- Poland

- /

- Retail Distributors

- /

- WSE:SFD

The SFD (WSE:SFD) Share Price Is Down 61% So Some Shareholders Are Wishing They Sold

SFD S.A. (WSE:SFD) shareholders should be happy to see the share price up 11% in the last month. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 61% in the period. Some might say the recent bounce is to be expected after such a bad drop. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

See our latest analysis for SFD

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

SFD became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

In contrast to the share price, revenue has actually increased by 8.4% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

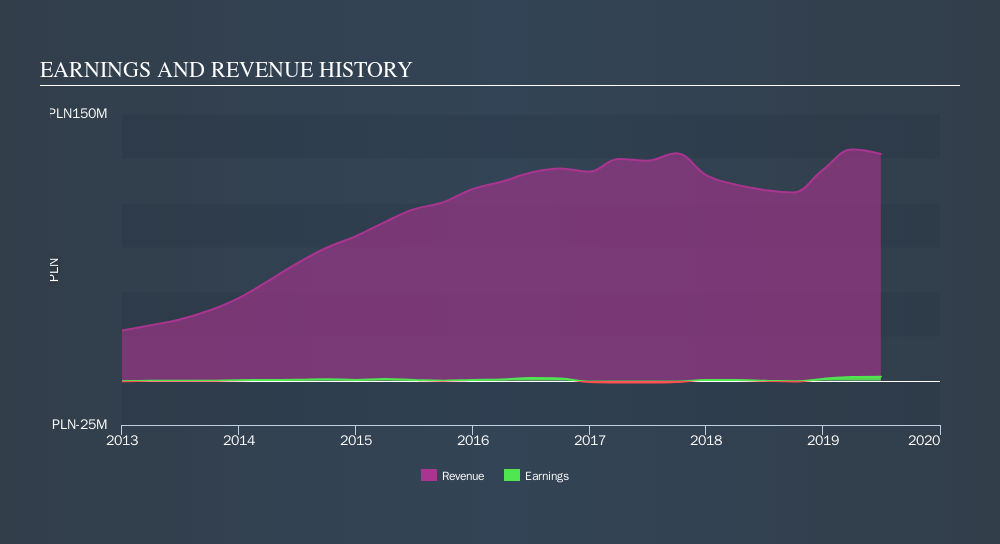

The image below shows how earnings and revenue have tracked over time.

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that SFD shareholders have received a total shareholder return of 20% over one year. That certainly beats the loss of about 17% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Is SFD cheap compared to other companies? These 3 valuation measures might help you decide.

Of course SFD may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WSE:SFD

SFD

Engages in the wholesale and retail of nutrients, dietary supplements, and sports accessories in Poland.

Excellent balance sheet low.

Market Insights

Community Narratives