- Norway

- /

- Marine and Shipping

- /

- OB:WWI

Undiscovered European Gems With Strong Fundamentals For May 2025

Reviewed by Simply Wall St

Amidst recent market turbulence, European equities have faced challenges, with the pan-European STOXX Europe 600 Index snapping a five-week winning streak due to renewed tariff threats from the U.S. and unexpected contractions in eurozone business activity. In this environment, identifying stocks with strong fundamentals becomes crucial for investors seeking resilience and potential growth opportunities; these undiscovered gems often exhibit robust financial health and strategic positioning that can withstand broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 8.97% | 21.29% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Wilh. Wilhelmsen Holding (OB:WWI)

Simply Wall St Value Rating: ★★★★★★

Overview: Wilh. Wilhelmsen Holding ASA is a global provider of maritime products and services, with a market capitalization of NOK17.55 billion.

Operations: The company's revenue streams are primarily from Maritime Services, generating $849 million, followed by New Energy at $315 million, and Strategic Holdings & Investments contributing $15 million. The net profit margin is not specified in the provided data.

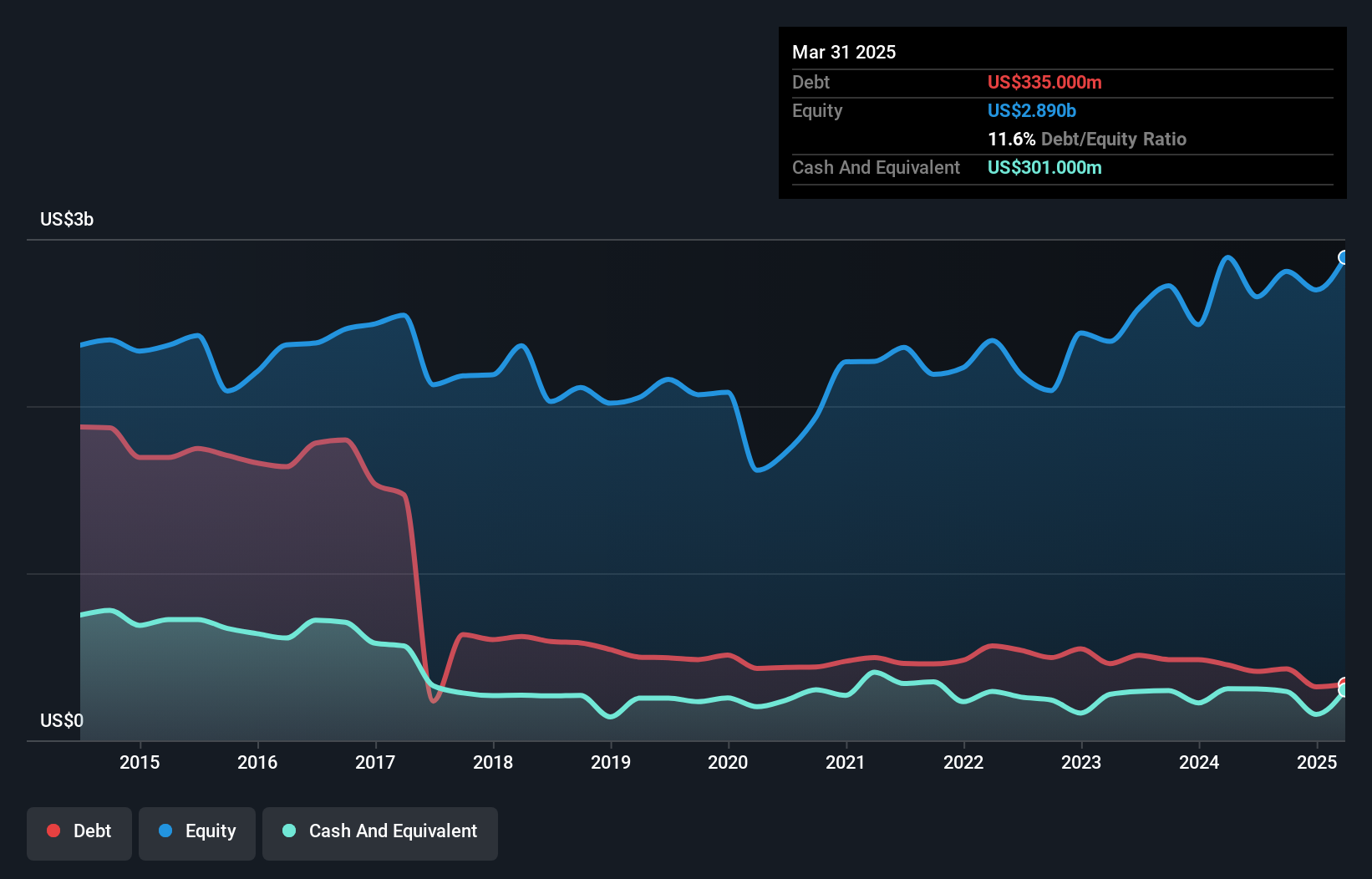

Wilh. Wilhelmsen Holding, a notable player in the shipping industry, has demonstrated robust financial health with a net debt to equity ratio of 1.2%, which is considered satisfactory. The company's earnings have grown by 9.2% over the past year, surpassing the industry average of 9.1%. With interest payments well covered at 4.9 times EBIT, its financial stability is further reinforced by strategic expansions in Maritime Services and New Energy sectors. Recent earnings for Q1 2025 showed sales of US$297 million and net income of US$132 million, reflecting strong operational performance compared to last year’s figures.

PlayWay (WSE:PLW)

Simply Wall St Value Rating: ★★★★★☆

Overview: PlayWay S.A. is a company that produces and publishes PC and mobile games globally, with a market capitalization of PLN2.11 billion.

Operations: PlayWay generates revenue primarily through the production and publishing of PC and mobile games. The company's net profit margin has shown a notable trend, reflecting its ability to manage costs effectively in relation to its revenues.

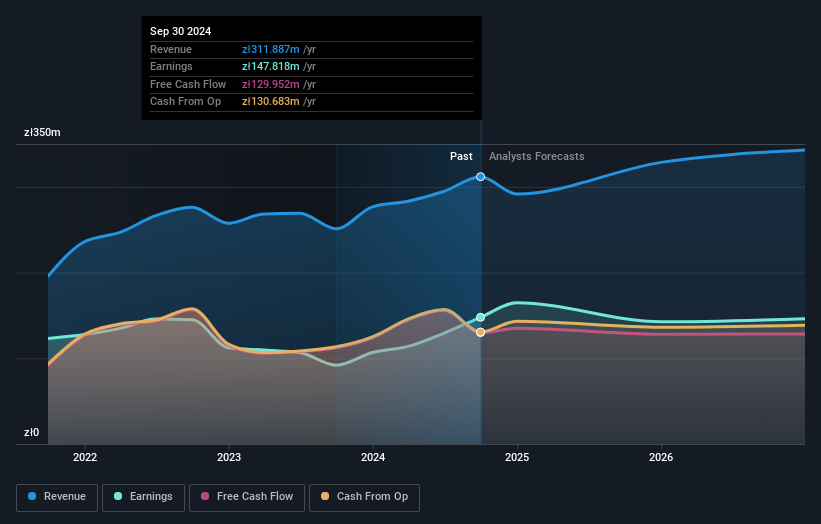

PlayWay, a promising player in the European market, reported net income of PLN 170.2 million for 2024, up from PLN 106.73 million the previous year. The company's basic earnings per share rose to PLN 25.79 from PLN 19.14, indicating robust financial health. Over the past five years, its debt-to-equity ratio has slightly increased to 0.07%, yet it remains well-covered by profits with more cash than total debt on hand. With earnings growth of 59% last year outpacing industry averages and trading at nearly a tenth below estimated fair value, PlayWay appears poised for continued success in its sector.

- Click to explore a detailed breakdown of our findings in PlayWay's health report.

Assess PlayWay's past performance with our detailed historical performance reports.

Shoper (WSE:SHO)

Simply Wall St Value Rating: ★★★★★★

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland with a market capitalization of PLN1.31 billion.

Operations: Shoper SA generates revenue primarily through its Software as a Service solutions tailored for e-commerce businesses in Poland. The company's financial performance is characterized by a net profit margin, which reflects its profitability after accounting for all expenses.

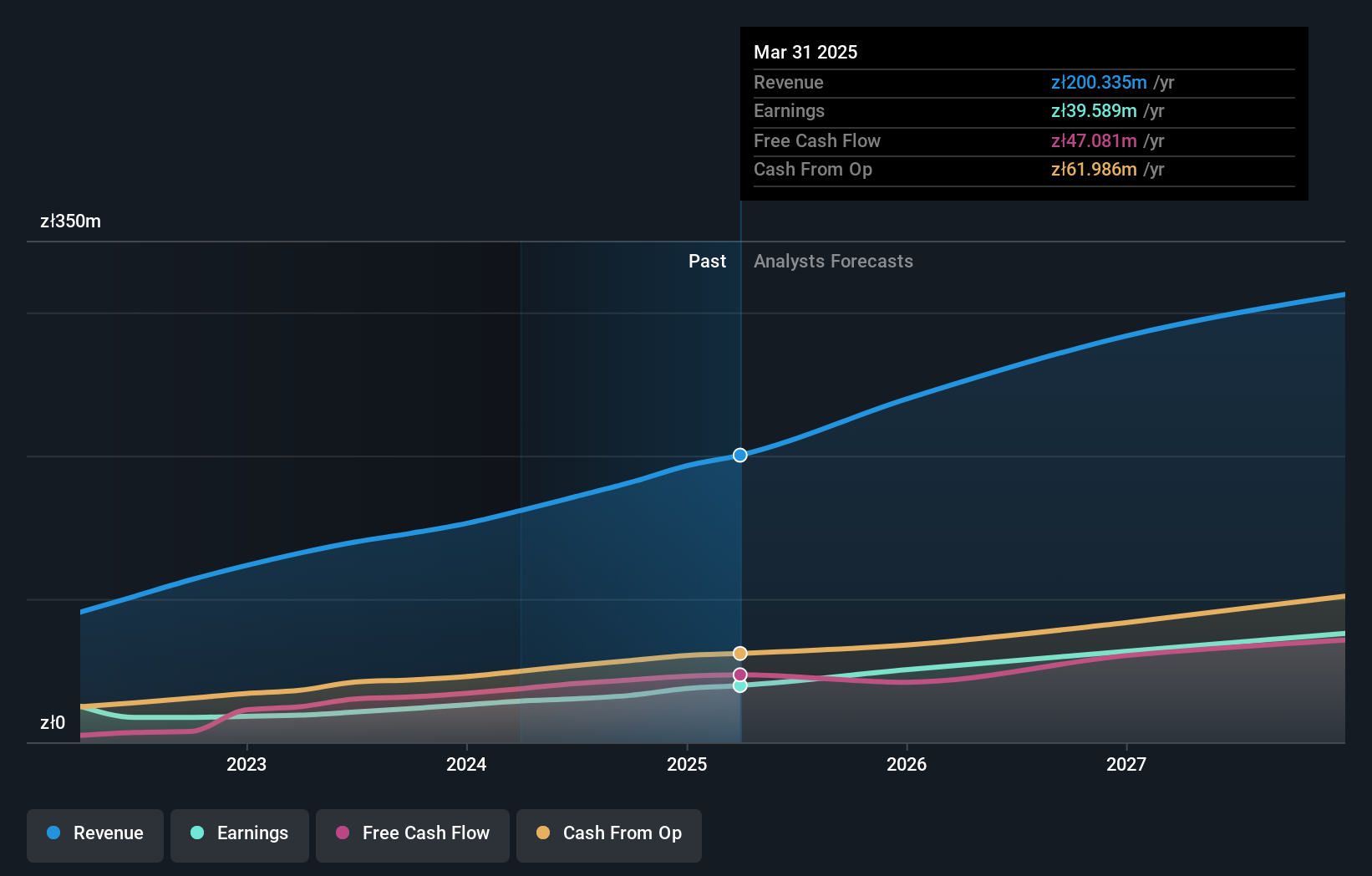

Shoper, a rising player in the European market, has demonstrated notable financial strength with a debt-free balance sheet and high-quality earnings. In recent years, Shoper's levered free cash flow jumped from PLN 5.26 million in 2018 to an impressive PLN 47.08 million by March 2025. The company reported first-quarter revenue of PLN 51.73 million for 2025, up from PLN 44.19 million the previous year, while net income rose to PLN 9.84 million from PLN 7.76 million over the same period last year. Earnings per share also increased to PLN 0.35 from PLN 0.28 a year ago, reflecting robust growth prospects ahead.

Key Takeaways

- Gain an insight into the universe of 331 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wilh. Wilhelmsen Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:WWI

Wilh. Wilhelmsen Holding

Provides maritime products and services worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives