- Poland

- /

- Real Estate

- /

- WSE:CZT

Czerwona Torebka Spólka Akcyjna (WSE:CZT) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Czerwona Torebka Spólka Akcyjna (WSE:CZT) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Czerwona Torebka Spólka Akcyjna

What Is Czerwona Torebka Spólka Akcyjna's Net Debt?

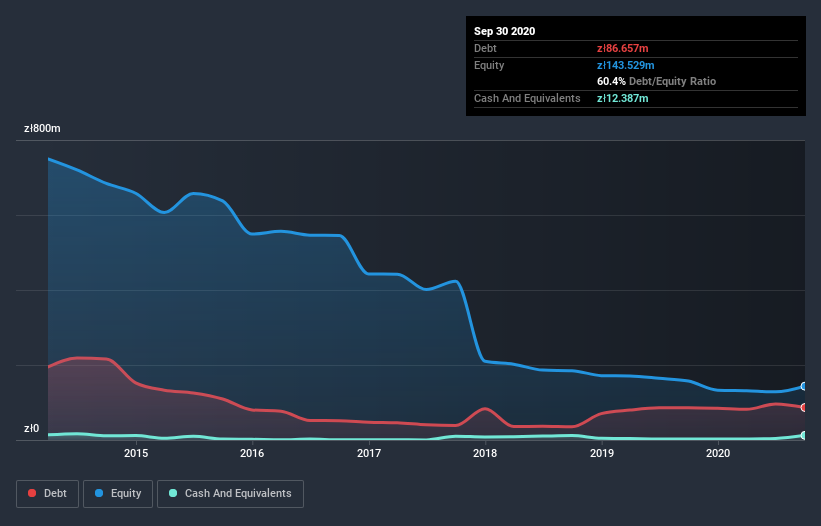

The chart below, which you can click on for greater detail, shows that Czerwona Torebka Spólka Akcyjna had zł86.2m in debt in September 2020; about the same as the year before. On the flip side, it has zł12.4m in cash leading to net debt of about zł73.8m.

A Look At Czerwona Torebka Spólka Akcyjna's Liabilities

We can see from the most recent balance sheet that Czerwona Torebka Spólka Akcyjna had liabilities of zł26.7m falling due within a year, and liabilities of zł129.5m due beyond that. Offsetting these obligations, it had cash of zł12.4m as well as receivables valued at zł14.2m due within 12 months. So its liabilities total zł129.6m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the zł46.9m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Czerwona Torebka Spólka Akcyjna would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Czerwona Torebka Spólka Akcyjna will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Czerwona Torebka Spólka Akcyjna had a loss before interest and tax, and actually shrunk its revenue by 28%, to zł3.8m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Czerwona Torebka Spólka Akcyjna's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable zł39m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely since it is low on liquid assets, and made a loss of zł14m in the last year. So we think this stock is quite risky. We'd prefer to pass. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 3 warning signs we've spotted with Czerwona Torebka Spólka Akcyjna .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Czerwona Torebka Spólka Akcyjna, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:CZT

Czerwona Torebka Spólka Akcyjna

Engages in the real estate business in Poland.

Flawless balance sheet with low risk.

Market Insights

Community Narratives