- Poland

- /

- Specialty Stores

- /

- WSE:ANR

Answear.com's (WSE:ANR) one-year earnings growth trails the favorable shareholder returns

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. For example, the Answear.com S.A. (WSE:ANR) share price is up 36% in the last 1 year, clearly besting the market decline of around 12% (not including dividends). So that should have shareholders smiling. We'll need to follow Answear.com for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Answear.com

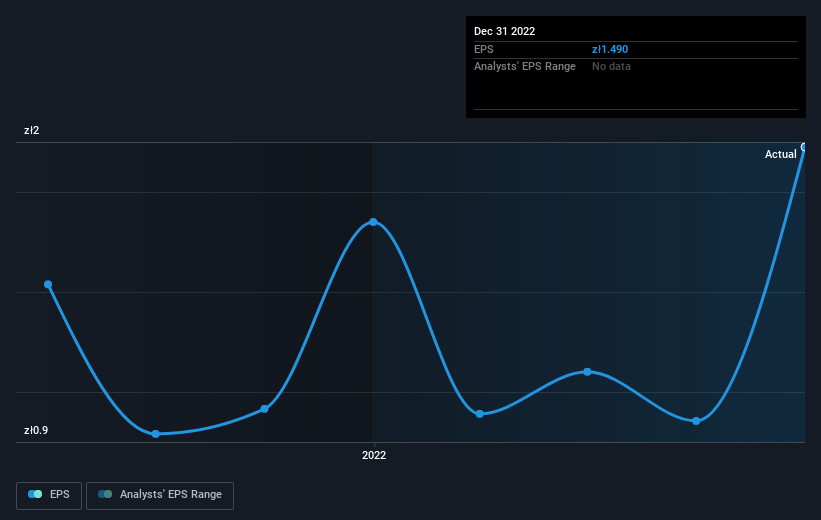

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Answear.com was able to grow EPS by 11% in the last twelve months. This EPS growth is significantly lower than the 36% increase in the share price. This indicates that the market is now more optimistic about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

It's nice to see that Answear.com shareholders have gained 36% over the last year. And the share price momentum remains respectable, with a gain of 24% in the last three months. This suggests the company is continuing to win over new investors. Before deciding if you like the current share price, check how Answear.com scores on these 3 valuation metrics.

Of course Answear.com may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ANR

Answear.com

Operates as an online multi-brand fashion retailer in Poland, the Czech Republic, Slovakia, Hungary, Romania, Bulgaria, Ukraine, Greece, Croatia, Cyprus, Slovenia, and Italy.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives