Just because a business does not make any money, does not mean that the stock will go down. For example, OncoArendi Therapeutics (WSE:OAT) shareholders have done very well over the last year, with the share price soaring by 401%. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

In light of its strong share price run, we think now is a good time to investigate how risky OncoArendi Therapeutics' cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for OncoArendi Therapeutics

Does OncoArendi Therapeutics Have A Long Cash Runway?

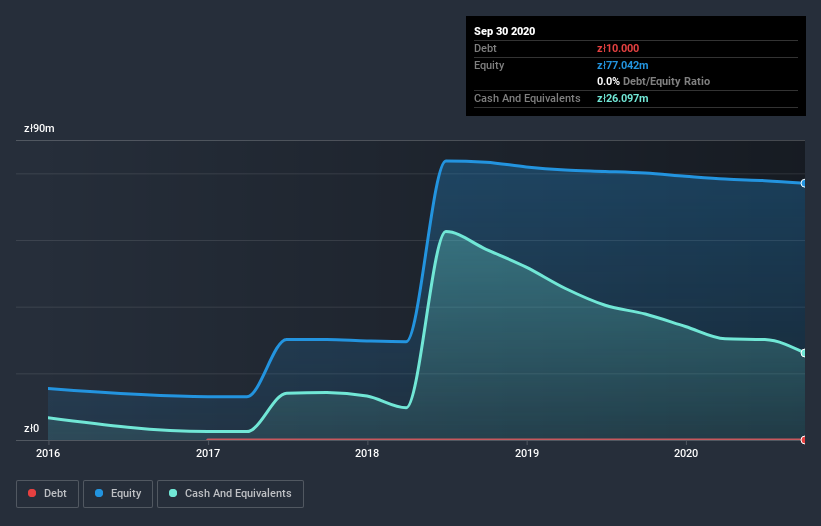

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When OncoArendi Therapeutics last reported its balance sheet in September 2020, it had zero debt and cash worth zł26m. Importantly, its cash burn was zł31m over the trailing twelve months. So it had a cash runway of approximately 10 months from September 2020. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

How Is OncoArendi Therapeutics' Cash Burn Changing Over Time?

Although OncoArendi Therapeutics had revenue of zł1.9m in the last twelve months, its operating revenue was only zł837 in that time period. Given how low that operating leverage is, we think it's too early to put much weight on the revenue growth, so we'll focus on how the cash burn is changing, instead. Given the length of the cash runway, we'd interpret the 28% reduction in cash burn, in twelve months, as prudent if not necessary for capital preservation. Admittedly, we're a bit cautious of OncoArendi Therapeutics due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Easily Can OncoArendi Therapeutics Raise Cash?

While OncoArendi Therapeutics is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

OncoArendi Therapeutics has a market capitalisation of zł688m and burnt through zł31m last year, which is 4.5% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is OncoArendi Therapeutics' Cash Burn A Worry?

On this analysis of OncoArendi Therapeutics' cash burn, we think its cash burn relative to its market cap was reassuring, while its cash runway has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about OncoArendi Therapeutics' situation. Separately, we looked at different risks affecting the company and spotted 4 warning signs for OncoArendi Therapeutics (of which 3 shouldn't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade OncoArendi Therapeutics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:MOC

Molecure

A biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics for the treatment of neoplastic and inflammatory diseases in Poland.

Moderate with adequate balance sheet.

Market Insights

Community Narratives