- Poland

- /

- Entertainment

- /

- WSE:RCW

If You Like EPS Growth Then Check Out Ruch Chorzów (WSE:RCW) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Ruch Chorzów (WSE:RCW), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Ruch Chorzów

How Fast Is Ruch Chorzów Growing Its Earnings Per Share?

In the last three years Ruch Chorzów's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Ruch Chorzów's EPS have grown from zł0.0041 to zł0.0046 over twelve months. That's a 12% gain; respectable growth in the broader scheme of things.

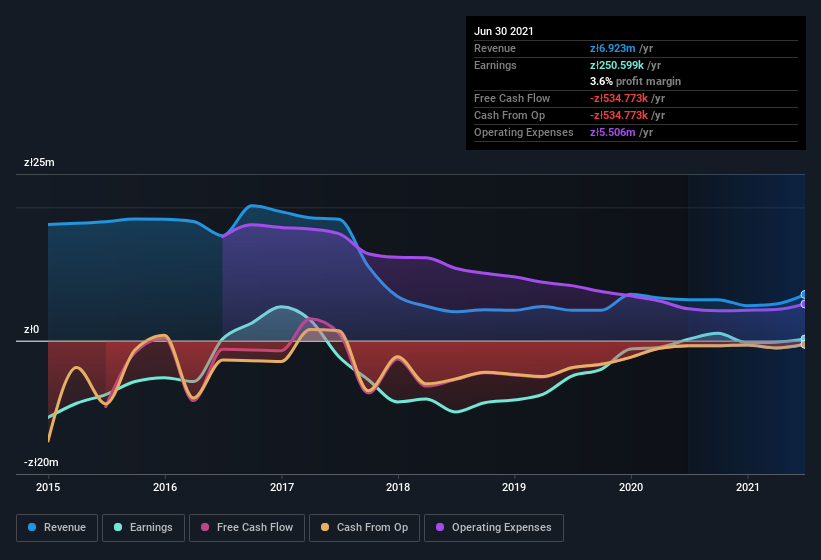

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Ruch Chorzów is growing revenues, and EBIT margins improved by 4.7 percentage points to 3.2%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since Ruch Chorzów is no giant, with a market capitalization of zł36m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Ruch Chorzów Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Ruch Chorzów insiders own a meaningful share of the business. Indeed, with a collective holding of 51%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. Valued at only zł36m Ruch Chorzów is really small for a listed company. That means insiders only have zł18m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does Ruch Chorzów Deserve A Spot On Your Watchlist?

One positive for Ruch Chorzów is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. What about risks? Every company has them, and we've spotted 6 warning signs for Ruch Chorzów (of which 5 are significant!) you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:RCW

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives