- Poland

- /

- Semiconductors

- /

- WSE:MLS

ML System's (WSE:MLS) Earnings Are Growing But Is There More To The Story?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether ML System's (WSE:MLS) statutory profits are a good guide to its underlying earnings.

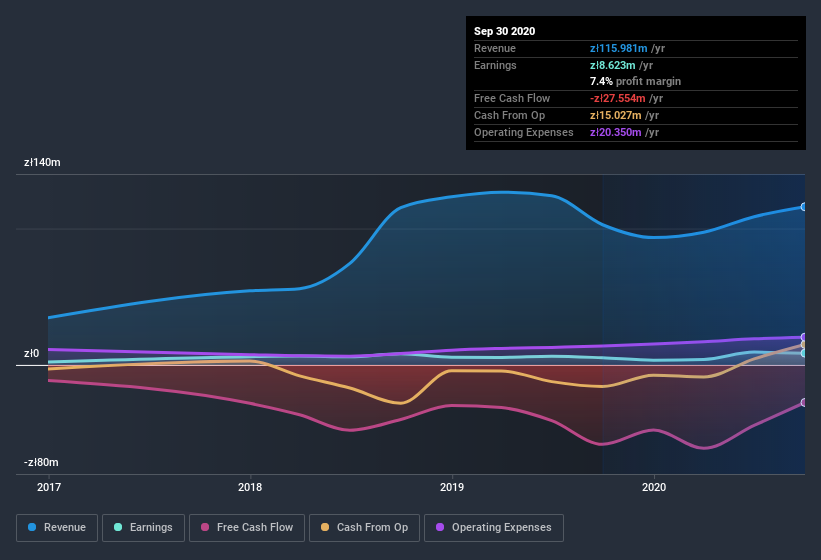

While ML System was able to generate revenue of zł116.0m in the last twelve months, we think its profit result of zł8.62m was more important. In the chart below, you can see that its profit and revenue have both grown over the last three years.

See our latest analysis for ML System

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. As a result, we'll today take a look at how dilution and cashflow shape our understanding of ML System's earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of ML System.

Zooming In On ML System's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

ML System has an accrual ratio of 0.27 for the year to September 2020. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had negative free cash flow of zł28m, in contrast to the aforementioned profit of zł8.62m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of zł28m, this year, indicates high risk. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, ML System issued 13% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out ML System's historical EPS growth by clicking on this link.

A Look At The Impact Of ML System's Dilution on Its Earnings Per Share (EPS).

As you can see above, ML System has been growing its net income over the last few years, with an annualized gain of 69% over three years. In comparison, earnings per share only gained 22% over the same period. And at a glance the 66% gain in profit over the last year impresses. On the other hand, earnings per share are only up 63% in that time. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So ML System shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On ML System's Profit Performance

In conclusion, ML System has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means its earnings per share growth is weaker than its profit growth. Considering all this we'd argue ML System's profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into ML System, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 3 warning signs for ML System (of which 1 makes us a bit uncomfortable!) you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade ML System, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:MLS

ML System

Produces and sale of flat glass and glass-photovoltaic panels in Poland.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026