- Poland

- /

- Entertainment

- /

- WSE:PLW

3 Undiscovered Gems with Solid Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major U.S. stock indices, the Russell 2000 Index, representing smaller companies, saw a decline after previously outperforming larger-cap peers. This backdrop of fluctuating market dynamics and economic indicators highlights the importance of identifying stocks with strong fundamentals and growth potential that can thrive despite broader market volatility. As we explore three undiscovered gems in this article, these stocks stand out for their solid potential amid shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Compañía General de Electricidad | 1.98% | 9.75% | -4.52% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

IMAX China Holding (SEHK:1970)

Simply Wall St Value Rating: ★★★★★★

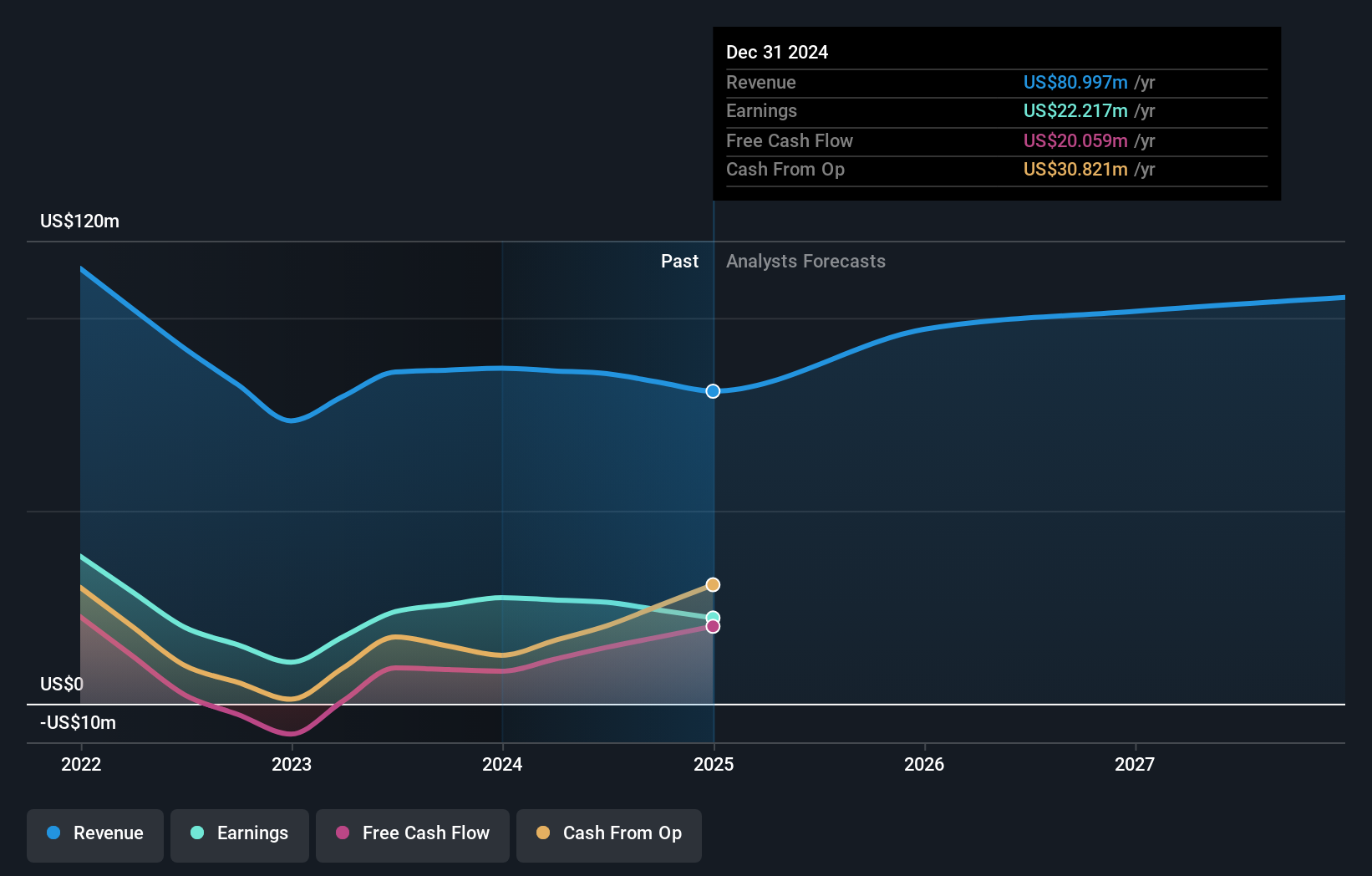

Overview: IMAX China Holding, Inc. is an investment holding company that offers digital and film-based motion picture technologies across the People's Republic of China, Hong Kong, Macau, and Taiwan with a market cap of HK$2.65 billion.

Operations: IMAX China generates revenue primarily from Technology Products and Services, contributing $64.08 million, and Content Solutions, adding $20.69 million.

IMAX China, a notable player in the entertainment sector, stands out with its debt-free status and high-quality earnings. Over the past five years, earnings have grown at an annual rate of 4.4%, showcasing steady progress. Despite not outpacing the industry growth of 10.1% last year, it remains a promising investment due to its robust financial health and positive free cash flow position. The company appears to be trading at about 4% below its estimated fair value, suggesting potential for appreciation as earnings are forecasted to grow by 14% annually moving forward.

- Delve into the full analysis health report here for a deeper understanding of IMAX China Holding.

Explore historical data to track IMAX China Holding's performance over time in our Past section.

Integral (TSE:5842)

Simply Wall St Value Rating: ★★★★★☆

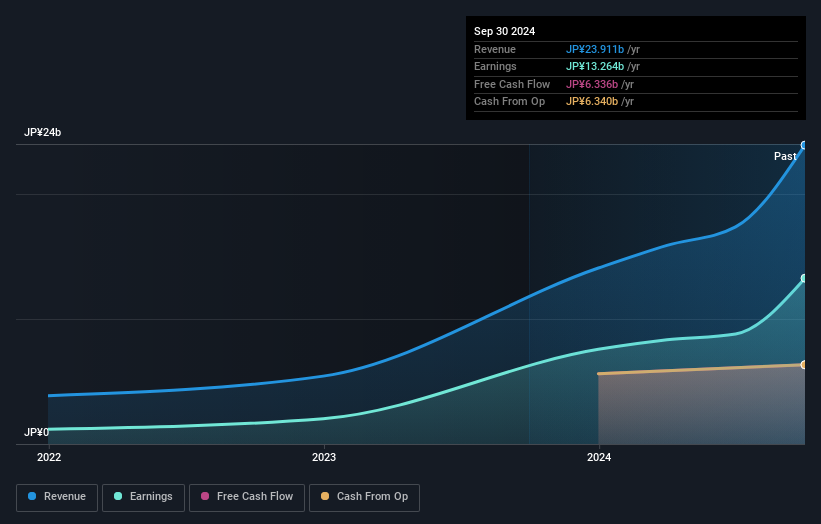

Overview: Integral Corporation is a private equity firm specializing in management buyouts, turnarounds, leveraged buyouts, mezzanine financing, and other minority investments with a market cap of ¥129.76 billion.

Operations: Integral's revenue is derived from its unclassified services, amounting to ¥23.91 billion.

Integral's recent strategic move to launch a real estate investment fund business, with an initial capital of JPY 90 million, highlights its ambition for mid- to long-term growth. This expansion aims to enhance corporate value by diversifying into asset classes like real estate alongside its private equity investments. The company has appointed four seasoned professionals to spearhead this venture under the newly formed Integral Real Estate Corporation. Financially, Integral is trading at 15.7% below its estimated fair value and boasts a robust earnings growth of 114.8% over the past year, outpacing industry averages significantly.

- Click to explore a detailed breakdown of our findings in Integral's health report.

Evaluate Integral's historical performance by accessing our past performance report.

PlayWay (WSE:PLW)

Simply Wall St Value Rating: ★★★★★☆

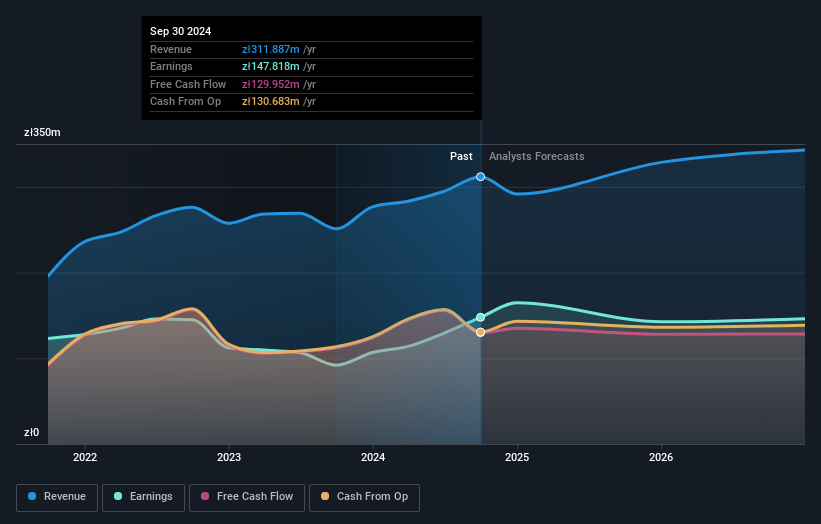

Overview: PlayWay S.A. is a global producer and publisher of PC and mobile games, with a market capitalization of PLN1.89 billion.

Operations: PlayWay generates revenue primarily from its computer graphics segment, which contributed PLN311.89 million.

PlayWay, a player in the entertainment industry, has shown impressive growth with earnings surging by 60.8% over the past year, outpacing its industry peers. The company trades at 30.7% below its estimated fair value, suggesting potential undervaluation. Financially sound with more cash than total debt and a modest debt-to-equity ratio of 0.08%, PlayWay's high-quality earnings are noteworthy. Recent reports highlight net income of PLN 45.71 million for Q3 2024, up from PLN 27.37 million last year, and basic EPS of PLN 6.93 for the quarter, indicating robust profitability and promising future prospects in its niche market segment.

- Click here to discover the nuances of PlayWay with our detailed analytical health report.

Assess PlayWay's past performance with our detailed historical performance reports.

Summing It All Up

- Gain an insight into the universe of 4628 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PLW

Undervalued with solid track record.