- Poland

- /

- Real Estate

- /

- WSE:PHN

Polski Holding Nieruchomosci (WSE:PHN) Use Of Debt Could Be Considered Risky

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Polski Holding Nieruchomosci S.A. (WSE:PHN) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Polski Holding Nieruchomosci

What Is Polski Holding Nieruchomosci's Net Debt?

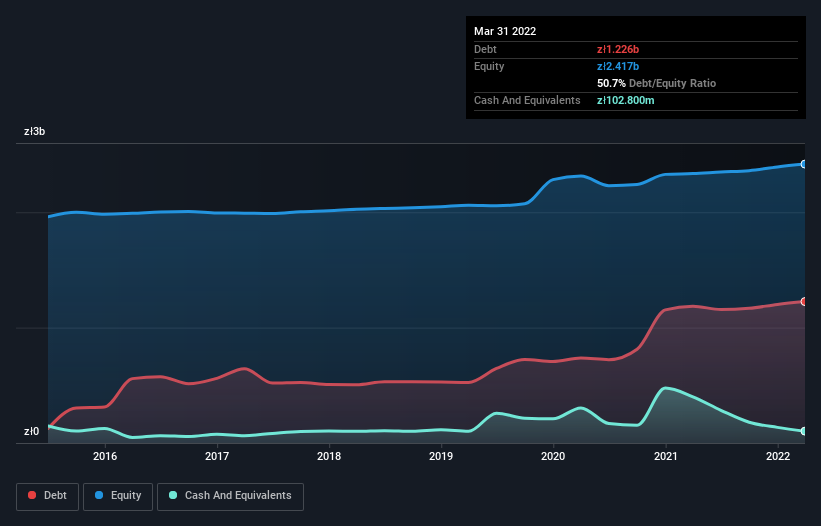

As you can see below, Polski Holding Nieruchomosci had zł1.23b of debt, at March 2022, which is about the same as the year before. You can click the chart for greater detail. However, it also had zł102.8m in cash, and so its net debt is zł1.12b.

How Strong Is Polski Holding Nieruchomosci's Balance Sheet?

According to the last reported balance sheet, Polski Holding Nieruchomosci had liabilities of zł386.5m due within 12 months, and liabilities of zł1.59b due beyond 12 months. Offsetting these obligations, it had cash of zł102.8m as well as receivables valued at zł80.7m due within 12 months. So its liabilities total zł1.79b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the zł614.6m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Polski Holding Nieruchomosci would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Polski Holding Nieruchomosci has a rather high debt to EBITDA ratio of 10.9 which suggests a meaningful debt load. However, its interest coverage of 3.0 is reasonably strong, which is a good sign. Worse, Polski Holding Nieruchomosci's EBIT was down 44% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Polski Holding Nieruchomosci's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Polski Holding Nieruchomosci actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

To be frank both Polski Holding Nieruchomosci's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. We're quite clear that we consider Polski Holding Nieruchomosci to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with Polski Holding Nieruchomosci (at least 2 which can't be ignored) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PHN

Polski Holding Nieruchomosci

Engages in real estate management and development project implementation activities in Poland.

Undervalued with moderate growth potential.

Market Insights

Community Narratives