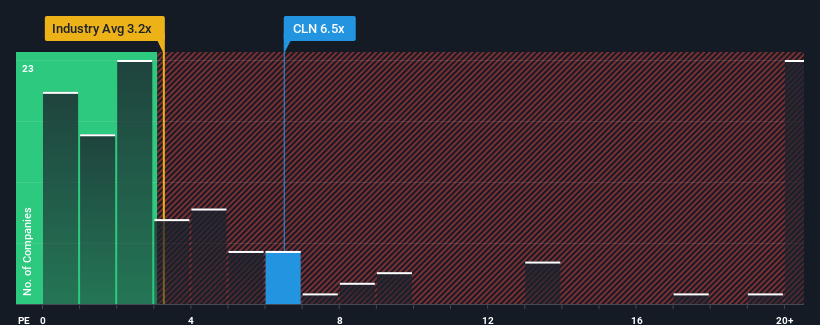

When you see that almost half of the companies in the Pharmaceuticals industry in Poland have price-to-sales ratios (or "P/S") above 78.4x, Celon Pharma S.A. (WSE:CLN) looks to be giving off very strong buy signals with its 6.5x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Celon Pharma

How Has Celon Pharma Performed Recently?

Celon Pharma has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Celon Pharma will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Celon Pharma?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Celon Pharma's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 12% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% per annum during the coming three years according to the five analysts following the company. With the industry only predicted to deliver 9.6% per annum, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Celon Pharma's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Celon Pharma's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Celon Pharma that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CLN

Celon Pharma

An integrated pharmaceutical company, engages in the research, manufacture, and marketing of pharmaceutical products and preparations.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives