- Italy

- /

- Interactive Media and Services

- /

- BIT:WBS

European Penny Stocks Under €20M Market Cap: 3 Picks To Consider

Reviewed by Simply Wall St

As European markets experience a resurgence, buoyed by the European Central Bank's rate cuts and improved investor sentiment, opportunities are emerging for those willing to explore beyond traditional investments. Penny stocks, despite their vintage moniker, continue to offer intriguing prospects for growth by focusing on smaller or newer companies that often fly under the radar. In this article, we explore three penny stocks that demonstrate financial resilience and potential for long-term value.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.08 | SEK1.99B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.63 | SEK239.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.80 | SEK231.19M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.60 | PLN122.02M | ✅ 3 ⚠️ 2 View Analysis > |

| FAE Technology (BIT:FAE) | €2.27 | €45.46M | ✅ 4 ⚠️ 3 View Analysis > |

| Cellularline (BIT:CELL) | €2.51 | €52.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €32.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.03 | €23.33M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.15 | €296.84M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 430 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Websolute (BIT:WBS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Websolute S.p.A. is a digital company based in Italy with a market capitalization of €11.87 million.

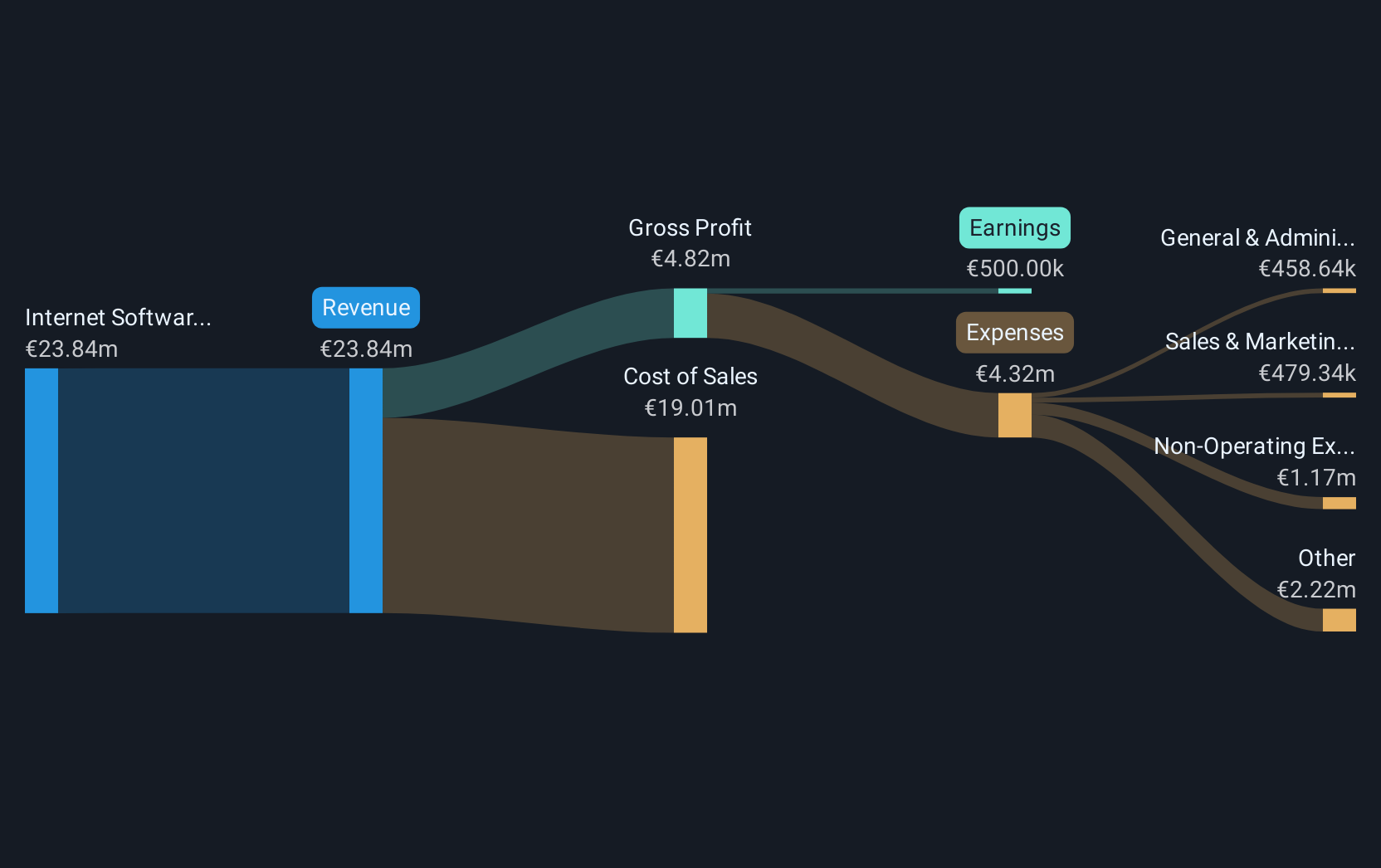

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to €23.84 million.

Market Cap: €11.87M

Websolute S.p.A., with a market capitalization of €11.87 million, has shown recent profitability, reporting net income of €0.5 million for 2024 after a previous loss. The company’s revenue increased to €24.11 million from the prior year, indicating growth in its Internet Software & Services segment. Despite this progress, Websolute faces challenges such as high debt levels and low return on equity at 11.6%. The dividend yield of 3.15% is not well covered by free cash flows, and the stock remains highly volatile compared to other Italian stocks, though it trades significantly below estimated fair value.

- Click to explore a detailed breakdown of our findings in Websolute's financial health report.

- Explore Websolute's analyst forecasts in our growth report.

Petrolia (OB:PSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Petrolia SE, with a market cap of NOK234.66 million, sells and rents energy service equipment to the energy industry across Norway, Europe, Asia, and Australia.

Operations: The company generates revenue of $53.47 million from its energy service segment, which involves selling and renting equipment to the energy industry.

Market Cap: NOK234.66M

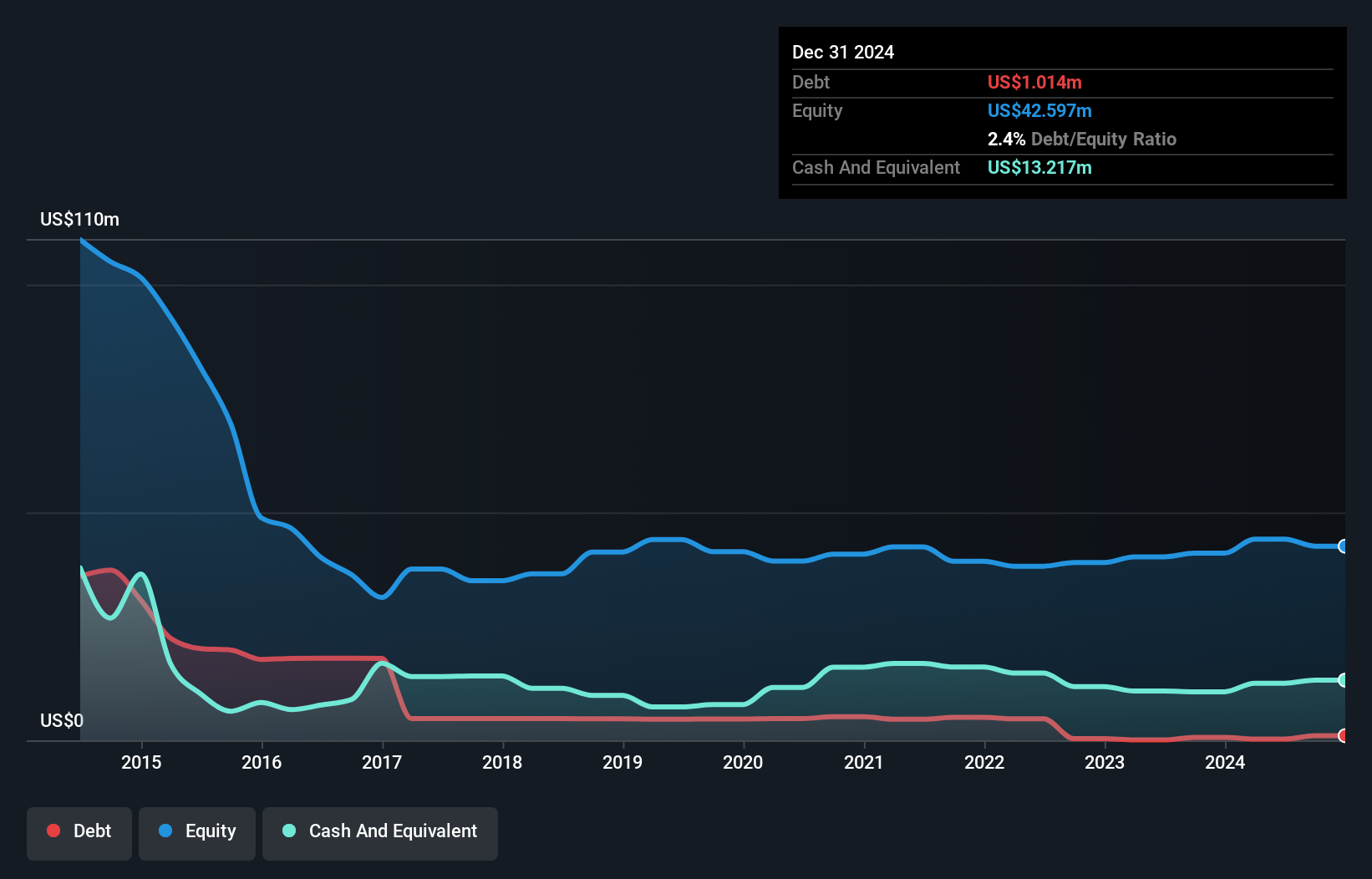

Petrolia SE, with a market cap of NOK234.66 million, has demonstrated significant earnings growth, with an 87.6% increase over the past year, outpacing the Energy Services industry average. The company reported net income of US$3.77 million for 2024, up from US$2.01 million the previous year, indicating improved profitability and high-quality earnings. Despite its low return on equity at 7.2%, Petrolia maintains a strong financial position with more cash than debt and adequate coverage of liabilities by short-term assets valued at $35M. The stock trades well below its estimated fair value but remains highly volatile.

- Navigate through the intricacies of Petrolia with our comprehensive balance sheet health report here.

- Gain insights into Petrolia's past trends and performance with our report on the company's historical track record.

Rank Progress (WSE:RNK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Rank Progress S.A. is engaged in investing in, developing, renting, and selling commercial real estate properties both in Poland and internationally, with a market cap of PLN167.21 million.

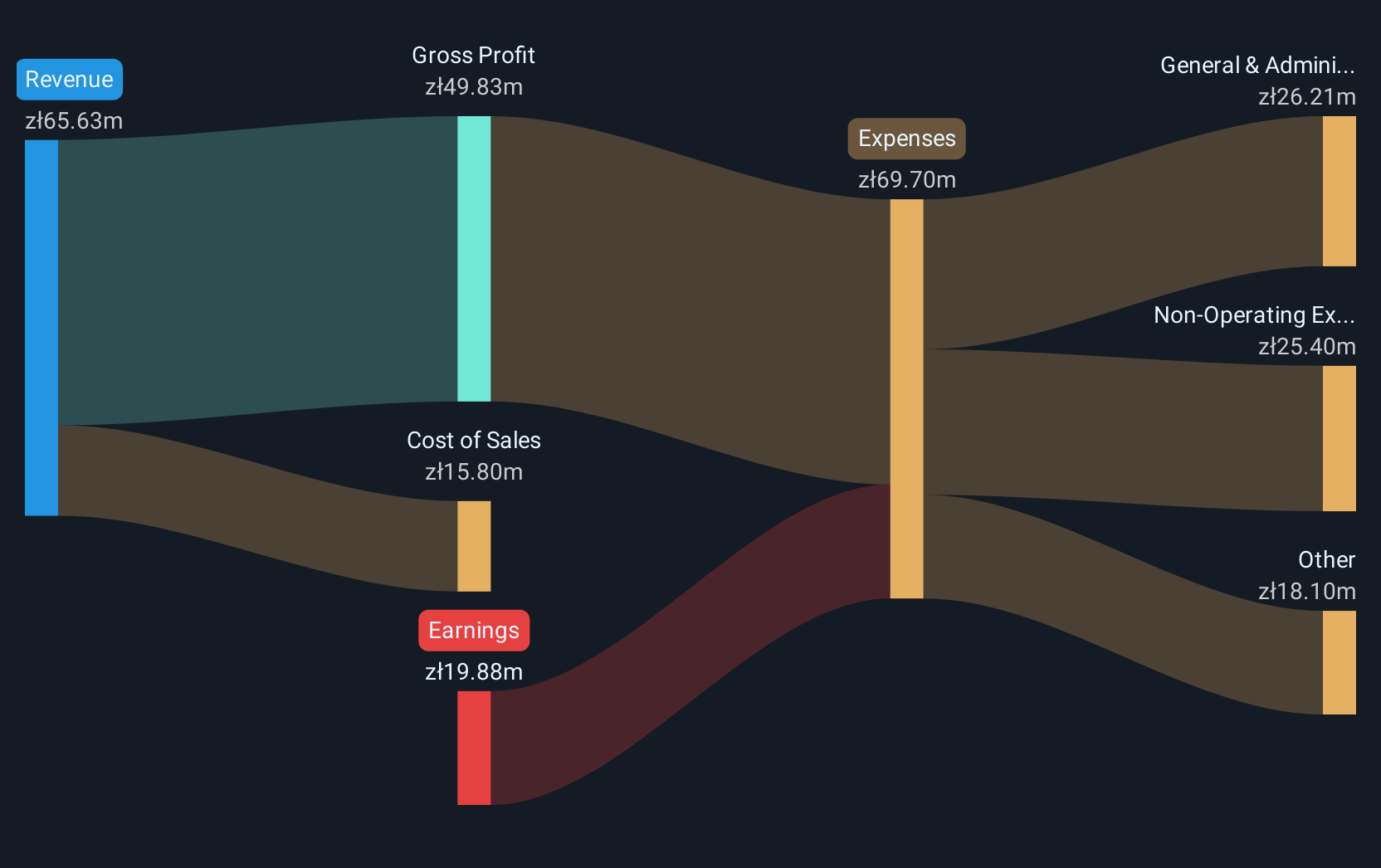

Operations: The company's revenue is generated from two primary segments: the lease of property, contributing PLN56.41 million, and the sale of real estate, accounting for PLN97.56 million.

Market Cap: PLN167.21M

Rank Progress S.A., with a market cap of PLN167.21 million, has shown remarkable earnings growth of 434.3% over the past year, surpassing its 5-year average and the Real Estate industry growth rate. Despite a high net debt to equity ratio of 41.8%, its debt is well covered by operating cash flow at 24.2%. The company experienced a large one-off loss impacting recent financials, but short-term assets exceed long-term liabilities significantly. Trading at a substantial discount to its estimated fair value, Rank Progress's interest payments are well covered by EBIT, although it faces challenges with covering short-term liabilities fully.

- Get an in-depth perspective on Rank Progress' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Rank Progress' track record.

Key Takeaways

- Dive into all 430 of the European Penny Stocks we have identified here.

- Searching for a Fresh Perspective? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Websolute might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:WBS

Medium-low and good value.

Market Insights

Community Narratives