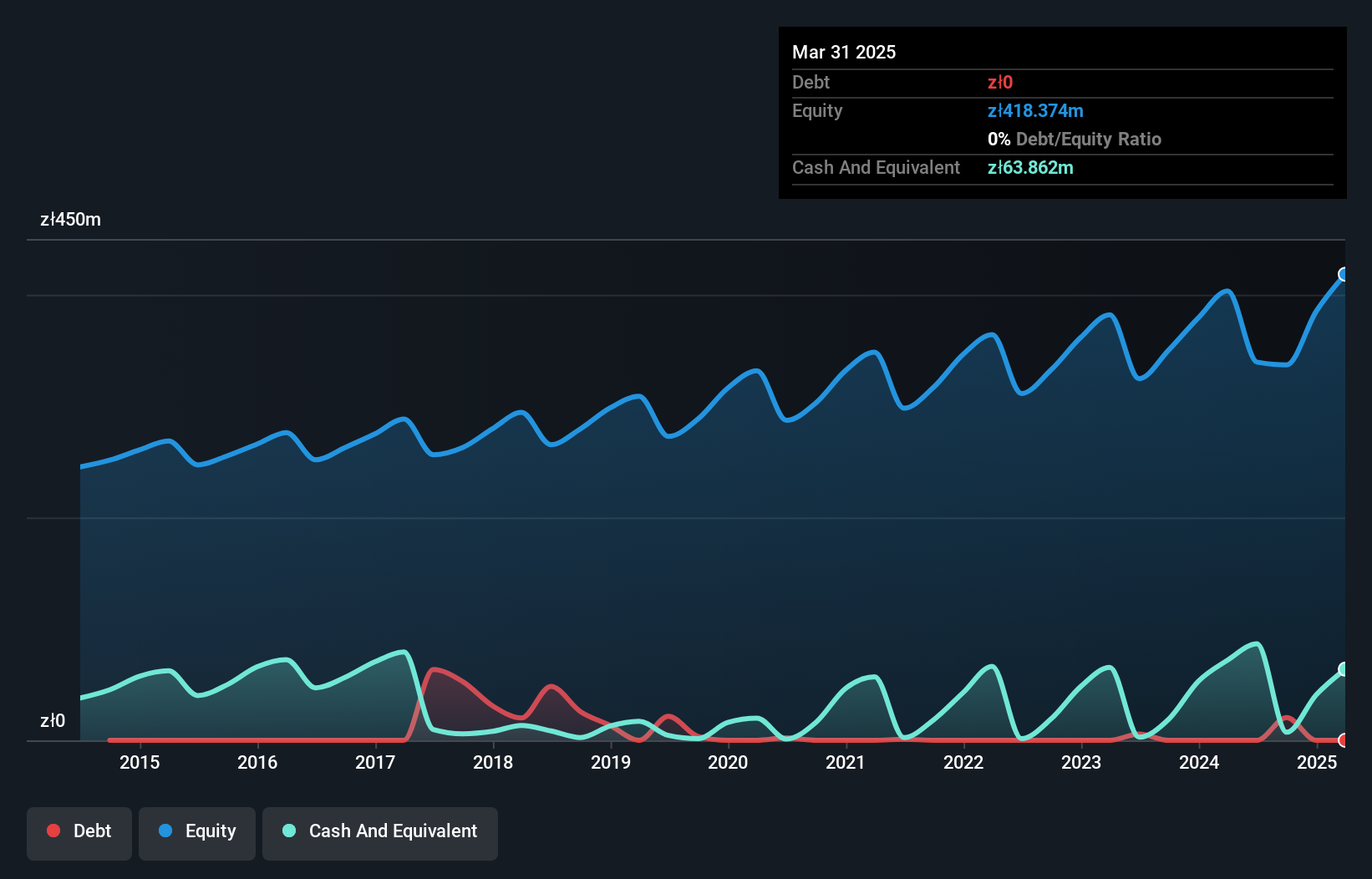

Asseco Business Solutions (WSE:ABS)

Simply Wall St Value Rating: ★★★★★★

Overview: Asseco Business Solutions S.A. designs and develops enterprise software solutions in Poland and internationally, with a market cap of PLN2.88 billion.

Operations: Asseco Business Solutions generates revenue through its enterprise software solutions. The company's financial performance is highlighted by a net profit margin of 23.5%.

Asseco Business Solutions, a notable player in the software sector, has shown impressive growth with earnings rising by 20.9% over the past year, outpacing the industry average of 4.9%. The company is debt-free and trades at a slight discount to its estimated fair value. Recent financials reveal sales of PLN 108.08 million for Q1 2025, up from PLN 99.82 million last year, while net income reached PLN 28.41 million compared to PLN 24.03 million previously. With high-quality earnings and positive free cash flow, Asseco seems well-positioned for continued performance in its market niche.

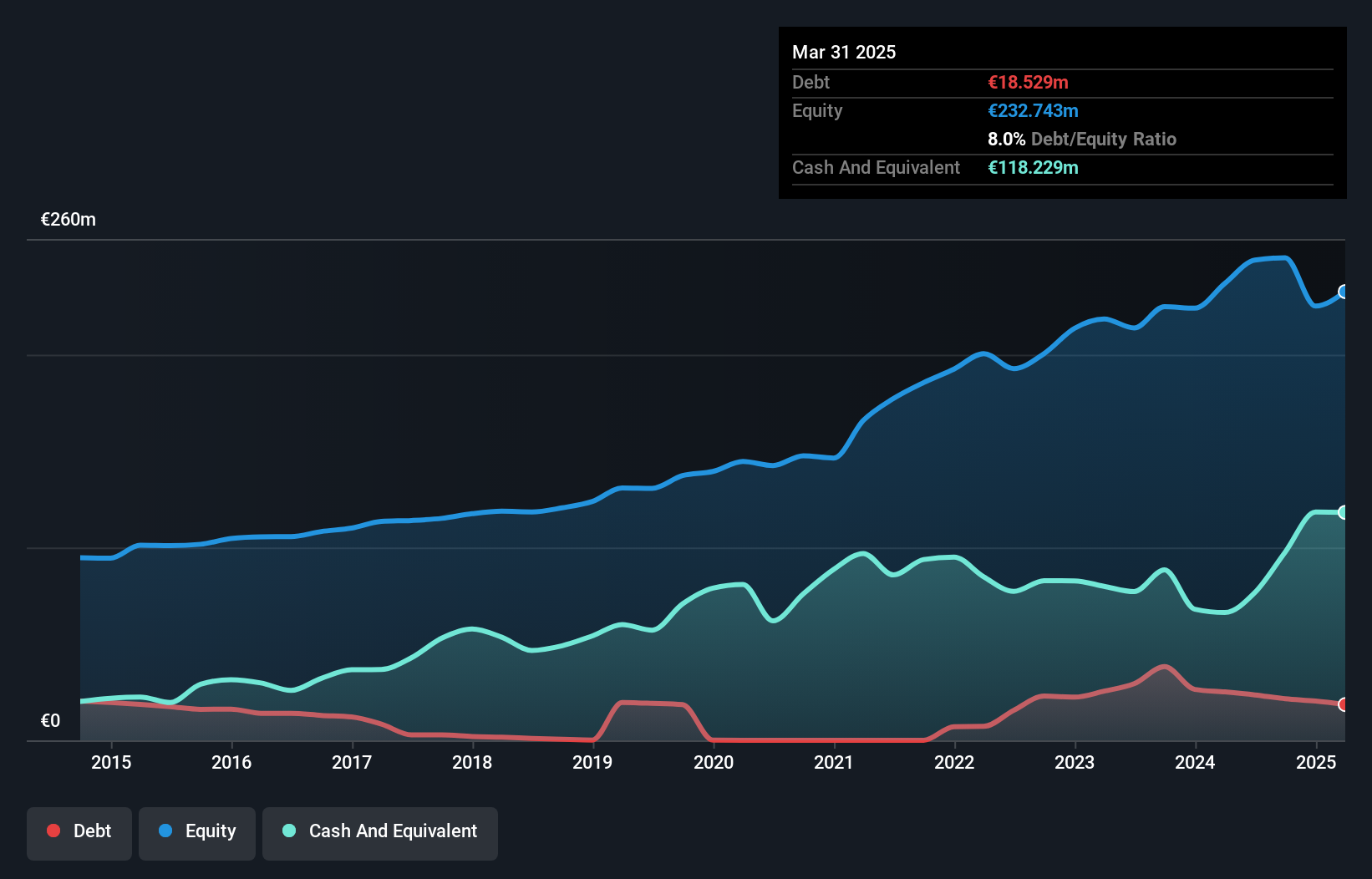

Baader Bank (XTRA:BWB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Baader Bank Aktiengesellschaft offers investment and banking services across Europe, with a market capitalization of approximately €227.88 million.

Operations: Baader Bank generates revenue primarily from its investment and banking services across Europe. The company has a market capitalization of approximately €227.88 million.

Baader Bank's recent performance paints a compelling picture, with earnings skyrocketing by 335% over the past year, significantly outpacing the 22.5% industry average. Despite this impressive growth, its earnings have seen a yearly decline of 27% over five years. The bank's debt to equity ratio has risen from 82.7% to 91.3%, indicating increased leverage, yet its net debt to equity remains satisfactory at 28.3%. Recent financials show net income for Q1 at €13 million compared to €4.3 million last year, alongside an annual dividend of €0.13 per share announced for July 2025 payout.

- Navigate through the intricacies of Baader Bank with our comprehensive health report here.

Evaluate Baader Bank's historical performance by accessing our past performance report.

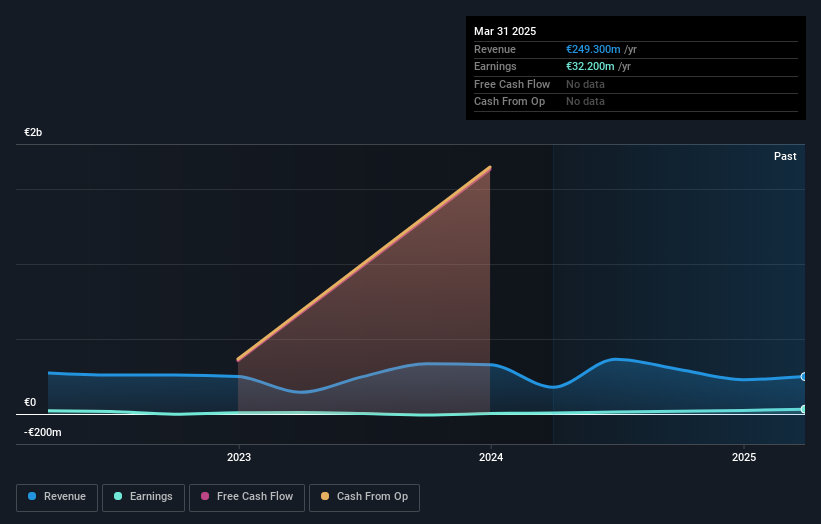

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Eckert & Ziegler SE is a global manufacturer and supplier of isotope technology components, with a market capitalization of approximately €1.26 billion.

Operations: Eckert & Ziegler generates revenue primarily from its Isotopes Products and Medical segments, with the Isotopes Products segment contributing €158.03 million and the Medical segment €148.71 million.

Eckert & Ziegler, a nimble player in the radiopharmaceuticals sector, is making waves with its strategic moves. The company reported a substantial earnings growth of 33% last year, outpacing the medical equipment industry's average. Its debt-to-equity ratio rose from 0.06% to 9% over five years, yet it maintains more cash than total debt. Recent collaborations with firms like Actinium Pharmaceuticals and Bicycle Therapeutics highlight its robust partnerships strategy. With an expected annual revenue growth of nearly 8%, Eckert & Ziegler seems poised for expansion despite potential market competition and regional economic challenges.

Next Steps

- Click through to start exploring the rest of the 333 European Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Asseco Business Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ABS

Asseco Business Solutions

Designs and develops enterprise software solutions in Poland and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives